- United States

- /

- Software

- /

- NasdaqGS:VRNS

Is It Too Late to Consider Varonis After a 38% Surge in 2025?

Reviewed by Bailey Pemberton

If you have Varonis Systems on your watchlist, you are not alone. Plenty of investors are debating their next move after what has been an eventful run for the stock. Over the past year, shares are up 8.2%, and if you zoom out to a three-year lens, the jump is a staggering 128.8%. That kind of long-term gain stands out, especially considering this year alone has already seen a robust 38.1% rise. Even in the shorter term, Varonis has eked out steady growth, nudging up 1.1% over the last week and 2.4% in the past month.

So, what’s fueling all this movement? Much of the upside appears connected to growing attention on data security and governance solutions, with organizations of all sizes reevaluating their cyber risk. Varonis has kept its name in the news by expanding its product capabilities and deepening partnerships with cloud providers, which has only added to investor optimism. This broader context helps explain why sentiment around the stock has remained positive despite a few bumps along the road.

When you dig into the numbers, though, the valuation picture isn’t exactly screaming ‘bargain’. By traditional standards, Varonis scores just 1 out of a possible 6 in our value assessment, meaning it looks undervalued on only a single criterion. Still, metrics only tell part of the story, and sometimes they can be misleading without context.

Let’s break down how those valuation checks stack up for Varonis, and stick around, because after we size up the numbers from every angle, we will explore a smarter, more holistic way to think about what this company might really be worth.

Varonis Systems scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Varonis Systems Discounted Cash Flow (DCF) Analysis

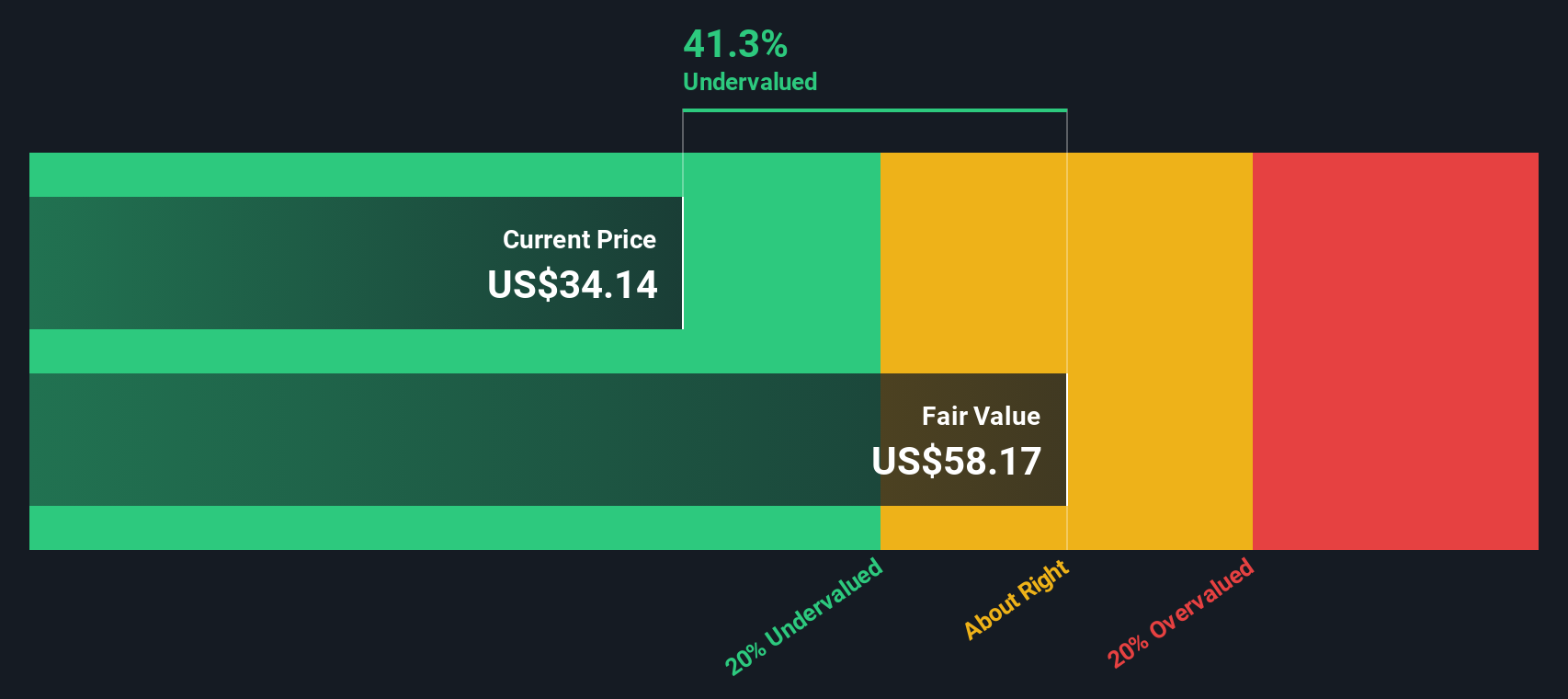

The Discounted Cash Flow (DCF) model estimates what a company is truly worth by forecasting its future free cash flows and then discounting them back to today’s value. This helps investors judge whether a stock’s current price accurately reflects its long-term profitability potential.

For Varonis Systems, the latest reported free cash flow is $127.7 million. Looking ahead, analysts expect this figure to steadily rise, projecting it to reach $358.9 million by the end of 2029. These cash flow estimates extend out ten years, with early projections sourced from analysts and later years extrapolated by Simply Wall St. This long-term view gives us a clearer sense of the company’s growth runway and overall financial health.

Running all these numbers through the DCF model, the estimated intrinsic value comes out to $66.94 per share. At today’s prices, this calculation suggests the stock is trading at an 8.5% discount to its fair value, implying the shares are just shy of being a bargain, but not dramatically so.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Varonis Systems's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

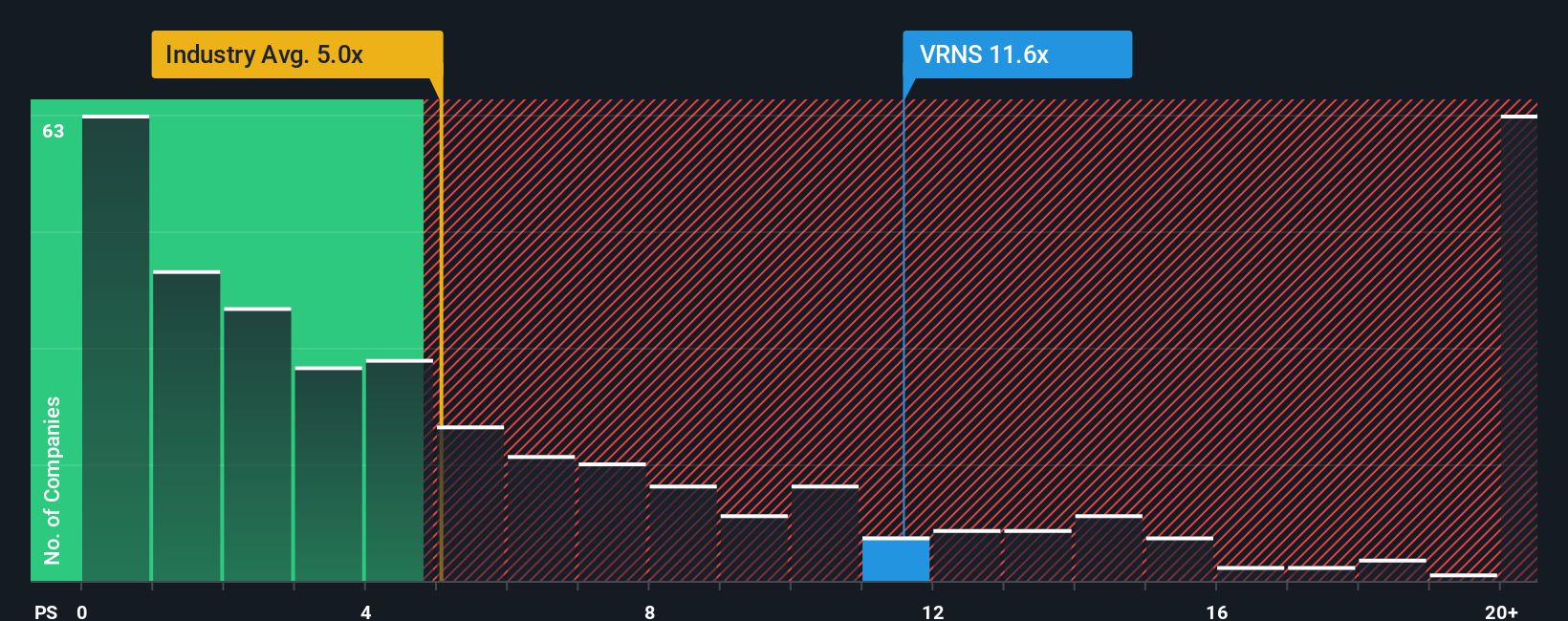

Approach 2: Varonis Systems Price vs Sales

When valuing profitable technology companies, the Price-to-Sales (P/S) ratio is a commonly used metric because it provides a straightforward comparison between a company’s market value and the revenue it generates. The P/S ratio is particularly useful for software companies like Varonis Systems that may reinvest heavily for growth, resulting in slim or negative earnings but still command substantial revenue streams.

What makes a “normal” or “fair” P/S multiple varies with market sentiment, growth prospects, and risk profile. Fast-growing, lower-risk firms typically justify higher multiples, while slower growth or higher uncertainty can push them lower.

Currently, Varonis trades at a P/S ratio of 11.53x, which is notably higher than both the software industry average of 5.17x and its peer group average of 6.14x. To offer deeper context, Simply Wall St’s proprietary “Fair Ratio” adjusts for factors like Varonis’s growth expectations, profit margins, industry, and company size. The Fair Ratio for Varonis is calculated at 7.33x, reflecting these nuanced elements and providing a sharper benchmark than standard peer or industry comparisons.

By weighing all these critical factors, the Fair Ratio offers a more meaningful measure of valuation. Comparing Varonis’s current P/S multiple of 11.53x to its Fair Ratio of 7.33x, the shares do appear overvalued by this standard.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Varonis Systems Narrative

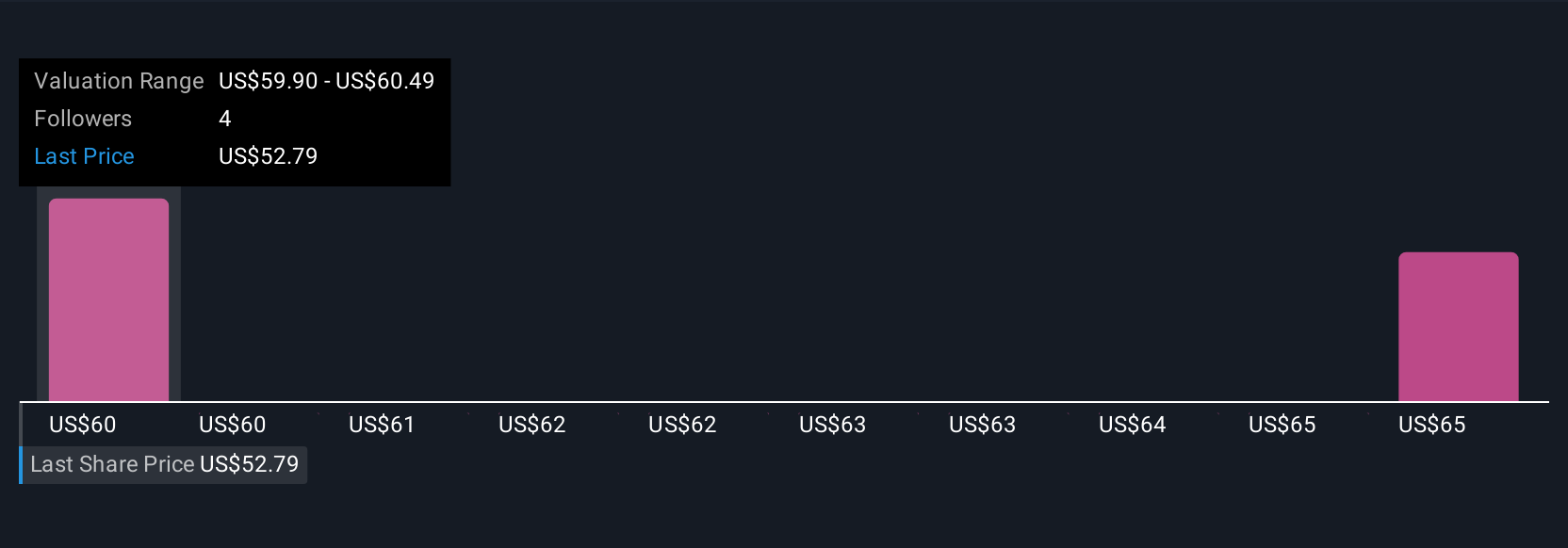

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story for the company, your reasoned perspective about where Varonis is headed, how it will perform, and why. Narratives connect the qualitative aspects of a business, like strategy and industry trends, with quantitative forecasts such as future revenue, earnings, and profit margins. This ultimately bridges them to your view of fair value.

On Simply Wall St’s Community page, Narratives empower millions of investors to share and compare their perspectives by writing out their investment thesis right alongside actual numbers and fair value estimates. By explicitly stating your assumptions and updating them as news or results come in, you get a living valuation process that evolves with the company, rather than just a static set of numbers.

Narratives make it far easier to assess whether to buy, hold, or sell Varonis by revealing how projected fair value compares to the current share price in real time. For example, some investors see deep, ongoing demand for data security and project robust margin expansion, leading to a fair value as high as $80 per share. Others, more cautious about SaaS transition risks, see value closer to just $47. Narratives help you frame your own expectations, check your beliefs, and invest with clarity and confidence.

Do you think there's more to the story for Varonis Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Intuit Stock: When Financial Software Becomes the Operating System for Small Business

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion