- United States

- /

- Software

- /

- NasdaqGS:SNPS

Is Synopsys (SNPS) Pricing Look Stretched After Recent Share Price Swings And NVIDIA Partnership

- If you are wondering whether Synopsys at around US$437.45 is giving you fair value for the risk you are taking, you are asking the right question and this article is going to stay focused on exactly that.

- The stock has recently been mixed, with a 4.4% gain over the last 7 days, a 16.7% decline over 30 days, and year to date and 1 year returns of 8.9% and 17.3% declines respectively, set against longer term 3 year and 5 year returns of 16.4% and 50.5%.

- These moves are coming in the context of ongoing interest in chip design and software names and regular updates around industry demand and capital spending. These factors can quickly change how investors think about companies like Synopsys. For a valuation focused investor, that kind of backdrop makes it even more important to separate share price swings from underlying worth.

- On our checks, Synopsys currently has a valuation score of 1 out of 6. Next we will look at what different valuation approaches say about that number and hint at an even better way to think about value that we will come back to at the end of the article.

Synopsys scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Synopsys Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash Synopsys is expected to generate in the future, then discounts those amounts back to what they might be worth in today’s dollars. It is a way of asking what a rational buyer might pay today for the stream of future cash flows.

For Synopsys, the latest twelve month free cash flow is about $1.33b. Using a 2 Stage Free Cash Flow to Equity model, analysts provide explicit forecasts out to 2028, with Simply Wall St extrapolating further to build a 10 year path. On these assumptions, projected free cash flow for 2028 is $3.21b, and the later year projections gradually climb from there, all in dollar terms.

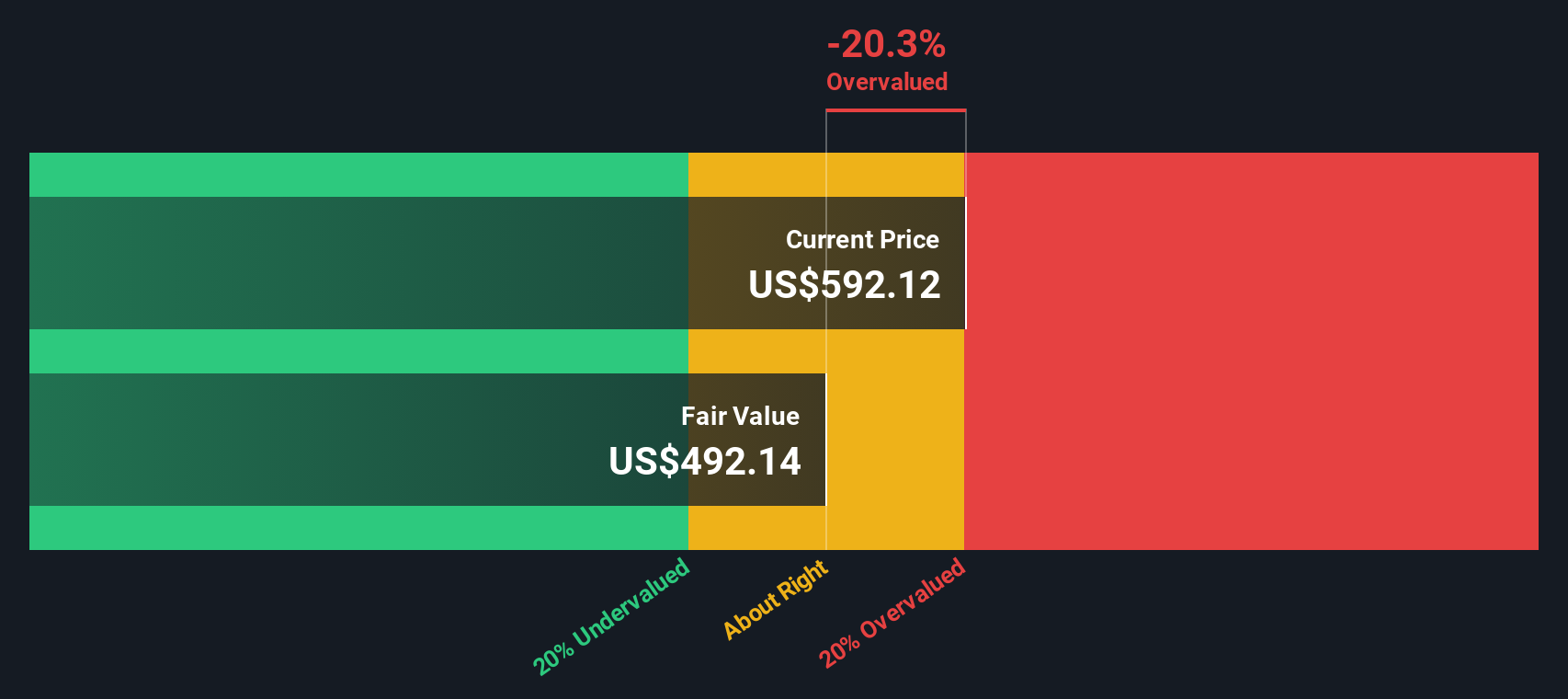

When these projected cash flows are discounted back, the model arrives at an estimated intrinsic value of about $381.11 per share. Compared with the recent share price around $437.45, the DCF output implies Synopsys trades at roughly a 14.8% premium to this estimate. Based on this specific model, the stock appears overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Synopsys may be overvalued by 14.8%. Discover 51 high quality undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Synopsys Price vs Earnings

For a profitable company like Synopsys, the P/E ratio is a useful yardstick because it links what you are paying directly to the earnings the business is already generating. It is a quick way to see how many dollars investors are currently willing to pay for each dollar of earnings.

What counts as a "normal" or "fair" P/E depends on how the market views a company’s growth prospects and risks. Higher expected growth or lower perceived risk can justify a higher P/E, while slower growth or higher uncertainty usually line up with a lower P/E.

Synopsys is trading on a P/E of 62.64x. That sits above the Software industry average of 28.71x and the peer group average of 41.70x. Simply Wall St’s Fair Ratio for Synopsys is 39.77x, which is its proprietary view of what the P/E could be given factors such as earnings growth, industry, profit margins, market cap and risk profile.

This Fair Ratio is more tailored than a simple comparison with peers or the broad industry, because it adjusts for the company’s specific characteristics rather than assuming all software names deserve the same multiple. When set against this Fair Ratio of 39.77x, the current P/E of 62.64x suggests Synopsys is trading at a premium.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Synopsys Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which let you set out your own story for Synopsys and tie that story to specific assumptions about future revenue, earnings and margins, then translate those into a fair value you can compare with today’s price.

A Narrative on Simply Wall St is your written view of what is driving Synopsys, linked directly to a forecast and a fair value estimate, all hosted in the Community page where millions of investors share their thinking in a format that sits on top of the same financial model.

This means Narratives can help you decide whether Synopsys looks attractive or not by showing you, in one place, how your fair value compares with the current share price, while automatically updating your view when fresh information such as news, analyst revisions or earnings guidance is added to the platform.

For example, one Synopsys Narrative might lean into the NVIDIA partnership, expected SaaS and cloud adoption and analyst consensus fair value of about US$555.65. Another might focus on IP segment risks, trimmed analyst targets between US$550 and US$715 and the updated US$520 target, leading to very different conclusions about whether the current US$437.45 price looks appealing or not.

Do you think there's more to the story for Synopsys? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides design IP solutions in the semiconductor and electronics industries.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Delta loses shine after warning of falling travel demand, but still industry leader

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.