- United States

- /

- Software

- /

- NasdaqGS:TENB

Tenable (TENB): Attractively Valued With 70.68% Forecasted Earnings Growth, Profitability Expected by 2027

Reviewed by Simply Wall St

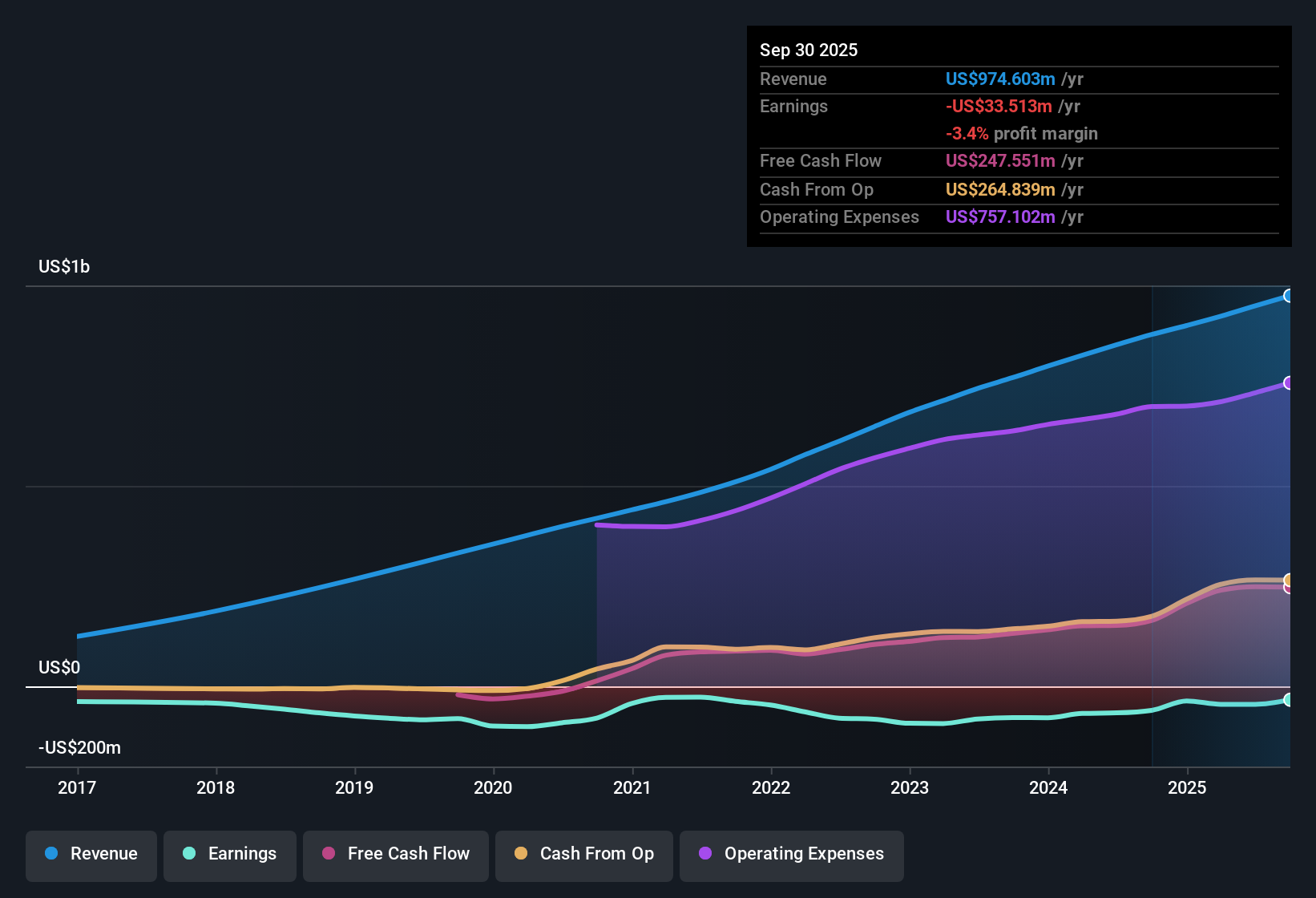

Tenable Holdings (TENB) remains unprofitable, but it is on track to achieve profitability within the next three years as earnings are forecast to surge by 70.68% annually. The company has steadily trimmed its losses over the past five years, though net profit margins have yet to see improvement. Investors are watching closely as anticipated profit growth, relative undervaluation, and progress reducing losses combine to set the tone for Tenable’s current earnings season.

See our full analysis for Tenable Holdings.Up next, we'll see how these results line up with the broader narratives investors are following, and where the numbers might challenge conventional wisdom.

See what the community is saying about Tenable Holdings

Margins Poised for Turnaround by 2027

- Analysts expect profit margins to swing from -4.7% today to a positive 2.8% in three years, which marks a transition from losses to profitability for the first time.

- According to the analysts' consensus view, this margin turnaround is being driven by two main forces:

- Demand for unified risk management solutions is rising because organizations are consolidating their IT, cloud, and operational tech. This platform approach is leading to larger deal sizes and higher average selling prices.

- Investments in AI and automation, plus acquisitions like Apex, are delivering new capabilities and increasing renewal rates, further helping gross margins and supporting a shift to consistent net profits over time.

Analysts say Tenable’s path to positive margins is all about bigger platform deals and AI-driven product strength, tipping the balance for cautious investors 📊 Read the full Tenable Holdings Consensus Narrative.

Revenue Growth Lags Market Leaders

- Projected annual revenue growth for Tenable stands at 7.6%, noticeably behind the 10.3% expected for the broader US market and analysts’ own forecast of 8.8% per year for Tenable itself.

- Reflecting the analysts' consensus view, this slow growth pace sparks debate:

- While regulatory pressures and cloud security spending are growing, Tenable’s heavy reliance on government contracts means that longer deal cycles and spending reviews could slow revenue momentum and risk missing out on the fastest growing end-markets.

- Critics highlight that strong backlog and multi-year commitments will help smooth year-to-year fluctuations, but competitive pressure from hyperscalers and large cybersecurity firms may limit how much Tenable can accelerate its growth relative to the industry.

Valuation Undercuts Peers Despite DCF Upside

- Tenable’s Price-to-Sales Ratio of 3.6x is well below both the US Software industry average of 5.2x and direct peers at 4.6x, and the current share price of $28.85 is sharply discounted versus its DCF fair value estimate of $52.84.

- In the analysts' consensus narrative, this relative undervaluation stands out:

- The price target from analysts is $37.89, about 31% above the current share price. Yet, reaching that level would require Tenable to trade at a future PE ratio of 188.6x, significantly higher than the industry norm of 36.6x, so the projected valuation is unusually aggressive if profit does not accelerate as forecast.

- Despite these risks, backlogs, high customer renewal rates, and successful product rollouts all reinforce the case for a re-rating, but investors must stay alert to the execution hurdles that could challenge closing the value gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Tenable Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an alternative angle in the data? Share your unique take and shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Tenable Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Tenable’s slower-than-market revenue growth and reliance on long government deal cycles leave it trailing industry leaders who are expecting faster and steadier expansion.

If consistent upward momentum matters to you, discover companies with the track record you want using our stable growth stocks screener (2113 results), and target steady performers built for all conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tenable Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TENB

Tenable Holdings

Provides cyber exposure management solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives