Stock Analysis

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Synchronoss Technologies, Inc. (NASDAQ:SNCR) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Synchronoss Technologies

How Much Debt Does Synchronoss Technologies Carry?

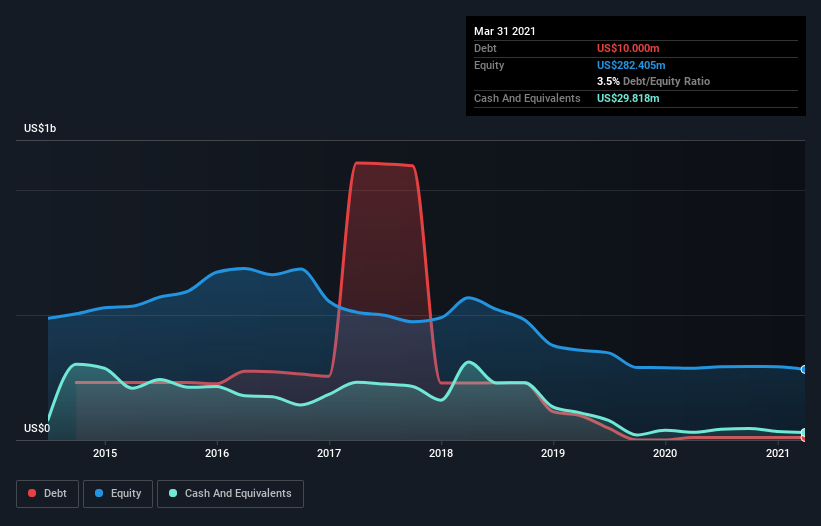

As you can see below, Synchronoss Technologies had US$10.0m of debt, at March 2021, which is about the same as the year before. You can click the chart for greater detail. However, it does have US$29.8m in cash offsetting this, leading to net cash of US$19.8m.

How Healthy Is Synchronoss Technologies' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Synchronoss Technologies had liabilities of US$127.0m due within 12 months and liabilities of US$55.8m due beyond that. On the other hand, it had cash of US$29.8m and US$46.2m worth of receivables due within a year. So it has liabilities totalling US$106.7m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of US$121.5m, so it does suggest shareholders should keep an eye on Synchronoss Technologies' use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. Despite its noteworthy liabilities, Synchronoss Technologies boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Synchronoss Technologies's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Synchronoss Technologies had a loss before interest and tax, and actually shrunk its revenue by 6.0%, to US$280m. That's not what we would hope to see.

So How Risky Is Synchronoss Technologies?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Synchronoss Technologies had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of US$566k and booked a US$59m accounting loss. With only US$19.8m on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Synchronoss Technologies that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Synchronoss Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Synchronoss Technologies is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:SNCR

Synchronoss Technologies

Provides cloud, messaging, digital, and network management solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Fair value with mediocre balance sheet.