- United States

- /

- Software

- /

- NasdaqGS:SNPS

What Does Synopsys' (NASDAQ:SNPS) CEO Pay Reveal?

Aart de Geus became the CEO of Synopsys, Inc. (NASDAQ:SNPS) in 2012, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Synopsys pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Synopsys

How Does Total Compensation For Aart de Geus Compare With Other Companies In The Industry?

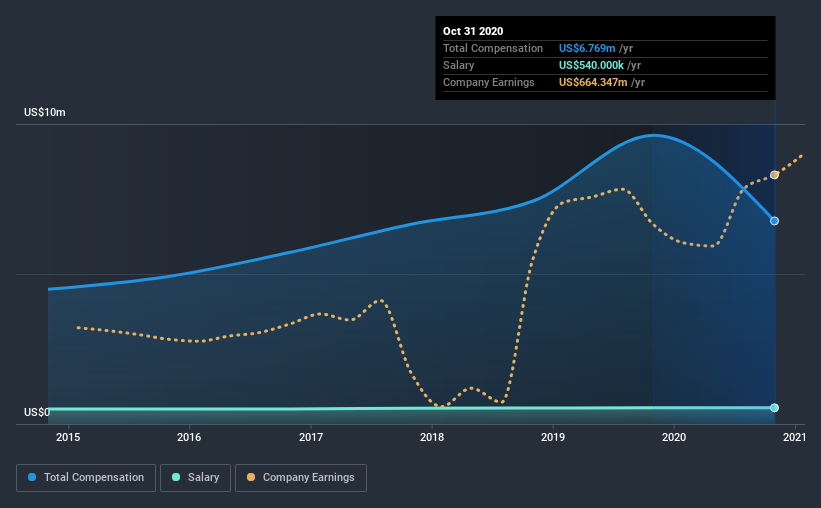

Our data indicates that Synopsys, Inc. has a market capitalization of US$41b, and total annual CEO compensation was reported as US$6.8m for the year to October 2020. That's a notable decrease of 30% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$540k.

For comparison, other companies in the industry with market capitalizations above US$8.0b, reported a median total CEO compensation of US$9.6m. From this we gather that Aart de Geus is paid around the median for CEOs in the industry. What's more, Aart de Geus holds US$129m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

On an industry level, roughly 13% of total compensation represents salary and 87% is other remuneration. Synopsys sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Synopsys, Inc.'s Growth Numbers

Synopsys, Inc. has seen its earnings per share (EPS) increase by 149% a year over the past three years. It achieved revenue growth of 13% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Synopsys, Inc. Been A Good Investment?

We think that the total shareholder return of 214%, over three years, would leave most Synopsys, Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As previously discussed, Aart is compensated close to the median for companies of its size, and which belong to the same industry. Few would be critical of the leadership, since returns have been juicy and EPS are moving in the right direction. Indeed, many might consider that Aart is compensated rather modestly, given the solid company performance! In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Synopsys that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Synopsys, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:SNPS

Synopsys

Provides design IP solutions in the semiconductor and electronics industries.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

VTEX - A hidden Latin American growth opportunity?

Overweight on ANN

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion