- United States

- /

- Software

- /

- NasdaqGM:VERI

Veritone (VERI): Evaluating Valuation Following ESPN NCAA Championship Audio Licensing Deal

Reviewed by Kshitija Bhandaru

Veritone (VERI) has caught the attention of investors following its new agreement with ESPN to license NCAA Division I Championship audio content. This partnership highlights Veritone’s platform in sports media and content licensing.

See our latest analysis for Veritone.

Veritone’s agreement with ESPN is not the only thing catching investors’ attention lately. With its AI platforms expanding into new markets and a steady stream of high-profile contracts, the stock’s momentum appears to be building, as seen in a 2.7% 90-day share price return and a steady 1-year total shareholder return. Both short-term and long-term signals suggest investors are taking notice of the company’s potential for growth beyond a single partnership.

If you're interested in finding technology innovators gaining traction beyond the headlines, now is the ideal moment to explore our curated opportunities with See the full list for free.

With analysts forecasting significant upside and Veritone trading far below its price target, the key question remains: Is the stock still undervalued at these levels, or has the market already priced in its future growth potential?

Most Popular Narrative: 45.5% Undervalued

Compared to the last close price of $5.59, the most popular narrative estimates Veritone’s fair value at $10.25, suggesting considerable upside if these projections materialize. This narrative frames the valuation around the company’s evolving business model and the catalysts supporting future earnings and revenue growth.

The accelerating demand for AI-powered analytics solutions, particularly in processing and transforming unstructured data streams such as audio, video, and text, is fueling rapid adoption of Veritone's aiWARE and VDR platforms. This demand is supported by expanding commercial and public sector pipelines, notably with hyperscalers and U.S. federal agencies, which are expected to drive substantial top-line revenue growth.

What’s hidden beneath the surface? The future valuation hinges on bold revenue growth assumptions and a massive shift in Veritone’s earnings power. Want to uncover the big projections and key financial levers that make analysts land on this target? Discover what could fuel a dramatic re-rating only in the full narrative.

Result: Fair Value of $10.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing net losses and customer concentration could challenge Veritone’s growth story if profitability and client diversification do not improve meaningfully.

Find out about the key risks to this Veritone narrative.

Another View: Market Ratios Tell a Different Story

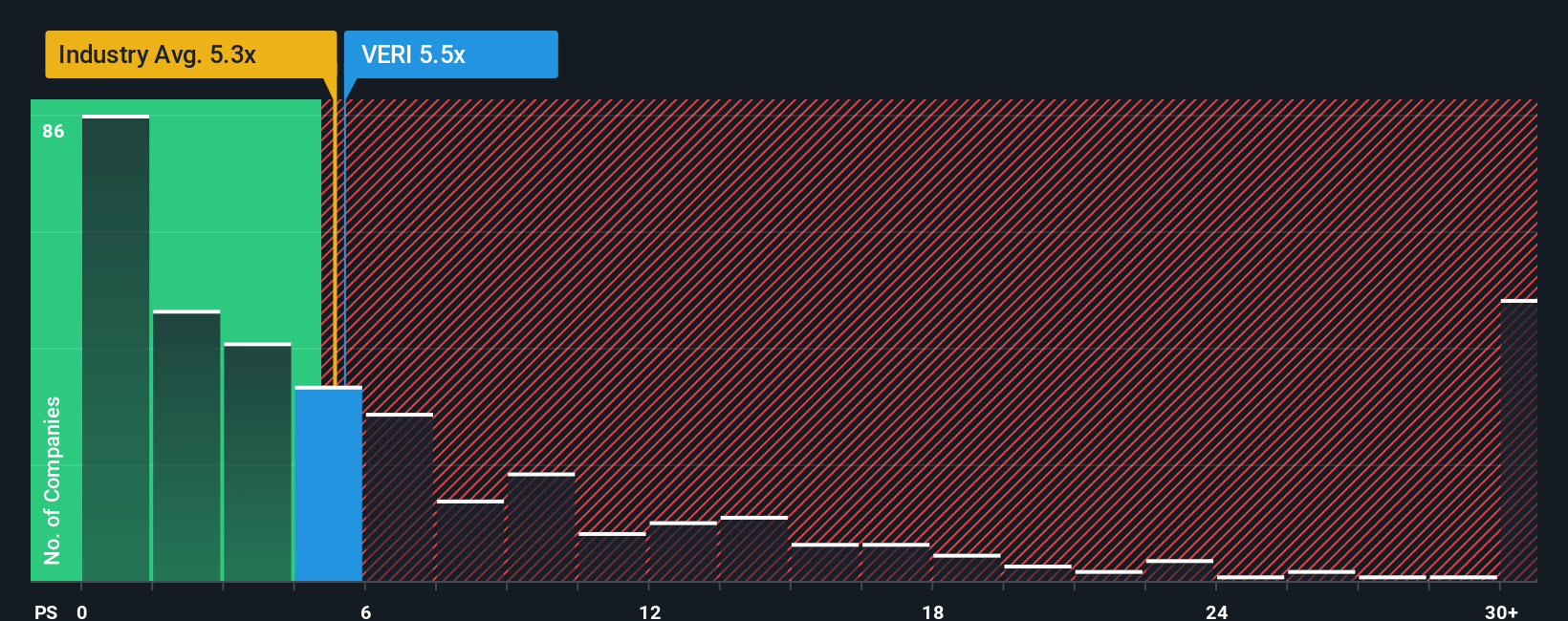

Looking at Veritone's price-to-sales ratio of 4.3x, it is pricier than its peer group at 2.2x, but appears more attractive than the broader US Software sector average of 5.3x. Interestingly, this figure is just below the fair ratio of 4.8x, suggesting the stock might not have clear-cut valuation risk or upside. If market sentiment shifts, this ratio could potentially become either a tailwind or a headwind for the stock.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veritone Narrative

If you see the numbers differently or want to dive into the data to shape your perspective, try building your own Veritone story in just a few minutes with Do it your way

A great starting point for your Veritone research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always look ahead for fresh opportunities. Fuel your portfolio’s growth by checking out high-conviction stock ideas other investors might be missing. You don’t want to look back and wish you had acted sooner.

- Unlock powerful growth by tapping into these 24 AI penny stocks, featuring companies leveraging artificial intelligence to transform industries and gain a competitive edge.

- Capture consistent income potential as you review these 19 dividend stocks with yields > 3%, highlighting businesses delivering yields above 3% with strong fundamentals.

- Catch up on cutting-edge breakthroughs by targeting these 26 quantum computing stocks, where innovators are shaping the future with quantum computing advances and next-level tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERI

Veritone

Engages in the provision of artificial intelligence (AI) computing solutions and services in the United States, the United Kingdom, France, Australia, Israel, and India.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives