- United States

- /

- Software

- /

- NasdaqGM:SOUN

How Investors May Respond To SoundHound AI (SOUN) Expanding Voice AI Services Into In-Car Parking Payments

Reviewed by Sasha Jovanovic

- Parkopedia announced an expanded partnership with SoundHound AI to launch an in-vehicle voice AI parking agent, integrating Parkopedia’s global parking database with SoundHound’s voice commerce platform for hands-free parking search and payments.

- This collaboration marks a significant extension of SoundHound’s voice commerce applications from food ordering to essential automotive services, highlighting growing adoption of AI assistants in daily driving scenarios.

- We'll explore how the new voice-powered parking agent could influence SoundHound AI's recurring revenue and industry expansion narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

SoundHound AI Investment Narrative Recap

To be a shareholder in SoundHound AI, you need to believe that the advance of AI-powered voice commerce, particularly within the automotive sector, will drive meaningful recurring revenue growth and enhance the company’s competitive moat. While the expanded Parkopedia partnership brings SoundHound’s technology into more essential driving scenarios, it does not materially change the short-term focus on achieving profitability, nor does it remove ongoing concerns around heavy operating losses and cash burn. Among recent company announcements, the August launch of SoundHound Chat AI Automotive in select Jeep vehicles stands out as directly relevant. This move advanced the market rollout of conversational AI for in-car use, reinforcing the company’s expansion into embedded automotive solutions, a key area tied to both immediate revenue opportunities and longer-term market penetration. But even with promising growth, investors should also consider the ongoing risk from rising R&D and sales expenses if revenue growth slows...

Read the full narrative on SoundHound AI (it's free!)

SoundHound AI's narrative projects $308.5 million revenue and $40.4 million earnings by 2028. This requires 32.9% yearly revenue growth and a $265.8 million increase in earnings from -$225.4 million today.

Uncover how SoundHound AI's forecasts yield a $16.94 fair value, a 42% upside to its current price.

Exploring Other Perspectives

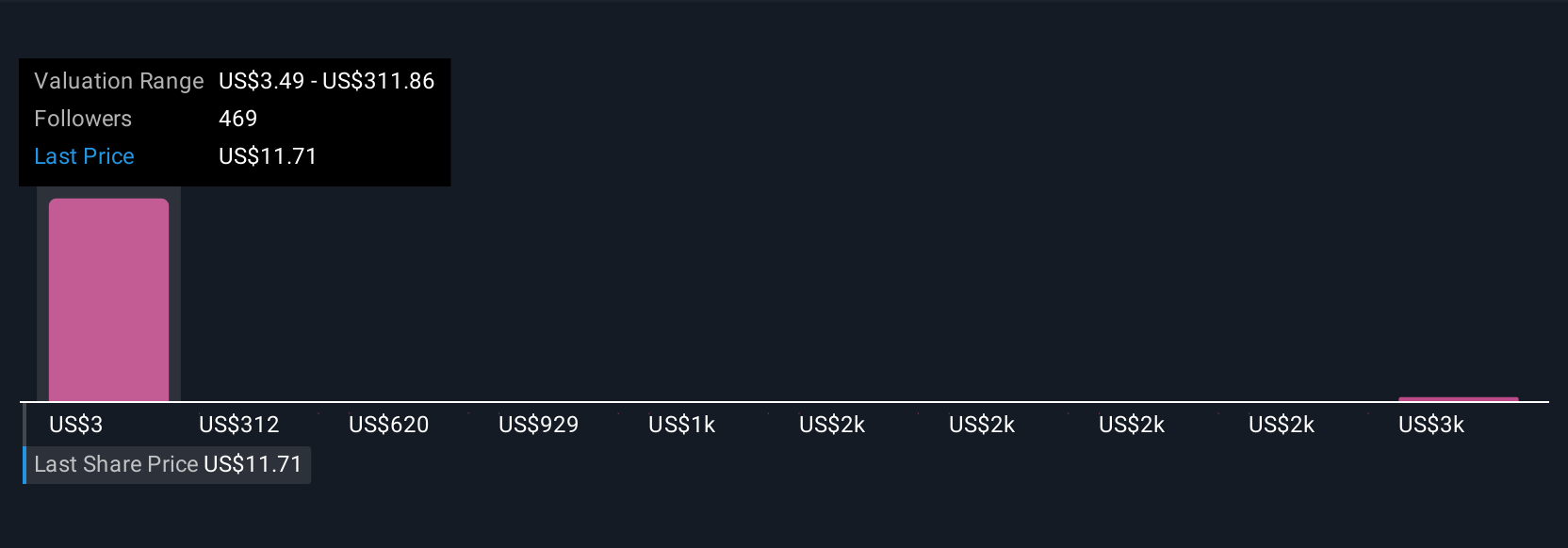

Fourteen members of the Simply Wall St Community shared fair value estimates for SoundHound AI ranging from US$3.41 to US$28.58. While these perspectives are broad, continued high operating costs and uneven profitability remain a concern for many, shaping expectations about the company’s long-term performance.

Explore 14 other fair value estimates on SoundHound AI - why the stock might be worth less than half the current price!

Build Your Own SoundHound AI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SoundHound AI research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free SoundHound AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SoundHound AI's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SOUN

SoundHound AI

Develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers in the United States, Korea, France, Japan, Germany, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success