- United States

- /

- Software

- /

- NasdaqGM:VERI

Do Veritone’s (VERI) New Compliance Features Shift Its Competitive Edge in Legal Tech?

Reviewed by Sasha Jovanovic

- Earlier this month, Veritone, Inc. announced major upgrades to its Veritone Redact SaaS application, including AI-powered voice masking, an inverse blur feature, and multilingual transcription, and showcased these at prominent industry conferences in Denver and San Diego.

- These advancements specifically address new state requirements for privacy and compliance in audio and video evidence, setting Veritone apart in the legal and law enforcement technology market.

- We'll examine how Veritone's enhanced AI-powered voice masking for compliance impacts its investment narrative and sector positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Veritone Investment Narrative Recap

To be a Veritone shareholder today, you have to believe that accelerating demand for AI-driven compliance tools, like Redact’s new voice masking, can turn rapid SaaS adoption into sustained revenue growth before dilution and continued net losses become bigger concerns. While these product enhancements respond well to recent privacy regulations and may boost short-term interest, the latest follow-on equity offering underscores that the biggest risk remains profitability and potential shareholder dilution rather than this specific product rollout.

Of the recent developments, the $75 million follow-on equity offering stands out for its direct impact on the near-term risk of dilution. Although exciting new product features strengthen Veritone’s competitive identity, the necessity to raise capital highlights ongoing financial pressures and keeps investors focused on whether growth can offset persistent operating losses.

In contrast, what investors should be aware of is how continued net losses and new share issuances could ...

Read the full narrative on Veritone (it's free!)

Veritone's narrative projects $158.0 million revenue and $20.7 million earnings by 2028. This requires 20.2% yearly revenue growth and a $114.1 million increase in earnings from the current level of -$93.4 million.

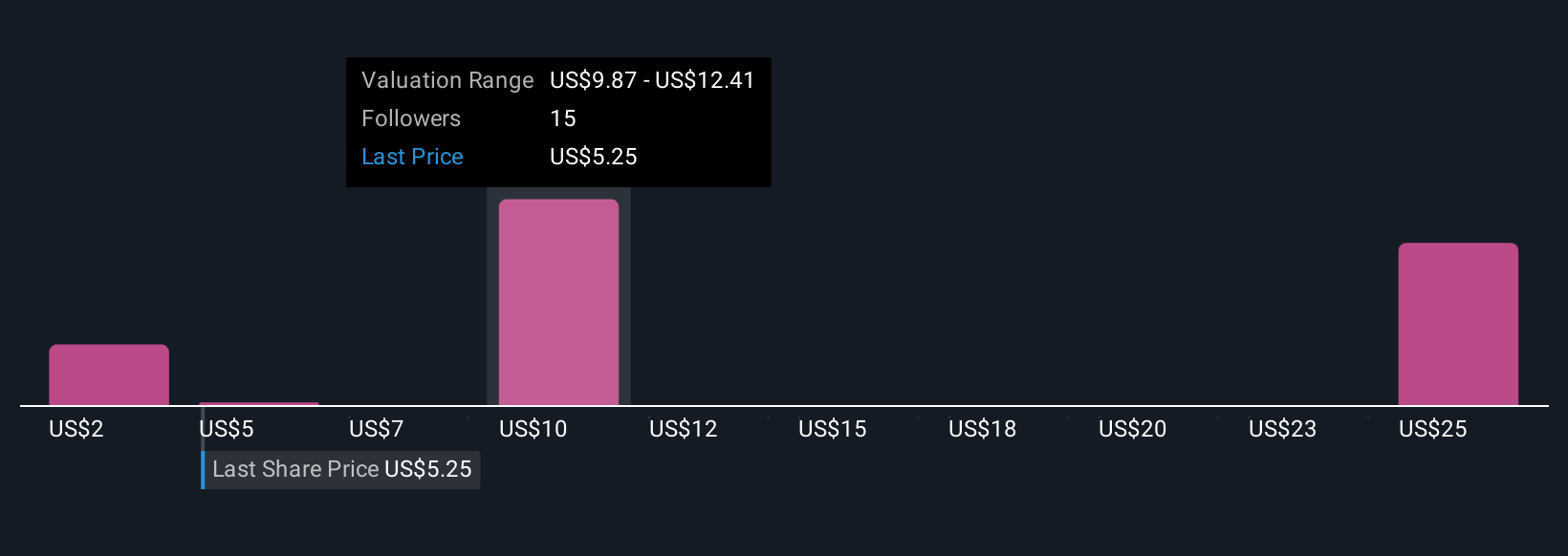

Uncover how Veritone's forecasts yield a $10.25 fair value, a 54% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair values between US$2.24 and US$10.60 across 7 unique estimates. While optimism around rapid AI adoption fuels projections, persistent net losses and dilution remain key topics that continue to drive discussion among market participants.

Explore 7 other fair value estimates on Veritone - why the stock might be worth less than half the current price!

Build Your Own Veritone Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veritone research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Veritone research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veritone's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERI

Veritone

Engages in the provision of artificial intelligence (AI) computing solutions and services in the United States, the United Kingdom, France, Australia, Israel, and India.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives