- United States

- /

- Software

- /

- NasdaqGS:TEAM

Assessing Atlassian (NasdaqGS:TEAM) Valuation After A Sharp Share Price Pullback

Recent share performance and valuation signals

Atlassian (TEAM) has drawn attention after a sharp pullback, with the share price around $94.72 and negative returns over the past month and past 3 months raising fresh questions about how to think about the stock today.

See our latest analysis for Atlassian.

The recent 19.9% 7 day share price decline caps a tough stretch for Atlassian, with the 1 year total shareholder return of 69.9% and 5 year total shareholder return of 62.6% highlighting how sentiment has cooled compared with earlier years. The steep 41.1% 30 day share price return and 40.0% 90 day share price return suggest momentum has been fading as investors reassess growth potential and risk around collaboration and AI tools at a US$94.72 share price.

If this pullback has you reassessing your software exposure, it could be a good moment to look at 56 profitable AI stocks that aren't just burning cash as another way to find AI focused names with established earnings profiles.

With Atlassian trading around US$94.72, a value score of 4, solid annual revenue growth of 14.6% and strong net income growth of 55%, is the pullback creating a mispriced entry point, or is future growth already baked in?

Most Popular Narrative: 53.7% Undervalued

According to FrugalBull, the most followed narrative sees Atlassian’s fair value at $204.74, more than double the recent $94.72 share price, framing the current slide as a potential mispricing.

Atlassian continues to expand its product portfolio and tiers, which increases revenue per customer. The company achieved a record number of $1M+ contracts in recent quarters as it attracted larger clients to its Enterprise edition (which grew 40% YoY, nearly double overall growth). Its Premium tier also grew 40%, showing success in upselling existing users to higher-priced plans.

Curious how this plays into the $204.74 fair value? The narrative leans heavily on long term revenue compounding, rising margins and a premium future earnings multiple. The exact mix of those assumptions might surprise you.

Result: Fair Value of $204.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on smooth enterprise adoption and AI product uptake, and any slowdown in cloud migrations or IT budgets could quickly challenge that $204.74 view.

Find out about the key risks to this Atlassian narrative.

Another angle on valuation

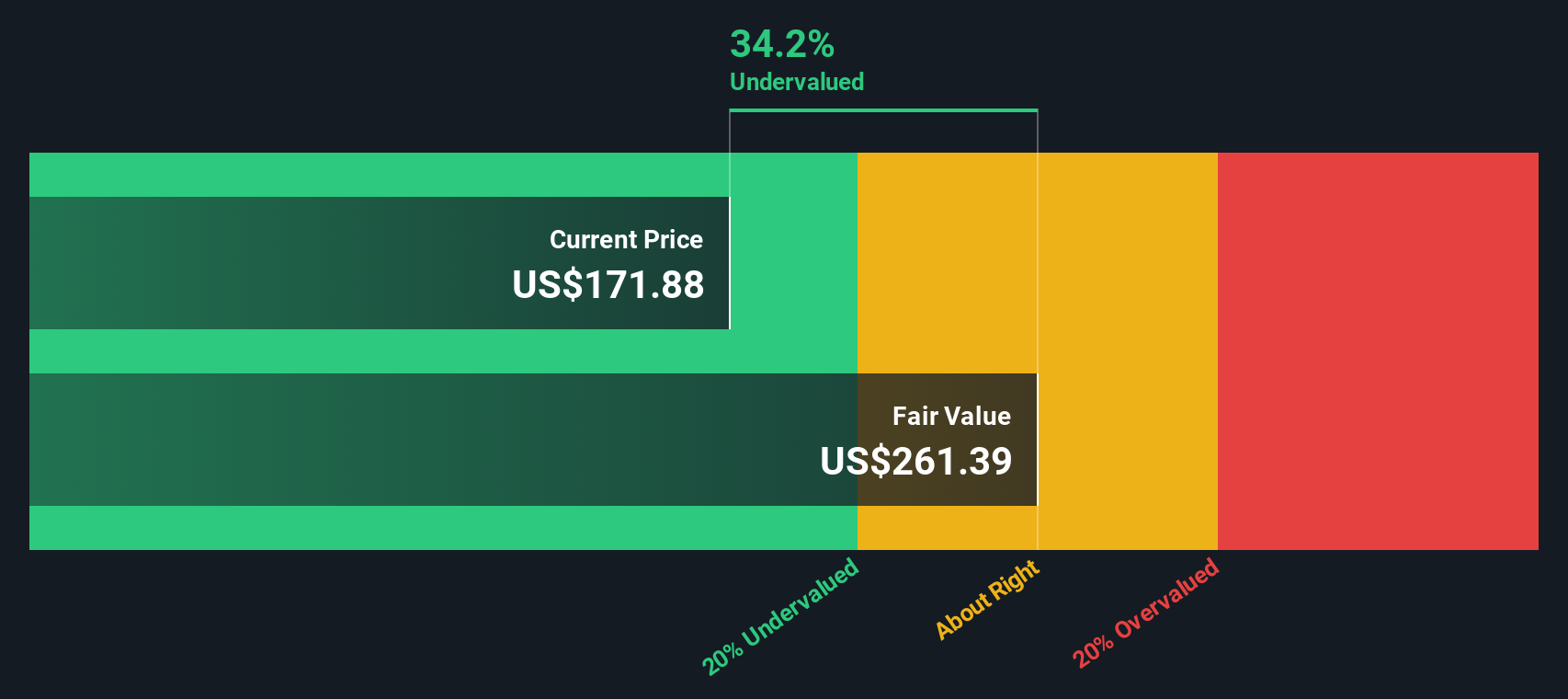

While FrugalBull’s narrative lands on a $204.74 fair value and labels Atlassian as undervalued, our SWS DCF model goes further and suggests fair value around $248.63, with the current $94.72 price sitting at a 61.9% discount. If both are right, is sentiment simply too pessimistic here? Or are the assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Atlassian Narrative

If you are not fully aligned with these views or prefer to rely on your own work, you can build a fresh thesis in just a few minutes by starting with Do it your way.

A great starting point for your Atlassian research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Atlassian has sharpened your focus, do not stop here. The right watchlist can start with just a few well chosen new ideas.

- Spot potential mispricings by reviewing companies in our 53 high quality undervalued stocks and see which names line up with the kind of margin and growth profile you care about.

- Prioritise resilience by checking out the 86 resilient stocks with low risk scores, where you can focus on businesses that our model flags with more measured risk characteristics.

- Hunt for future leaders before they attract wider attention by scanning the screener containing 25 high quality undiscovered gems and shortlisting a few for deeper research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Provides a collaboration software that enables organizations to connect all teams through a system of work that unlocks productivity at scale worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Future PE of 12.8x Shines Bright for FactSet Growth

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Quintessential serial acquirer

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.