- United States

- /

- Software

- /

- NasdaqGS:SNPS

Is Synopsys (NASDAQ:SNPS) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Synopsys, Inc. (NASDAQ:SNPS) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Synopsys

What Is Synopsys's Debt?

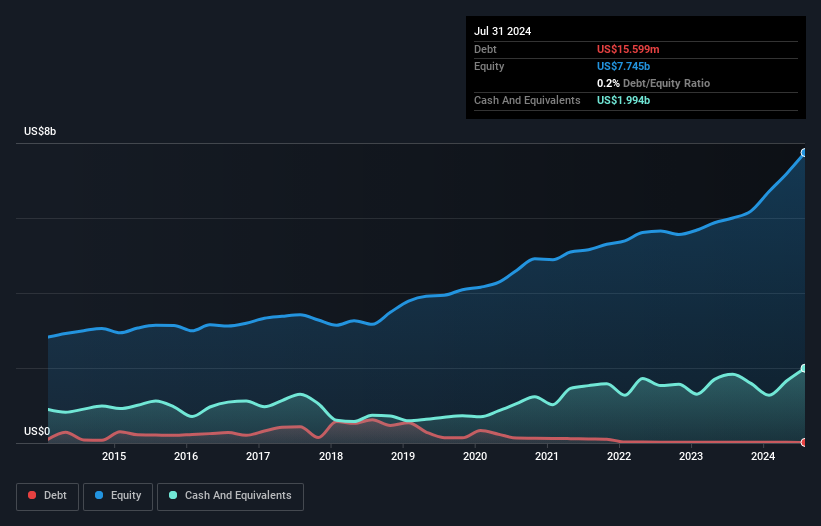

The image below, which you can click on for greater detail, shows that Synopsys had debt of US$15.6m at the end of July 2024, a reduction from US$18.2m over a year. But on the other hand it also has US$1.99b in cash, leading to a US$1.98b net cash position.

A Look At Synopsys' Liabilities

Zooming in on the latest balance sheet data, we can see that Synopsys had liabilities of US$2.53b due within 12 months and liabilities of US$1.37b due beyond that. Offsetting these obligations, it had cash of US$1.99b as well as receivables valued at US$1.50b due within 12 months. So it has liabilities totalling US$410.0m more than its cash and near-term receivables, combined.

Having regard to Synopsys' size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$79.6b company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, Synopsys boasts net cash, so it's fair to say it does not have a heavy debt load!

In addition to that, we're happy to report that Synopsys has boosted its EBIT by 33%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Synopsys can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Synopsys has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Synopsys actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

We could understand if investors are concerned about Synopsys's liabilities, but we can be reassured by the fact it has has net cash of US$1.98b. The cherry on top was that in converted 111% of that EBIT to free cash flow, bringing in US$998m. So is Synopsys's debt a risk? It doesn't seem so to us. Another factor that would give us confidence in Synopsys would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SNPS

Synopsys

Provides design IP solutions in the semiconductor and electronics industries.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion