- United States

- /

- Software

- /

- NasdaqGS:TTAN

A Fresh Look at ServiceTitan (TTAN) Valuation After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

ServiceTitan (TTAN) shares have seen a drop over the past month, drawing investor interest in its valuation. The market's latest moves suggest it is worth taking a closer look at how ServiceTitan's financial momentum might set up future opportunities.

See our latest analysis for ServiceTitan.

Despite some recent volatility, ServiceTitan's momentum has shifted downward as the 1-month share price return now stands at -20.95%. This decline has erased much of the modest progress made earlier this year. That movement has brought more attention to whether momentum could lead to a rebound or indicate further caution ahead.

If you’re curious to see what else is gaining attention in the market right now, it’s worth broadening your search and discovering fast growing stocks with high insider ownership

With the recent pullback, the big question for investors is whether ServiceTitan is now trading at bargain levels, or if the current share price already factors in all the company’s future growth prospects.

Price-to-Sales of 9.9x: Is it justified?

ServiceTitan is currently trading at a price-to-sales ratio of 9.9x, which makes it appear expensive compared to similar companies in the software sector. With a last closing price of $92.69, the market seems to be factoring in substantial future growth, yet actual financial performance may not be keeping pace with these elevated expectations.

The price-to-sales ratio reflects how much investors are willing to pay for each dollar of revenue. This is an important metric for fast-growing, but unprofitable, companies like ServiceTitan. This measure helps investors evaluate whether the market is overestimating or underestimating a company's sales potential and is particularly relevant in the software industry where profits can be elusive during periods of expansion.

ServiceTitan’s ratio stands well above both the US Software industry average of 5.1x and its peer group average of 5.9x. Additionally, the fair price-to-sales ratio, as estimated by regression, is 6.6x. This is a level the market could turn towards if sentiment shifts or growth falls short. This spread suggests that the shares are priced at a substantial premium and challenges remain to justify such valuations, especially as revenue growth is forecast to trail sector leaders.

Explore the SWS fair ratio for ServiceTitan

Result: Price-to-Sales of 9.9x (OVERVALUED)

However, slowing revenue growth or persistent losses could quickly reverse any premium. This could prompt a sharp reassessment of ServiceTitan’s current valuation.

Find out about the key risks to this ServiceTitan narrative.

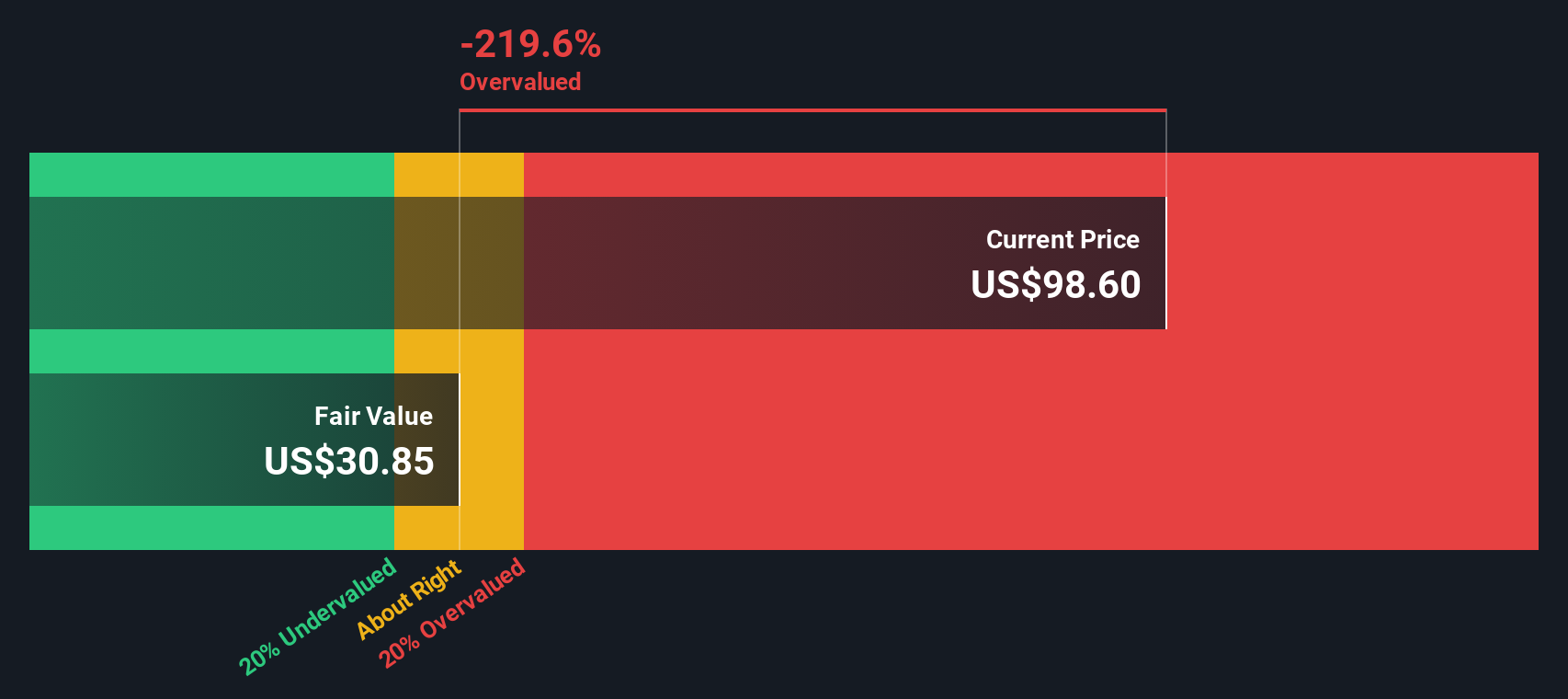

Another View: DCF Model Paints a Sharper Picture

For a different perspective, the SWS DCF model estimates ServiceTitan's fair value at just $30.77 per share, which is much lower than the current trading price of $92.69. This suggests shares may be significantly overvalued based on fundamentals, even more so than the market’s valuation multiples imply. Could the market be pricing in far too much optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ServiceTitan for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ServiceTitan Narrative

If you'd like to analyze the numbers your own way or have a different perspective on ServiceTitan's story, you can easily build your narrative in just a few minutes. Do it your way

A great starting point for your ServiceTitan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let fresh opportunities slip away. The stock market is full of tomorrow’s winners. Find your next breakthrough investment now with these proven strategies.

- Boost your potential passive income by checking out these 20 dividend stocks with yields > 3% with strong returns and robust payouts above 3%.

- Tap into the power of artificial intelligence with these 24 AI penny stocks that are positioned at the forefront of transformative tech innovation.

- Seize undervalued opportunities by uncovering these 874 undervalued stocks based on cash flows offering compelling value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTAN

ServiceTitan

Provides an end-to-end cloud-based software platform in the United States and Canada.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion