- United States

- /

- Software

- /

- NasdaqGS:TEAM

Atlassian (TEAM) Valuation Check After Fresh Buy Ratings and Higher 2026 Cloud Revenue Outlook

Reviewed by Simply Wall St

Atlassian (TEAM) just picked up fresh Wall Street support as new coverage highlighted its long term growth story, while the company lifted its 2026 cloud revenue outlook and reaffirmed its multi year expansion targets.

See our latest analysis for Atlassian.

Those upbeat growth signals are arriving after a choppy run, with Atlassian’s share price now at $161.07 and showing a 1 month share price return of 10.11 percent but a much weaker year to date share price return of negative 33.55 percent. The 3 year total shareholder return of 26.61 percent hints that, despite recent volatility, the longer term growth story still has support.

If Atlassian’s setup has you thinking about what else might be primed for the next leg higher, this could be a good moment to explore high growth tech and AI stocks.

With analysts calling for sizable upside and Atlassian still trading well below consensus targets despite faster cloud and AI driven growth, is this a discounted entry point for patient investors, or is the market already pricing in that future expansion?

Most Popular Narrative: 34.3% Undervalued

With Atlassian last closing at $161.07 and the most followed narrative pointing to fair value near $245, that gap anchors a bullish long term setup.

Accelerating adoption of AI powered features and investments in integrating AI deeply into Atlassian's core cloud platform are expanding differentiated use cases, leading to higher user engagement, greater value per customer, and increased opportunities for premium upsells supporting future revenue growth and margin expansion.

Curious how fast growing revenues, margin lift, and a punchy future earnings multiple can still justify this higher value? The underlying assumptions may surprise you.

Result: Fair Value of $245.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in complex cloud migrations or weaker than expected monetization of new AI features could undermine those upbeat, long term assumptions.

Find out about the key risks to this Atlassian narrative.

Another Angle on Valuation

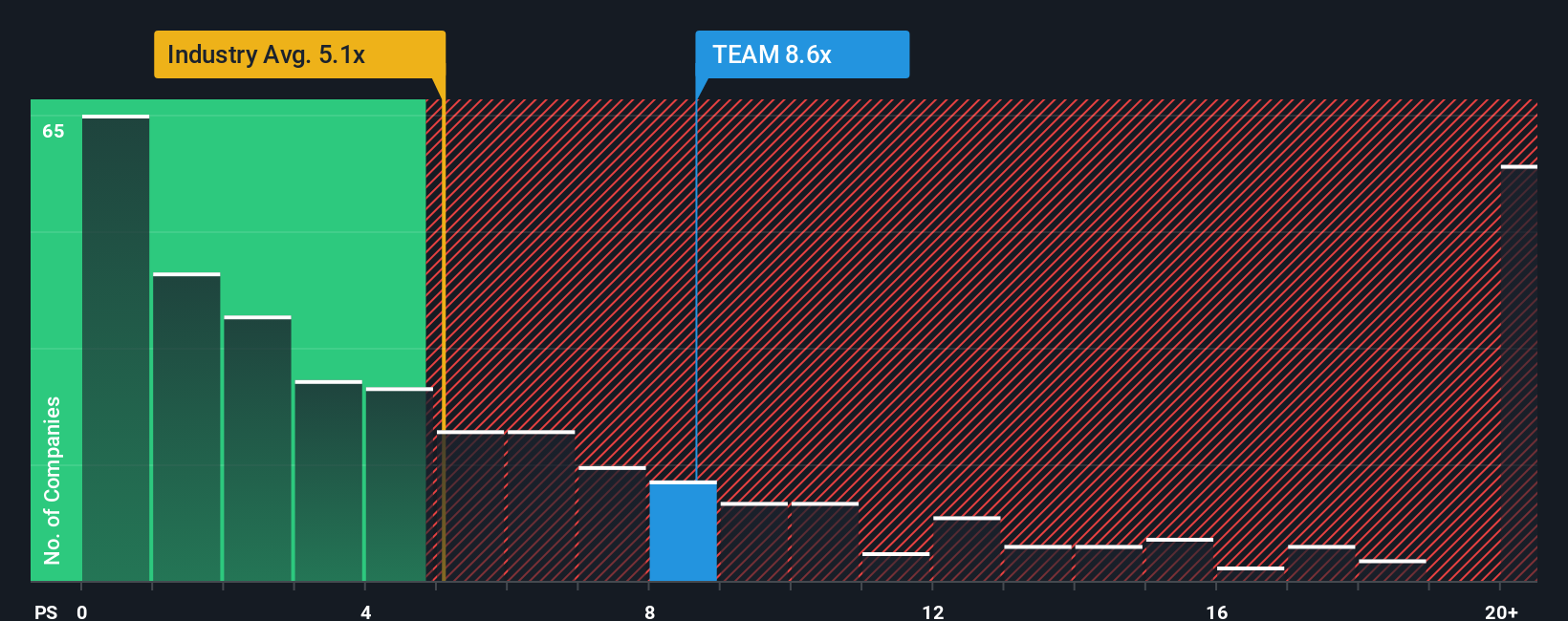

On a simple price to sales lens, Atlassian looks stretched at 7.8 times versus 4.9 times for the wider US software sector, yet still below its peer average of 12.1 times and our fair ratio of 12.5 times. Is that a margin of safety, or a premium already at risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atlassian Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Atlassian research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider your next move by scanning a few focused stock ideas that match your goals, risk tolerance, and curiosity.

- Tap into potential recovery stories by targeting these 913 undervalued stocks based on cash flows that the market may be overlooking today.

- Explore innovation trends by zeroing in on these 24 AI penny stocks involved in artificial intelligence adoption.

- Strengthen your income stream by focusing on these 12 dividend stocks with yields > 3% that can support more reliable long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Provides a collaboration software that enables organizations to connect all teams through a system of work that unlocks productivity at scale worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion