- United States

- /

- Food and Staples Retail

- /

- NYSE:TBBB

3 Growth Companies With Up To 36% Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences a mix of gains and losses, with indices like the Dow Jones and S&P 500 showing resilience despite some sector-specific downturns, investors are keenly observing growth companies that demonstrate strong potential amid fluctuating economic indicators. In this environment, insider ownership can be a compelling factor for investors seeking confidence in a company's future prospects, as it often signals alignment between company insiders and shareholders' interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 22.6% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.2% |

| Astera Labs (ALAB) | 11.9% | 29.1% |

| AppLovin (APP) | 27.5% | 26.4% |

Here we highlight a subset of our preferred stocks from the screener.

AAON (AAON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AAON, Inc. operates in the engineering, manufacturing, marketing, and selling of air conditioning and heating equipment across the United States and Canada, with a market cap of $7.46 billion.

Operations: The company's revenue segments include Basx at $261.14 million, AAON Oklahoma at $800.67 million, and AAON Coil Products at $304.10 million.

Insider Ownership: 15.9%

AAON, Inc. is positioned for growth with insider ownership supporting its strategic direction. Recent guidance indicates robust revenue growth driven by production recovery and pricing strategies. Despite a decline in net income, earnings are expected to grow significantly over the next three years, outpacing the US market average. The company trades below analyst price targets and has seen modest insider buying recently. However, profit margins have decreased compared to last year, reflecting challenges in maintaining profitability amidst expansion efforts.

- Get an in-depth perspective on AAON's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that AAON's share price might be on the expensive side.

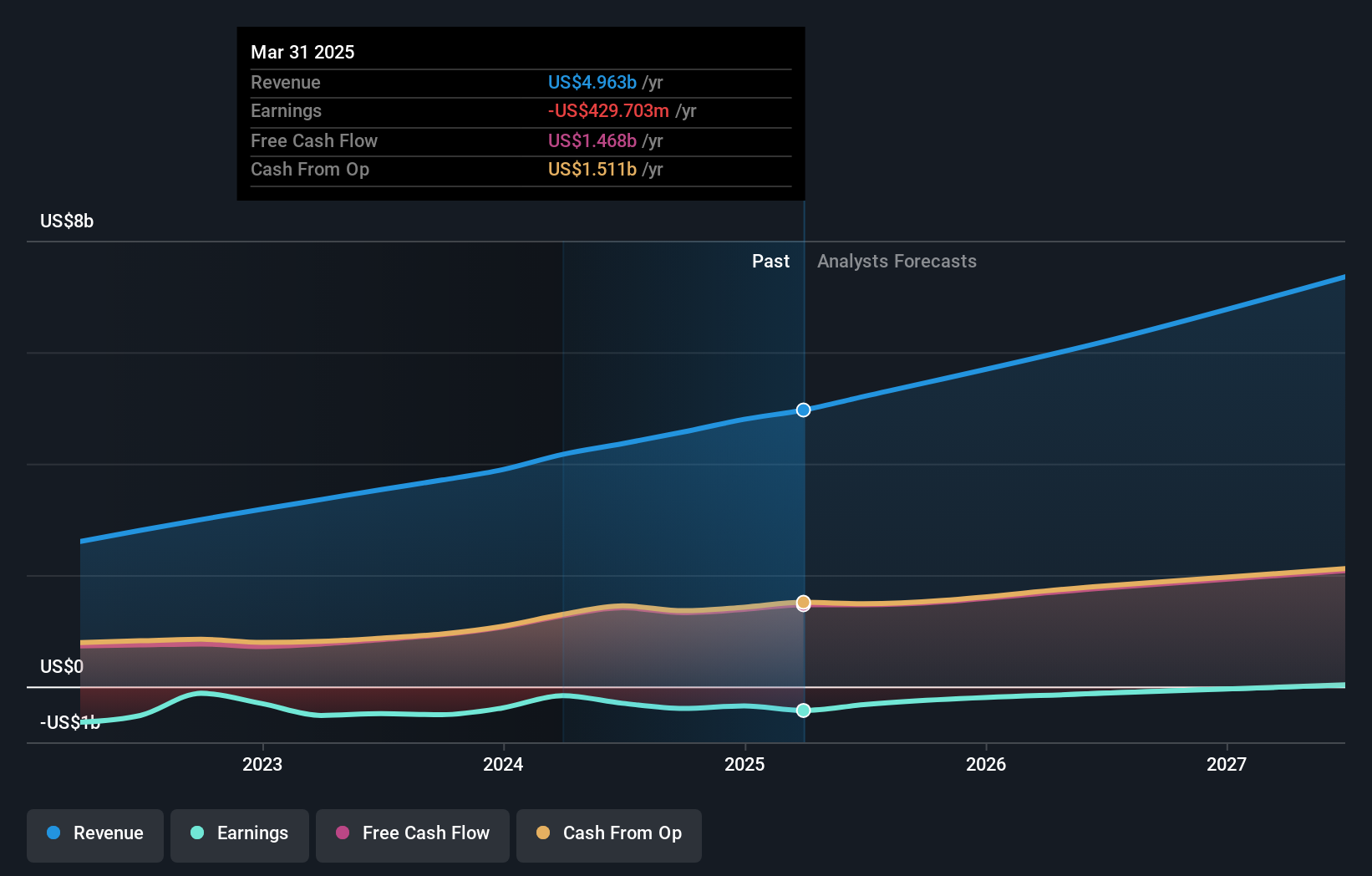

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation offers collaboration software designed to enhance organizational productivity globally, with a market cap of approximately $38.49 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $5.46 billion.

Insider Ownership: 36.7%

Atlassian is poised for growth with significant insider ownership, though recent months saw substantial insider selling. The company has completed a share buyback of $578.73 million and announced a new $2.5 billion repurchase plan, indicating confidence in its valuation. Despite reporting a net loss in Q1 2026, revenue grew to $1.43 billion from the previous year, with future earnings expected to outpace market averages as profitability is anticipated within three years.

- Click to explore a detailed breakdown of our findings in Atlassian's earnings growth report.

- Upon reviewing our latest valuation report, Atlassian's share price might be too pessimistic.

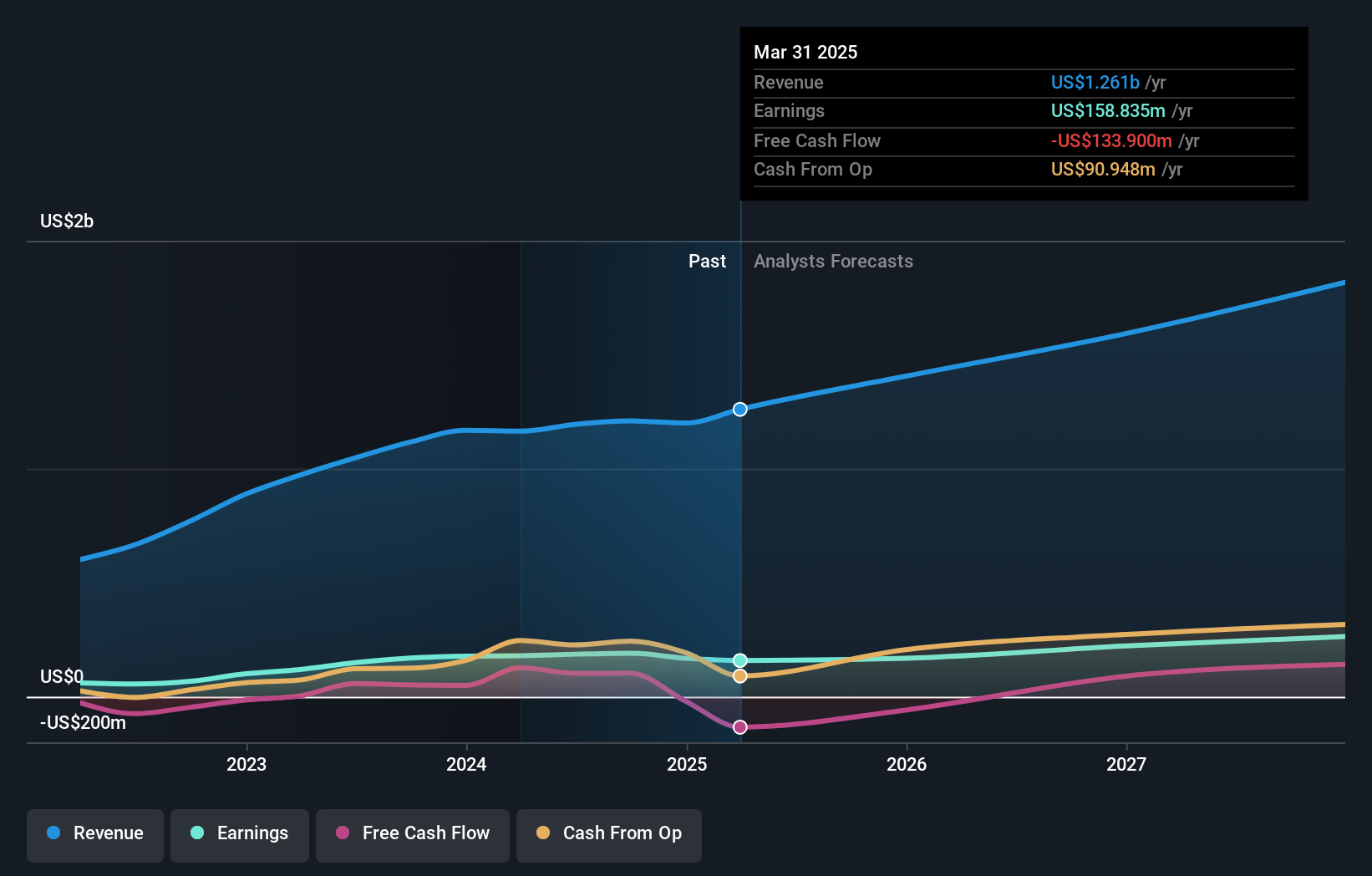

BBB Foods (TBBB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BBB Foods Inc., with a market cap of $3.65 billion, operates a chain of grocery retail stores in Mexico through its subsidiaries.

Operations: The company's revenue is primarily derived from the sale, acquisition, and distribution of various products and consumer goods, amounting to MX$72.53 billion.

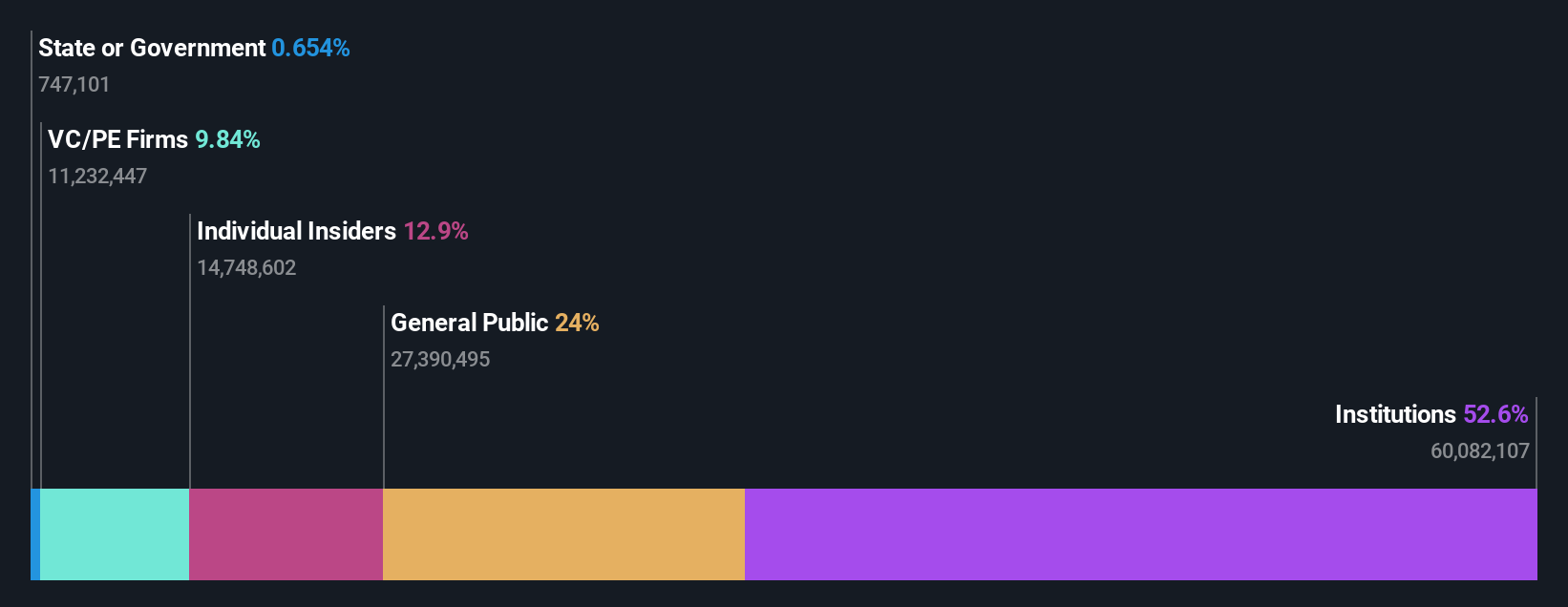

Insider Ownership: 12.9%

BBB Foods shows potential for growth with high insider ownership, despite recent financial challenges. The company reported a significant net loss in Q3 2025, contrasting with the previous year's profit, yet revenue surged to MXN 20.28 billion from MXN 14.83 billion year-on-year. Analysts forecast robust annual profit growth of over 71% and expect revenue to grow at an impressive rate of 21.9% annually, surpassing market averages and indicating future profitability within three years.

- Take a closer look at BBB Foods' potential here in our earnings growth report.

- Our valuation report here indicates BBB Foods may be overvalued.

Seize The Opportunity

- Access the full spectrum of 200 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BBB Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TBBB

BBB Foods

Through its subsidiaries, operates a chain of grocery retail stores in Mexico.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success