- United States

- /

- Software

- /

- NasdaqGM:VERI

Veritone (VERI): Assessing Valuation After Major AI Upgrades, Data Partnerships, and Raised Q3 2025 Outlook

Reviewed by Simply Wall St

Veritone, Inc. (VERI) has been drawing attention after a string of impactful announcements. These include new AI features in its Redact software, significant data partnership wins, and a much higher Q3 2025 revenue forecast.

See our latest analysis for Veritone.

Momentum is clearly building for Veritone. Over the past month, the company notched a 43.7% share price return, and its 90-day share price return is a staggering 268.7%. Recent public sector contract wins and Redact software upgrades have fueled this surge. Year-to-date share price returns of 128.1% highlight how the narrative has shifted in Veritone’s favor, even though its 1-year total shareholder return sits at 89.6%. The longer-term picture is more mixed, but the latest developments are giving investors plenty to consider.

If you’re interested in what other tech innovators are achieving right now, it’s worth exploring the landscape with our curated list in See the full list for free.

With such rapid gains and bullish forecasts, the question for investors is clear: is Veritone genuinely undervalued based on its new growth trajectory, or has the market already priced in all of its future promise?

Most Popular Narrative: 28.8% Undervalued

With the most followed narrative placing Veritone's fair value at $10.25, shares remain well below that target after their recent rally. The market's optimism stands on a foundation of big growth forecasts and anticipated public sector AI adoption, signaling belief that today's price still leaves upside.

The accelerating demand for AI-powered analytics solutions, particularly in processing and transforming unstructured data streams such as audio, video, and text, is fueling rapid adoption of Veritone's aiWARE and VDR platforms. This demand is supported by expanding commercial and public sector pipelines (notably with hyperscalers and U.S. federal agencies), which are expected to drive substantial top-line revenue growth.

Curious about the logic behind that price target? The secret lies in bold revenue expansion plans and a profit outlook that could place Veritone alongside high-multiple tech peers. Find out what specific financial drivers make this possible. Only a few crucial assumptions are needed for the story to stick. Will you spot the turning point?

Result: Fair Value of $10.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and falling gross margins could still threaten Veritone's trajectory if these pressures are not contained in the coming quarters.

Find out about the key risks to this Veritone narrative.

Another View: Multiples Tell a Different Story

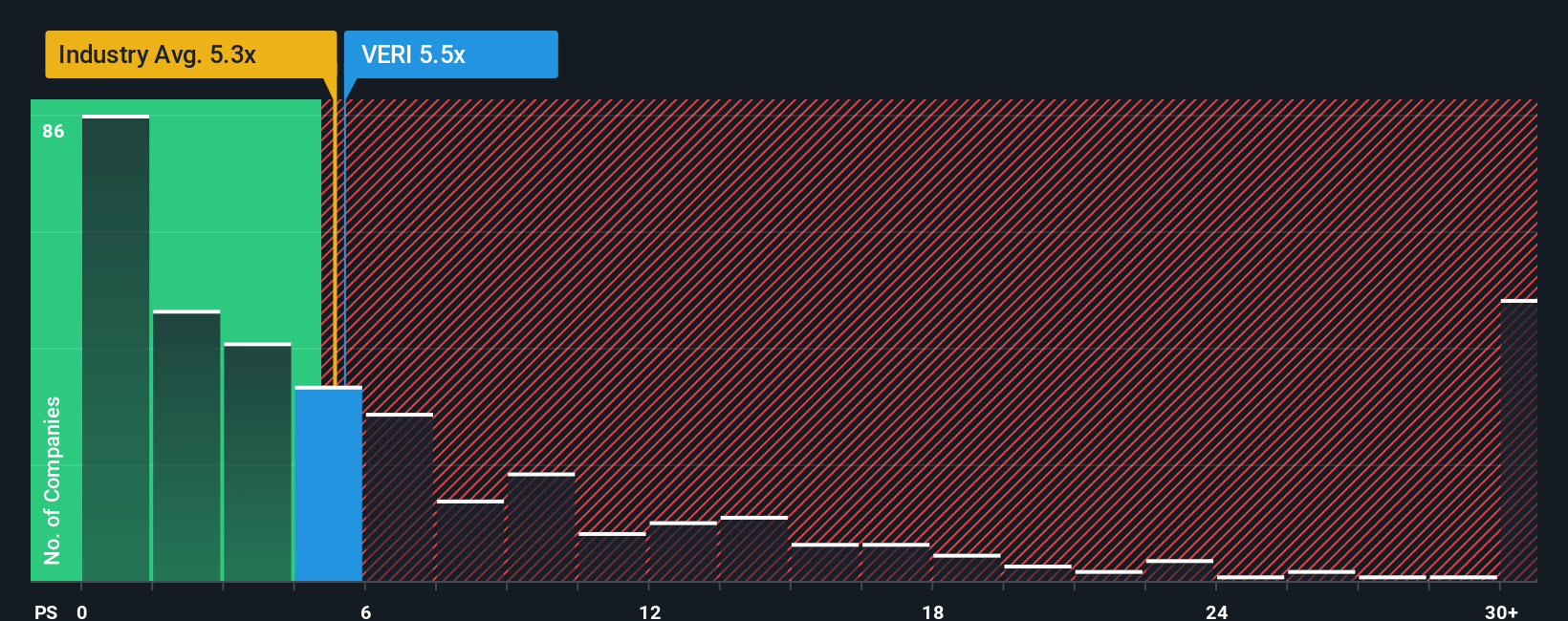

Looking at Veritone's valuation through the price-to-sales lens, its ratio of 6.9x stands out as more expensive than the US Software industry average of 5.5x. However, it is less expensive than its peer average of 8x. Still, the fair ratio for the company sits at 5.6x. This suggests investors may be taking on extra risk by paying above that benchmark. Does this premium signal strong growth ahead, or should investors take a closer look at the possible downside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veritone Narrative

If you see things differently or want to dive into the details yourself, it’s quick and easy to shape your own perspective. You can Do it your way in just a few minutes.

A great starting point for your Veritone research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t leave opportunity on the table. Use the Simply Wall St Screener to quickly unlock strategies beyond Veritone and put yourself a step ahead of the market.

- Tap into reliable income streams by checking out these 19 dividend stocks with yields > 3% that consistently offer yields above 3% and reward shareholders.

- Catch the next wave of cutting-edge innovation by exploring these 27 AI penny stocks with strong potential in artificial intelligence breakthroughs.

- Hunt for bargains with these 874 undervalued stocks based on cash flows that are priced below their intrinsic value using robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERI

Veritone

Engages in the provision of artificial intelligence (AI) computing solutions and services in the United States, the United Kingdom, France, Australia, Israel, and India.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives