- United States

- /

- Software

- /

- NasdaqGS:VRNS

Assessing Varonis Stock After Strong 2025 Gains and Ongoing Cybersecurity Momentum

Reviewed by Bailey Pemberton

If you are on the fence about Varonis Systems stock, you are not alone. This company often sparks debate among investors who want strong returns but worry about paying too much for growth. The stock’s movement recently has given everyone even more to talk about. Over just the past week, Varonis shares edged up 1.5%, and they have climbed 4.6% in the last month. If you look a little further back, the results get even more interesting. Varonis has delivered an impressive 34.1% return so far this year, and an outstanding 112.6% gain over the last three years. While there are longer periods where the stock has cooled off, like the 7.0% return over the past year, it is clear long-term investors have already seen plenty of upside.

Some of these jumps come as data security stocks catch a tailwind from the growing urgency around cyber threats and digital transformation. Even so, Varonis’s valuation story is not simple. By the numbers, the current value score for the company is just 1, meaning it is considered undervalued in only one of six major valuation checks. That suggests the stock could be priced for much of its potential, at least by traditional metrics.

So, how should you make sense of this? In the next section, I will break down what those different valuation checks actually mean for Varonis. And stick around, there is an even more insightful way to look at valuation that goes beyond just the usual models, which I will cover at the end.

Varonis Systems scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Varonis Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to today’s dollars. This helps investors gauge what a company is fundamentally worth, regardless of current market sentiment.

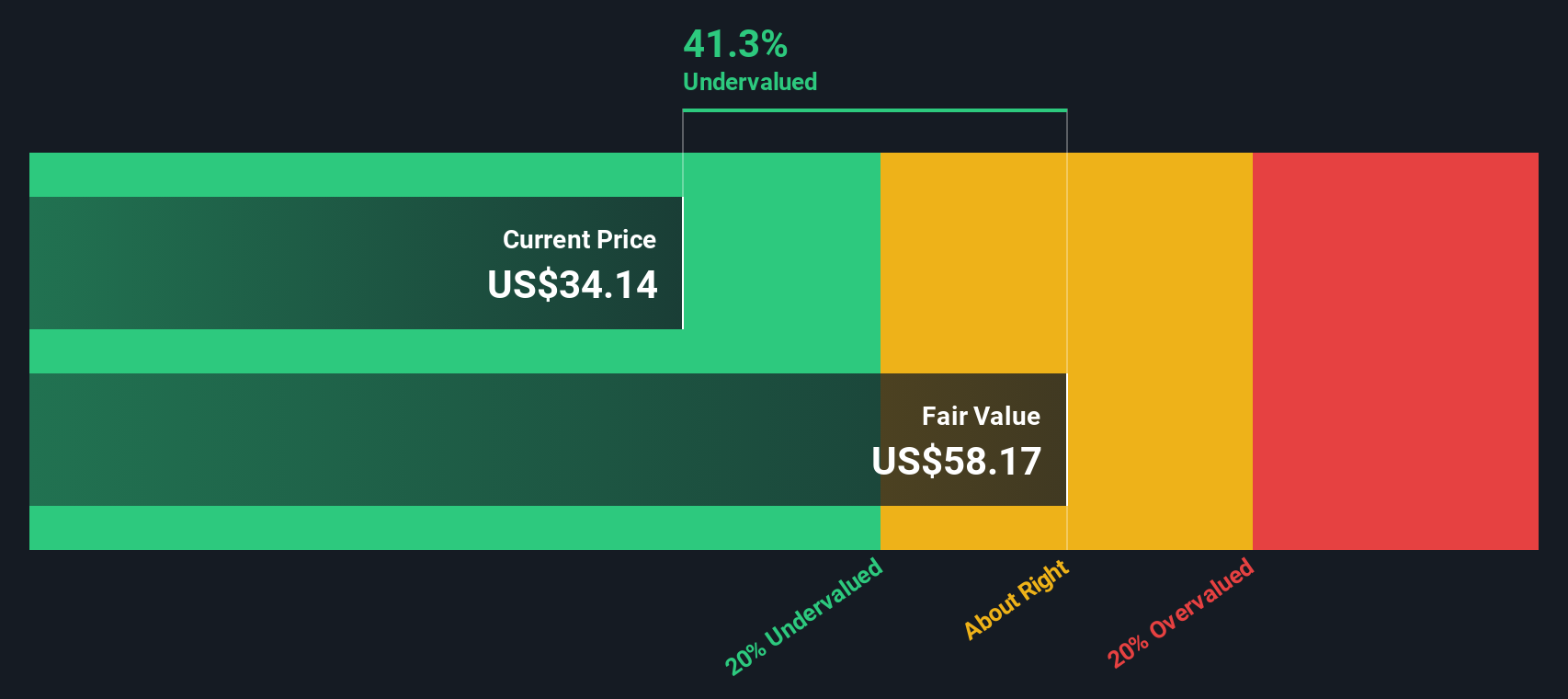

For Varonis Systems, the DCF analysis uses a 2 Stage Free Cash Flow to Equity model. Right now, Varonis is generating Free Cash Flow (FCF) of $127.7 million, a figure that analysts project will continue to climb at a healthy pace. Cash flow estimates from analysts go out five years, reaching $358.9 million by 2029. Further projections, extrapolated by Simply Wall St, forecast continued growth into the next decade.

Based on these projections, the model arrives at a fair value per share of $65.92. With the implied discount at 9.8%, the stock stands just at the threshold of being undervalued, suggesting Varonis may be trading near its true worth.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Varonis Systems's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

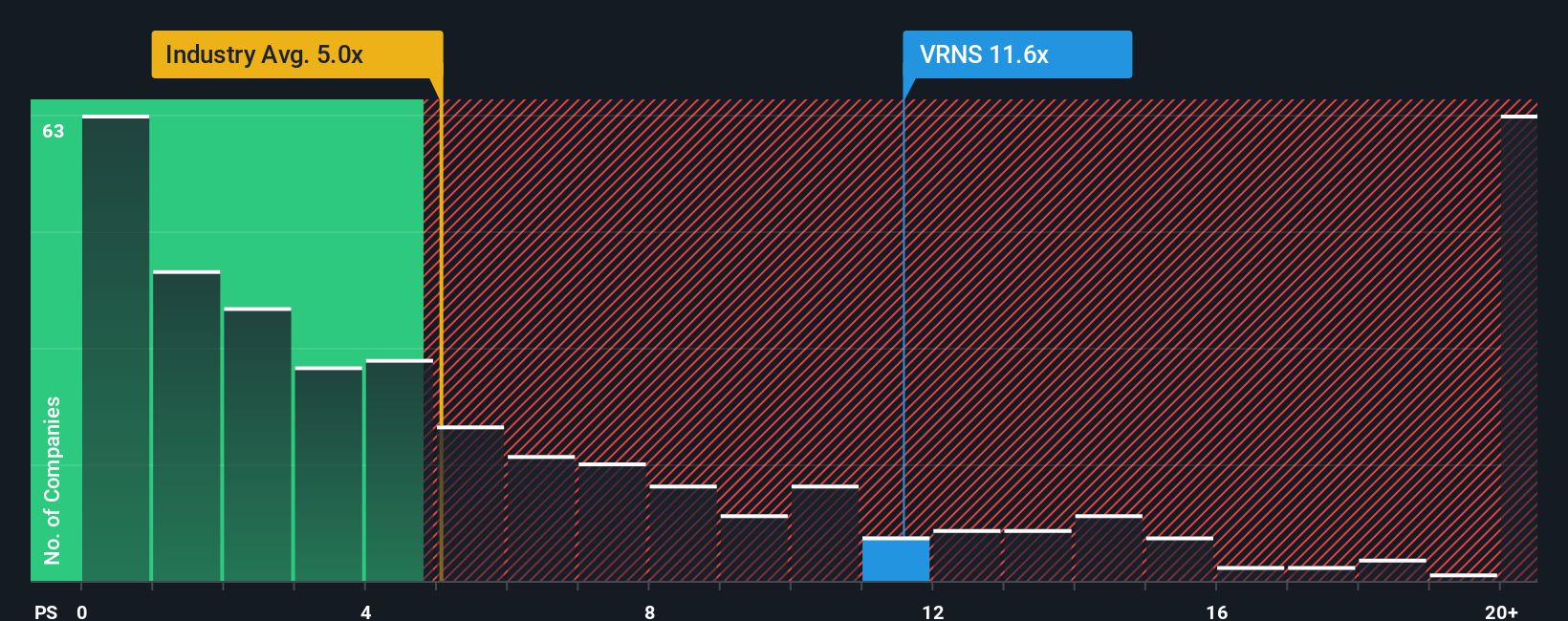

Approach 2: Varonis Systems Price vs Sales

The Price-to-Sales (P/S) ratio is a valuable valuation tool for technology companies like Varonis Systems, especially when earnings are negative or volatile. Since growing software companies often invest heavily to drive future growth, the P/S ratio helps investors assess how much they are paying for each dollar of current sales, making it a useful stand-in for value when profits are not the whole story.

Higher growth expectations and lower perceived risks typically justify a higher "normal" P/S ratio. In contrast, slower-growing or riskier companies usually trade at lower multiples. For Varonis, the current P/S stands at 11.2x, which is notably higher than the Software industry average of 5.3x and above the peer average of about 6.2x.

Simply Wall St introduces the “Fair Ratio” to account for more than just surface-level comparisons. By weighing factors such as Varonis’s earnings growth outlook, profit margins, industry dynamics, market cap, and specific risks, the Fair Ratio offers a more comprehensive and context-rich benchmark. This tailored metric, at 7.2x for Varonis, provides a clearer sense of what multiple would make sense for the business today.

Comparing Varonis's actual P/S of 11.2x to its Fair Ratio of 7.2x suggests the stock is currently trading at a significant premium to what its fundamentals justify, even after accounting for its strong growth narrative.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Varonis Systems Narrative

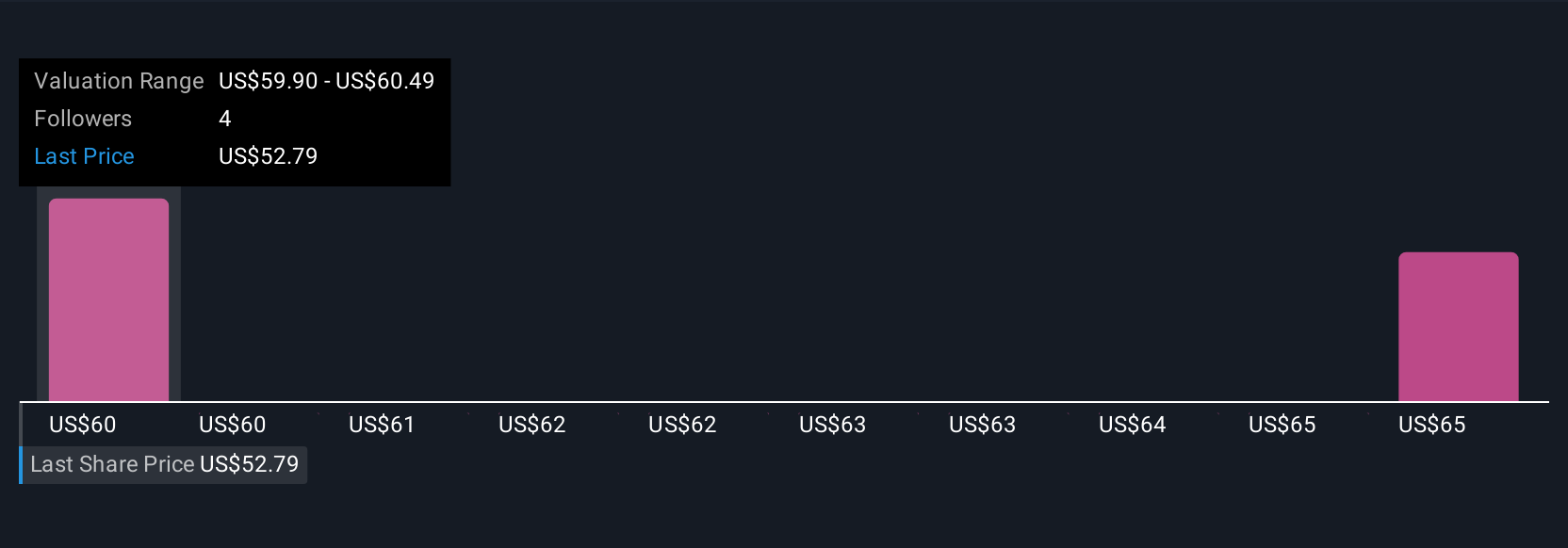

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple, story-driven approach that lets you map your own assumptions about a company, such as future revenue growth, profitability, and industry trends, directly to a fair value estimate. Unlike traditional models that rely only on historic data, Narratives connect a company’s evolving business story with its financial outlook. This approach shows you how your view of Varonis Systems translates into an actionable fair value.

Narratives are easy to use and available on Simply Wall St’s Community page, where millions of investors share, refine, and update their perspectives as new news or earnings emerge. By crafting or adopting a Narrative, you can quickly see how your unique expectations compare with the insights of other investors and the latest analyst targets. Narratives empower you to make smarter buy or sell decisions by directly comparing your Fair Value with the current share price, and they automatically update in response to fresh information so your outlook stays current.

For example, if you believe Varonis’s robust SaaS platform and increasing AI adoption will drive sustained revenue growth and margin expansion, your Narrative might reflect a fair value near the high analyst price target of $80.00. If you are more cautious about competitive risks and industry consolidation, your Narrative could be closer to the low target of $47.00.

Do you think there's more to the story for Varonis Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion