- United States

- /

- Software

- /

- NasdaqGM:VERX

A Fresh Look at Vertex (VERX) Valuation After Q3 Results, New Guidance, and $150 Million Buyback

Reviewed by Simply Wall St

Vertex (VERX) made headlines by releasing its third quarter results, sharing updated revenue guidance for the rest of 2025, and announcing a plan to buy back up to $150 million of its shares. These moves provide investors with several points to consider about the company’s outlook and strategy.

See our latest analysis for Vertex.

Vertex’s share price has come under heavy pressure this year, dropping 62.1% year-to-date, even as management rolled out updated earnings guidance and a significant buyback plan. Despite signs that momentum is struggling in the short term, the company’s three-year total shareholder return of 34.9% suggests there may be underlying growth potential beyond recent volatility.

If this market reset has you hunting for fresh opportunities, now is an ideal moment to discover fast growing stocks with high insider ownership.

With shares trading far below recent highs, while management signals confidence through buybacks and steady growth, investors are left weighing a key question: is Vertex now undervalued, or is future upside already reflected in the price?

Most Popular Narrative: 45.2% Undervalued

Compared to the $20.17 last close, the most popular narrative sees Vertex trading far below its fair value estimate. This sets the stage for a major re-rating if expectations turn into reality. The gap between current market pricing and analyst projections could catch the attention of investors looking for deep value and future growth potential.

Significant near-term acceleration is expected as regulatory mandates for e-invoicing begin in major European economies like France and Germany in 2026 and 2027. This will require multinational enterprises to adopt advanced tax automation solutions, a dynamic that should drive robust new customer wins and recurring revenue expansion for Vertex.

Want to know the growth blueprint behind this high valuation? Bold assumptions are being made about future margins and recurring revenues. Discover what ambitious scenarios are built into this forecast and what it means for the next chapter.

Result: Fair Value of $36.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a prolonged slowdown in cloud migrations or increased competition from global tax technology vendors could challenge Vertex’s growth assumptions and reduce future returns.

Find out about the key risks to this Vertex narrative.

Another View: How Do the Ratios Stack Up?

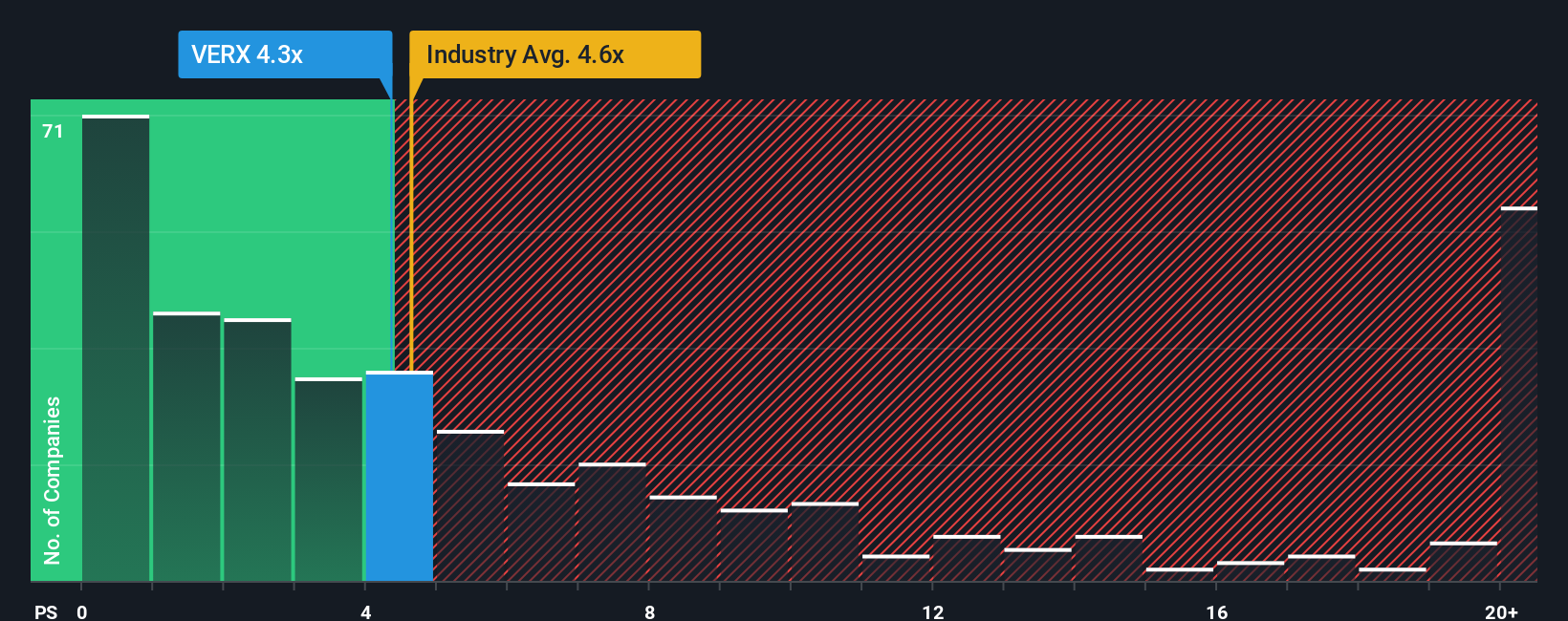

Looking from a different angle, Vertex trades at a price-to-sales ratio of 4.4x. This places it below the US Software industry average of 4.7x and just under the peer average of 4.5x. However, this is still slightly above its fair ratio of 4.1x, which signals a small premium. Does this suggest a margin of safety for value seekers or indicate there is limited room for a re-rating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertex Narrative

If you have your own take on Vertex or want to dig deeper into the numbers, crafting your own perspective is quick and straightforward. It takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Vertex.

Looking for More Smart Investment Ideas?

Don’t let your next winning stock slip through your fingers. Give yourself an edge by choosing opportunities tailored to your investing style with Simply Wall Street’s powerful screeners.

- Seize the potential of emerging technology by checking out these 26 quantum computing stocks to see where tomorrow’s breakthroughs are being built today.

- Tap into regular income streams with these 16 dividend stocks with yields > 3% and discover companies offering higher-than-average yields that could boost your portfolio’s cash flow.

- Ride the artificial intelligence wave by exploring these 26 AI penny stocks to get ahead of market shifts in this rapidly evolving field.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERX

Vertex

Provides enterprise tax technology solutions for retail trade, wholesale trade, and manufacturing industries in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives