- United States

- /

- Software

- /

- NasdaqCM:SNCR

Shareholders May Not Overlook Synchronoss Technologies Insiders Selling US$1.2m In Stock

Even though Synchronoss Technologies, Inc. (NASDAQ:SNCR) stock gained 11% last week, insiders who sold US$1.2m worth of stock over the past year are probably better off. Holding on to stock would have meant their investment would be worth less now than it was at the time of sale. Thus selling at an average price of US$12.54, which is higher than the current price, may have been the best decision.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

The Last 12 Months Of Insider Transactions At Synchronoss Technologies

In the last twelve months, the biggest single sale by an insider was when the insider, Bryant Riley, sold US$336k worth of shares at a price of US$12.14 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is US$8.25. So it is hard to draw any strong conclusion from it.

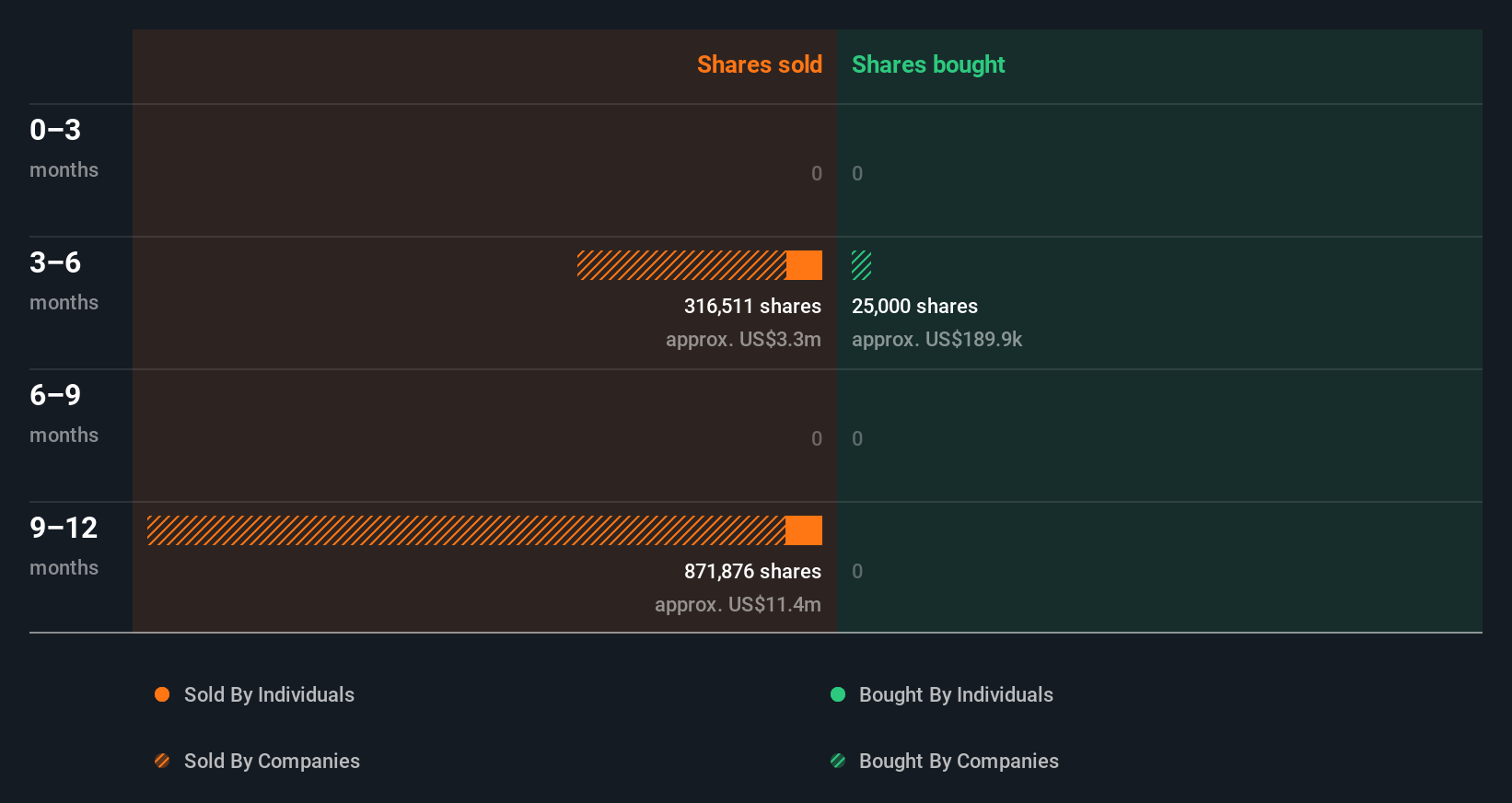

Synchronoss Technologies insiders didn't buy any shares over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Check out our latest analysis for Synchronoss Technologies

I will like Synchronoss Technologies better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Insider Ownership Of Synchronoss Technologies

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Our data indicates that Synchronoss Technologies insiders own about US$9.5m worth of shares (which is 12% of the company). Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

So What Do The Synchronoss Technologies Insider Transactions Indicate?

The fact that there have been no Synchronoss Technologies insider transactions recently certainly doesn't bother us. The insider transactions at Synchronoss Technologies are not inspiring us to buy. We also note that, as far as we can see, insider ownership is fairly low, compared to other companies. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Synchronoss Technologies. At Simply Wall St, we found 1 warning sign for Synchronoss Technologies that deserve your attention before buying any shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SNCR

Synchronoss Technologies

Provides white label cloud software and services in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Superintelligence Pivot: Meta’s $135 Billion Bet on the Energy-Compute Nexus

The Privacy Fortress: Apple’s Lean AI Path and the $100 Billion Buyback Engine

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.