- United States

- /

- IT

- /

- NasdaqCM:TSSI

TSS (NasdaqCM:TSSI) Seals US$20M Credit Facility With Susser Bank As Stock Gains 1%

Reviewed by Simply Wall St

TSS (NasdaqCM:TSSI) has recently closed a $20 million credit facility with Susser Bank, which is aimed at enhancing its facilities to accommodate an anticipated growth in AI technology demand. Concurrently, TSS signed a long-term lease at Georgetown Logistics Park, underscoring its expansion efforts. Despite economic concerns affecting broader markets, with major indices like the Dow and S&P 500 experiencing declines due to weak manufacturing data and tariff impacts, TSS's inclusion in the S&P TMI Index indicates growing market recognition. This combination of strategic financial moves and increased market visibility may have played a part in TSS achieving a 0.74% price increase over the last quarter. While the Nasdaq and tech sectors faced downturns, TSS's focused approach toward growth through capacity expansion distinguishes its performance amidst wider market fluctuations.

Click here and access our complete analysis report to understand the dynamics of TSS.

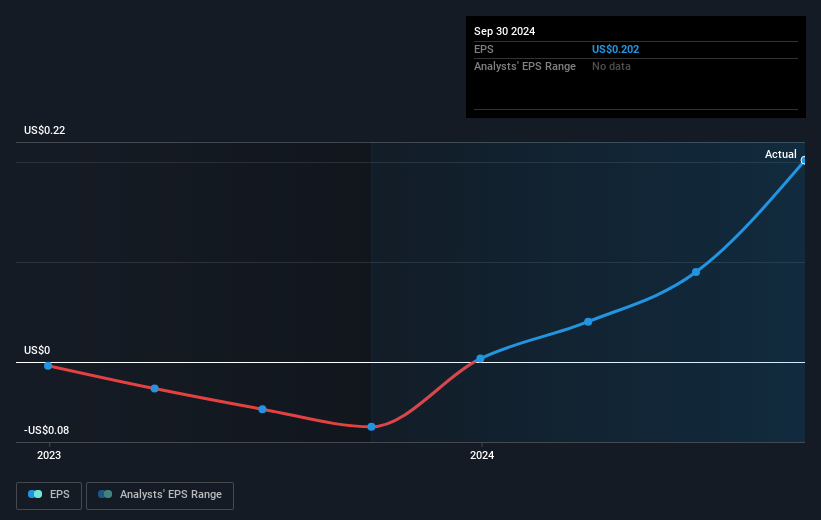

TSS, Inc. experienced a very large total return of 2122.45% over the past three years, driven by several pivotal developments. The company surpassed both the US market and the IT industry averages over the past year, cementing its standout performance. In November 2024, TSS moved from the OTC Equity market to the NASDAQ, enhancing its visibility and liquidity. The successful listing followed strong third-quarter earnings results showcasing a significant rise in revenue and net income compared to the previous year. Earlier, in August 2024, TSS had appointed a new Chief Revenue Officer to bolster revenue generation and market expansion, aligning the company’s efforts with its AI-focused strategy.

Additional efforts in corporate governance saw the appointment of a new CFO in June 2024, which coincided with the launch of innovative service offerings like "Data Center Moves" in March 2024. These initiatives underline TSS's commitment to growth, evidenced by a 60% capacity increase plan announced in October 2024, setting the foundation for its exceptional three-year return. These steps reflect its focused approach to scaling its operations alongside cutting-edge technology demands.

- Get the full picture of TSS' valuation metrics and investment prospects—click to explore.

- Understand the uncertainties surrounding TSS' market positioning with our detailed risk analysis report.

- Already own TSS? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TSSI

TSS

Engages in the planning, design, deployment, maintenance, refresh, and take-back of end-user and enterprise systems in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives