- United States

- /

- Software

- /

- NasdaqGS:VRNS

Some Confidence Is Lacking In Varonis Systems, Inc. (NASDAQ:VRNS) As Shares Slide 45%

Varonis Systems, Inc. (NASDAQ:VRNS) shareholders that were waiting for something to happen have been dealt a blow with a 45% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

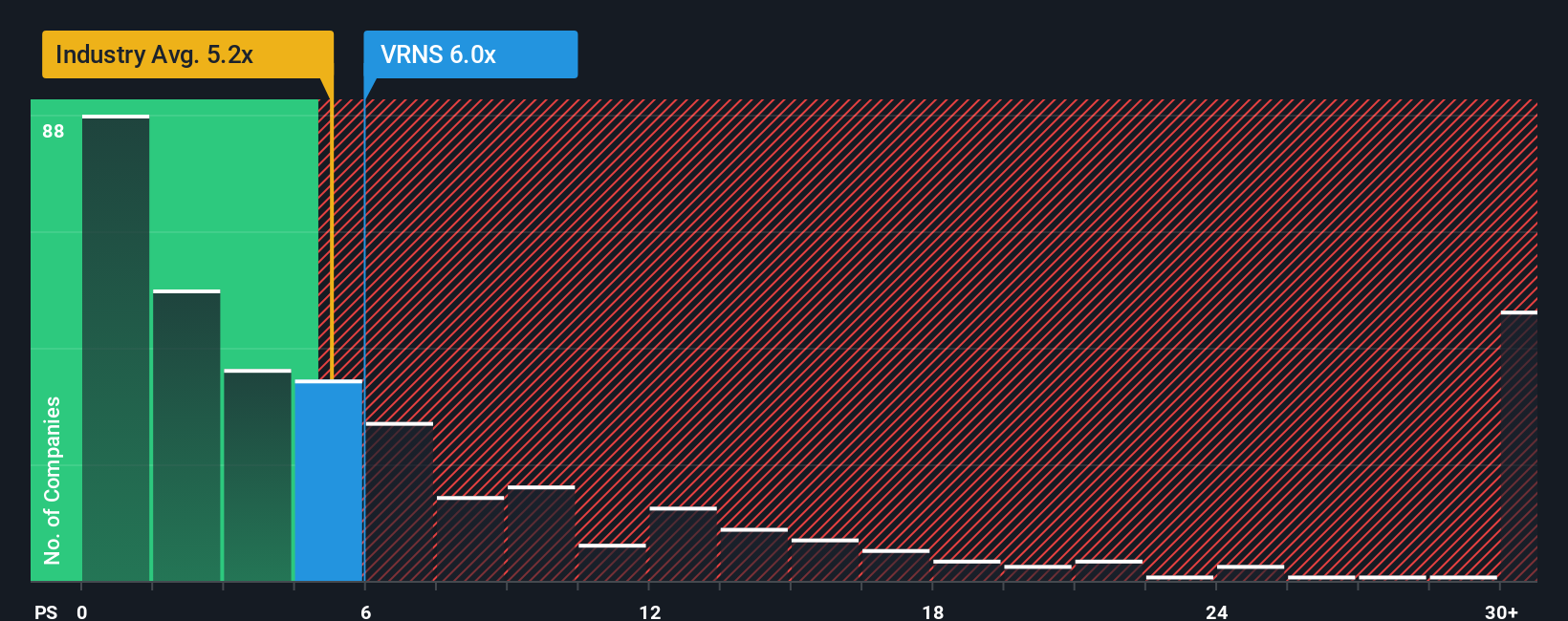

In spite of the heavy fall in price, there still wouldn't be many who think Varonis Systems' price-to-sales (or "P/S") ratio of 6x is worth a mention when the median P/S in the United States' Software industry is similar at about 5.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Varonis Systems

How Has Varonis Systems Performed Recently?

Varonis Systems could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Varonis Systems.How Is Varonis Systems' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Varonis Systems' to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 33% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 15% per annum over the next three years. That's shaping up to be materially lower than the 32% each year growth forecast for the broader industry.

With this information, we find it interesting that Varonis Systems is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

With its share price dropping off a cliff, the P/S for Varonis Systems looks to be in line with the rest of the Software industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Varonis Systems' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 1 warning sign for Varonis Systems that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of worlds.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Quintessential serial acquirer

EU#1 - From German Startup to EU’s Biggest Company

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.