- United States

- /

- Software

- /

- NasdaqGS:VRNS

Some Varonis Systems, Inc. (NASDAQ:VRNS) Shareholders Look For Exit As Shares Take 26% Pounding

Varonis Systems, Inc. (NASDAQ:VRNS) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

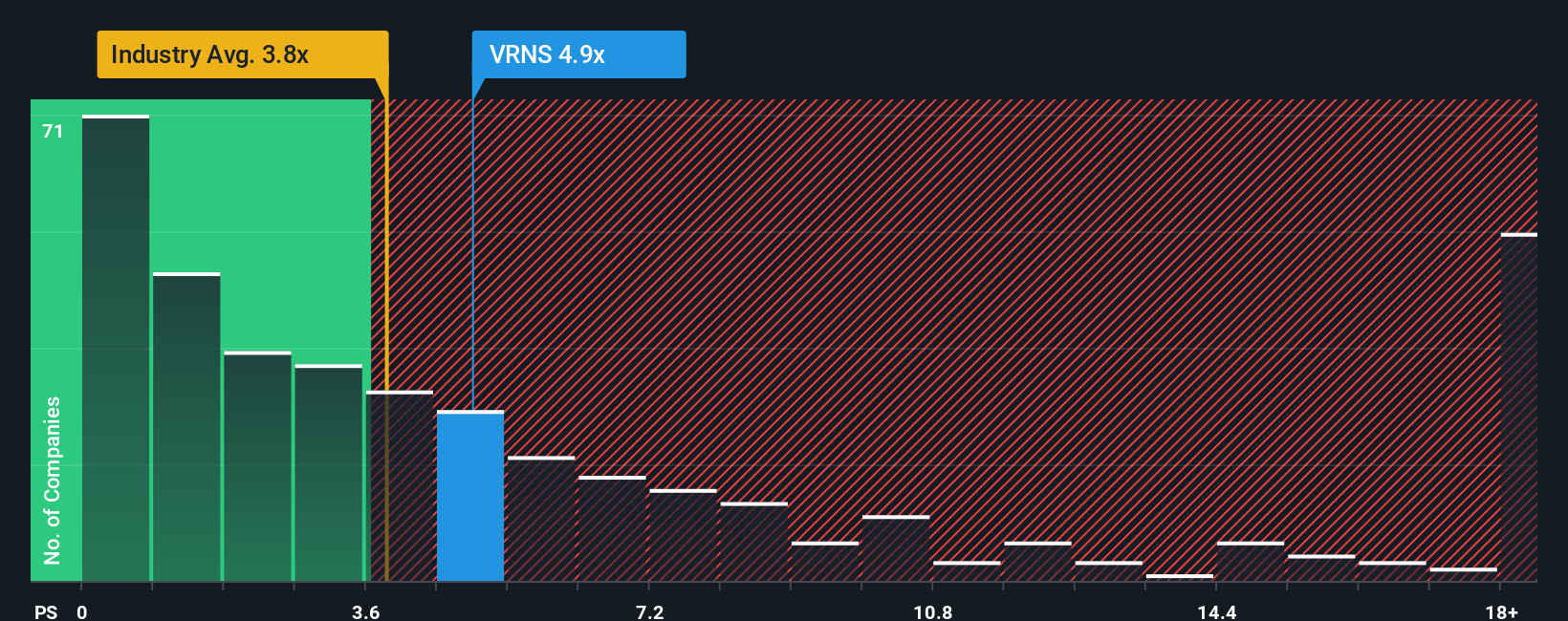

Even after such a large drop in price, Varonis Systems may still be sending sell signals at present with a price-to-sales (or "P/S") ratio of 4.9x, when you consider almost half of the companies in the Software industry in the United States have P/S ratios under 3.8x and even P/S lower than 1.6x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Varonis Systems

How Has Varonis Systems Performed Recently?

With revenue growth that's inferior to most other companies of late, Varonis Systems has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Varonis Systems' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Varonis Systems' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. This was backed up an excellent period prior to see revenue up by 32% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 17% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 34% per annum, which is noticeably more attractive.

In light of this, it's alarming that Varonis Systems' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Varonis Systems' P/S

There's still some elevation in Varonis Systems' P/S, even if the same can't be said for its share price recently. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Varonis Systems, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Varonis Systems that you should be aware of.

If these risks are making you reconsider your opinion on Varonis Systems, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of worlds.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Inotiv NAMs Test Center

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.