- United States

- /

- IT

- /

- NasdaqCM:TCX

This Is Why Tucows Inc.'s (NASDAQ:TCX) CEO Compensation Looks Appropriate

Shareholders may be wondering what CEO Elliot Noss plans to do to improve the less than great performance at Tucows Inc. (NASDAQ:TCX) recently. At the next AGM coming up on 07 September 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for Tucows

Comparing Tucows Inc.'s CEO Compensation With the industry

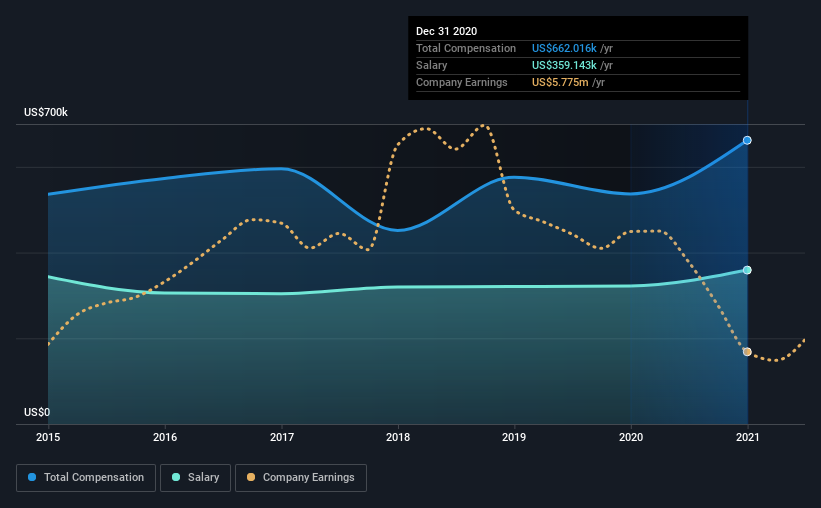

At the time of writing, our data shows that Tucows Inc. has a market capitalization of US$791m, and reported total annual CEO compensation of US$662k for the year to December 2020. Notably, that's an increase of 23% over the year before. In particular, the salary of US$359.1k, makes up a fairly large portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$1.6m. This suggests that Elliot Noss is paid below the industry median. What's more, Elliot Noss holds US$52m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$359k | US$322k | 54% |

| Other | US$303k | US$215k | 46% |

| Total Compensation | US$662k | US$537k | 100% |

On an industry level, around 18% of total compensation represents salary and 82% is other remuneration. Tucows is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Tucows Inc.'s Growth

Over the last three years, Tucows Inc. has shrunk its earnings per share by 33% per year. In the last year, its revenue is down 14%.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Tucows Inc. Been A Good Investment?

With a total shareholder return of 28% over three years, Tucows Inc. shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Shareholder returns while positive, need to be looked at along with earnings, which have failed to grow and this could mean that the current momentum may not continue. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 5 warning signs for Tucows you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Tucows, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tucows might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:TCX

Tucows

Provides domain name registration, email, and other internet related services in North America and Europe.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026