- United States

- /

- Software

- /

- NasdaqGS:SPSC

Evaluating SPS Commerce (SPSC): Is the Recent Downtrend Creating a Potential Value Opportunity?

See our latest analysis for SPS Commerce.

SPS Commerce’s share price momentum has faded considerably compared to earlier in the year, with this month’s sharp drop capping off a tough stretch. The stock has a year-to-date share price return of -56.3%, and has delivered a -54.7% total shareholder return over the past year. This recent weakness continues a longer-term trend rather than being an isolated event.

If you’re interested in uncovering fresh opportunities, now is a great moment to broaden your view and check out fast growing stocks with high insider ownership.

With shares now trading well below analyst targets and the company still showing profitable growth, could SPS Commerce be a bargain at current prices? Or are markets already accounting for all future upside?

Most Popular Narrative: 18.5% Undervalued

According to the most widely followed narrative, SPS Commerce’s fair value estimate stands notably above the last close price of $79.89. This gap between current trading levels and the calculated fair value calls for a closer look at the underlying assumptions driving this projection.

The accelerating digitalization of retail supply chains and rising compliance requirements are driving robust demand for SPS Commerce's cloud-based EDI and supply chain solutions, supporting sustained growth in new customer adds and recurring revenue. As the complexity of omni-channel retail and need for real-time, integrated supply chain analytics increases, SPS Commerce is well positioned to expand its average revenue per user (ARPU) through expanded network connections and the cross-selling of high-value products like analytics and revenue recovery solutions.

Curious what powers this bullish outlook? The fair value is built on ambitious targets for growth, profitability, and customer expansion that push the boundaries of typical projections. There is a key detail at the heart of the narrative that could surprise you; find out what it is by reading the full analysis.

Result: Fair Value of $98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing caution from U.S. suppliers and persistent revenue pressure could still challenge the recovery and test investor confidence in the current narrative.

Find out about the key risks to this SPS Commerce narrative.

Another View: What Do Multiples Say?

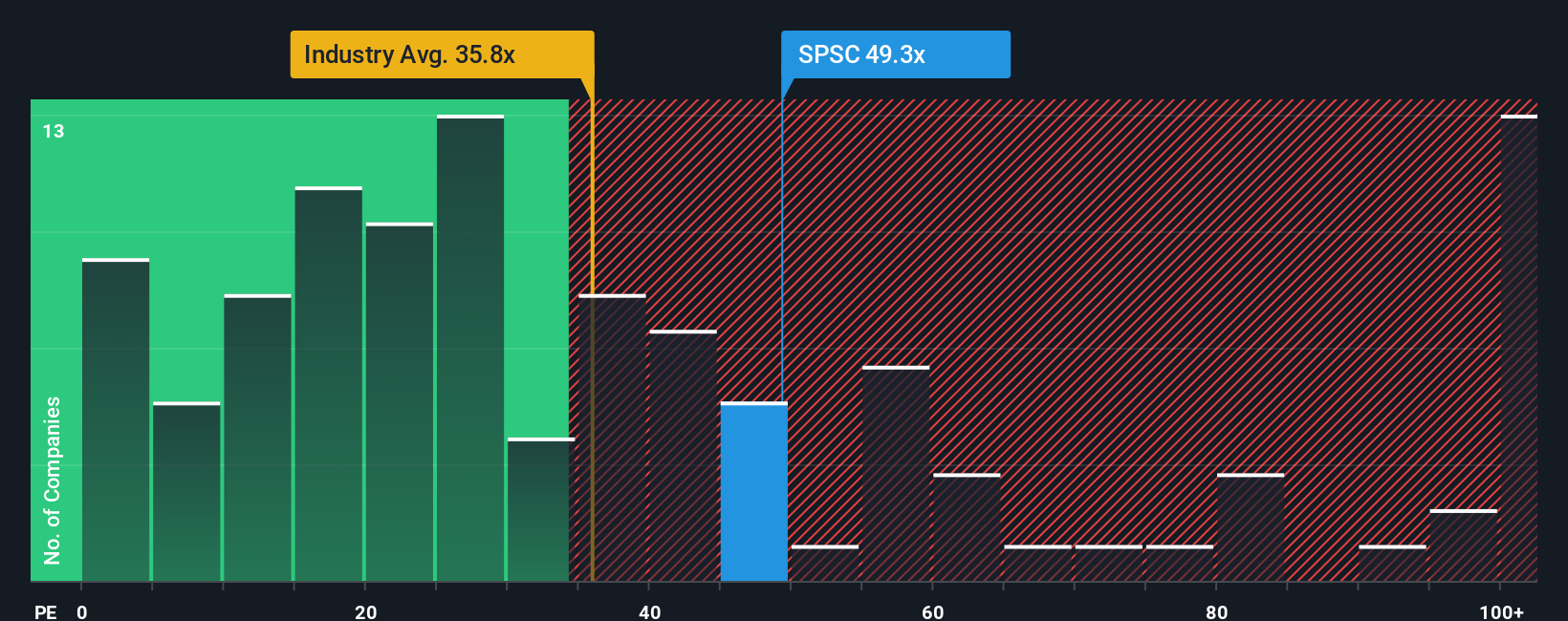

Looking from a different angle, SPS Commerce currently trades at a price-to-earnings ratio of 35.4x. This is higher than the US Software industry average of 31.2x, but still below its peers’ average of 51x. Compared to a fair ratio of 31.5x, the stock could appear a little pricey, which signals a risk that the market may reprice if expectations shift. Does this premium reflect justified growth, or is it a warning sign for value-conscious investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SPS Commerce Narrative

If you want to follow your own path or dig deeper into the numbers, you can easily craft your own view of SPS Commerce in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding SPS Commerce.

Looking for More Smart Investment Ideas?

Why stop here? Your next great investment could be just a click away. Take action now to uncover market movers you might regret missing.

- Unlock the potential of tomorrow by checking out these 26 AI penny stocks, a resource for businesses shaping the artificial intelligence landscape.

- Earn passive income and seek stability by reviewing these 18 dividend stocks with yields > 3%, a selection offering attractive dividend yields and robust fundamentals.

- Gain an edge with overlooked bargains by analyzing these 899 undervalued stocks based on cash flows, which includes stocks trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SPSC

SPS Commerce

Provides cloud-based supply chain management solutions in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Spotify - A Fundamental and Historical Valuation

Very Bullish

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.