- United States

- /

- Software

- /

- NasdaqCM:SPT

Further weakness as Sprout Social (NASDAQ:SPT) drops 7.8% this week, taking three-year losses to 78%

Every investor on earth makes bad calls sometimes. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Sprout Social, Inc. (NASDAQ:SPT) investors who have held the stock for three years as it declined a whopping 78%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 62%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 39% in the last 90 days.

After losing 7.8% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Sprout Social isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Sprout Social grew revenue at 22% per year. That's well above most other pre-profit companies. So why has the share priced crashed 21% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Sometimes fast revenue growth doesn't lead to profits. Unless the balance sheet is strong, the company might have to raise capital.

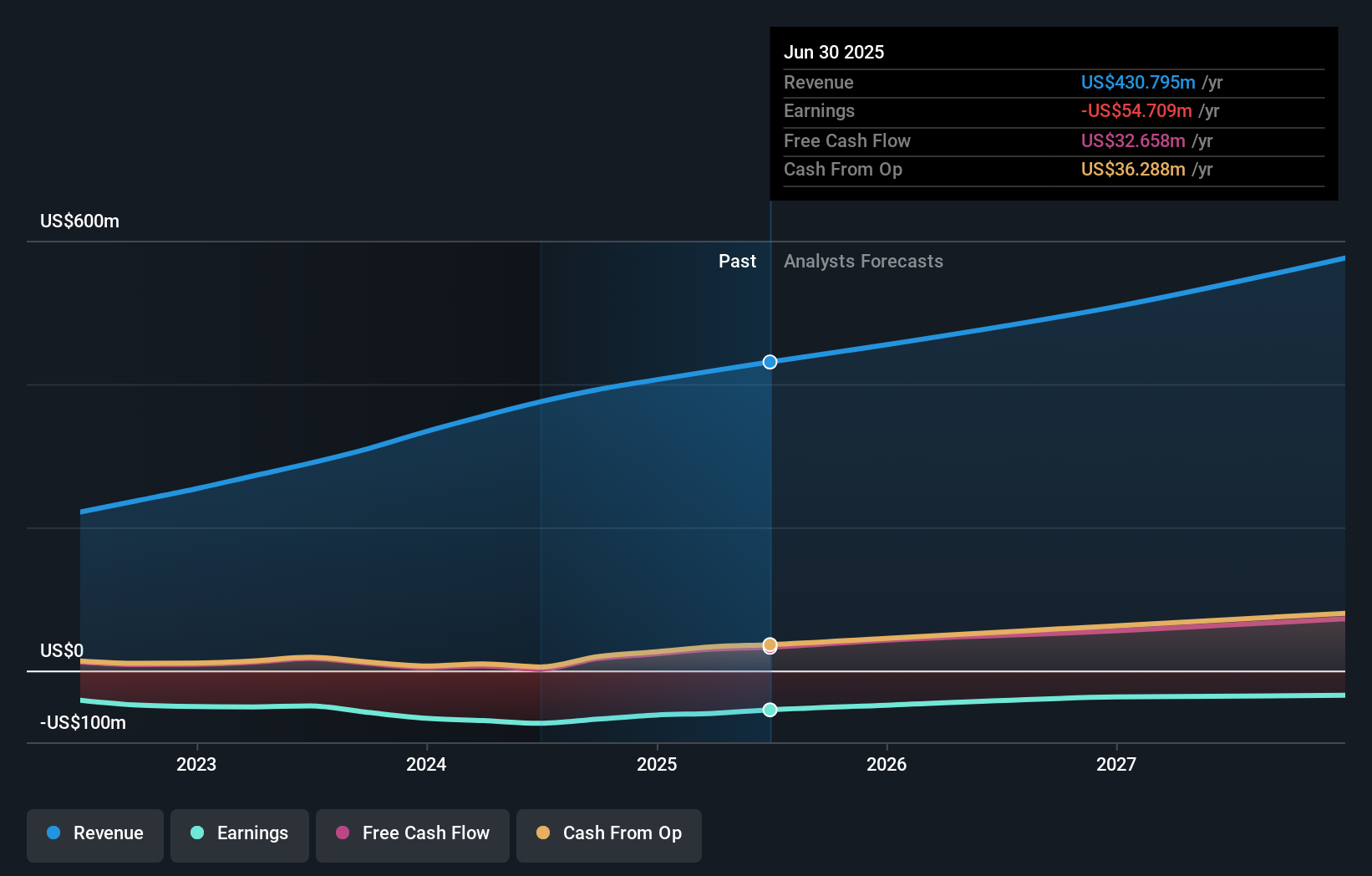

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Sprout Social is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Sprout Social will earn in the future (free analyst consensus estimates)

A Different Perspective

While the broader market gained around 21% in the last year, Sprout Social shareholders lost 62%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Sprout Social is showing 1 warning sign in our investment analysis , you should know about...

But note: Sprout Social may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SPT

Sprout Social

Designs, develops, and operates a web-based social media management platform in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives