- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (SHOP) Partners with OpenAI to Enable Instant Checkout in ChatGPT—What Does This Mean for AI-Driven Commerce?

Reviewed by Sasha Jovanovic

- OpenAI recently announced a partnership to integrate Shopify merchants into ChatGPT, enabling users to make direct purchases from Shopify sellers through the new Instant Checkout feature.

- This integration is poised to reshape how consumers discover and buy products, as it makes purchasing more seamless within AI-driven conversations and signals Shopify's growing focus on AI innovation.

- We'll examine how bringing instant checkout to ChatGPT could accelerate Shopify's AI adoption and expand new commerce opportunities for merchants.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Shopify Investment Narrative Recap

To be a Shopify shareholder, you need to believe in the company’s ability to be the core e-commerce platform powering global merchants, capturing value as digital commerce and AI-driven shopping accelerate. The recent integration with OpenAI’s ChatGPT brings short-term excitement around new commerce channels and AI-led features, though the most important near-term catalyst remains sustaining revenue momentum. However, Shopify’s exposure to increased regulatory pressures and intensifying competition remains a key risk, and this news does not directly diminish those concerns.

Among recent company news, the renewed partnership with Global-e Online stands out. By deepening international e-commerce capabilities, Shopify further supports global merchant growth and positions the platform to benefit from global digital commerce trends, fitting squarely into the AI and international expansion catalysts at the heart of the latest OpenAI announcement.

But in sharp contrast, investors should also be aware of rising regulatory scrutiny and digital taxation that could...

Read the full narrative on Shopify (it's free!)

Shopify's narrative projects $18.5 billion in revenue and $2.7 billion in earnings by 2028. This requires 22.6% annual revenue growth and a $0.4 billion increase in earnings from the current $2.3 billion.

Uncover how Shopify's forecasts yield a $163.15 fair value, in line with its current price.

Exploring Other Perspectives

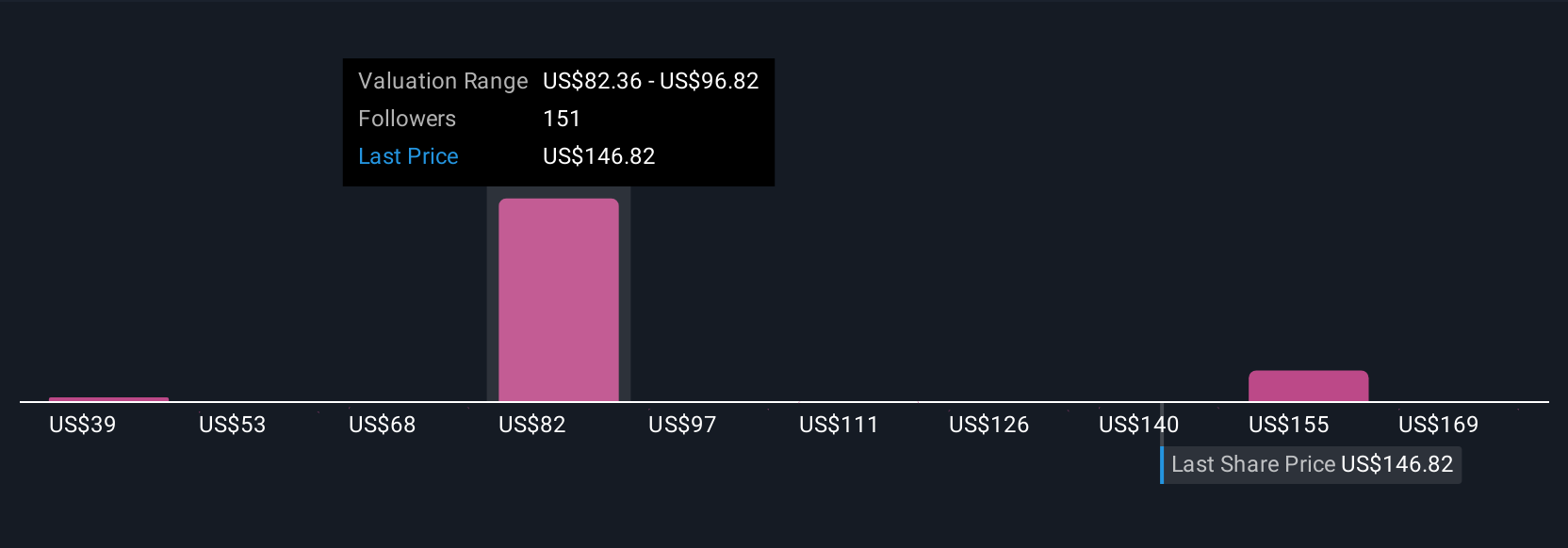

Thirty-two members of the Simply Wall St Community estimate Shopify’s fair value in a broad range between US$39 and US$200 per share. While opinions differ, Shopify’s continued AI integration and growth abroad could influence just how far the platform can go, see how other investors interpret these signals and more.

Explore 32 other fair value estimates on Shopify - why the stock might be worth as much as 24% more than the current price!

Build Your Own Shopify Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Shopify research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shopify's overall financial health at a glance.

No Opportunity In Shopify?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives