- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (SHOP): Evaluating Valuation as Shares Climb 9% on Renewed Growth Optimism

Reviewed by Kshitija Bhandaru

Shopify (SHOP) shares have been active lately as investors continue to digest the company's recent business updates and financial performance. The stock has posted a 9% gain over the past month, drawing attention from both retail and institutional investors.

See our latest analysis for Shopify.

Shopify’s momentum has been building, with a 9% run over the past month that extends its rebound from earlier in the year. While recent gains have caught attention, the bigger story is its impressive 93.6% one-year total shareholder return, which signals renewed confidence in Shopify’s growth potential.

Curious where the next success stories could come from? Now is a great time to broaden your investing perspective and discover fast growing stocks with high insider ownership

With such a strong surge behind it, the question now is whether Shopify’s current share price reflects all of its future prospects or if there is still room for investors to find untapped value in the stock.

Most Popular Narrative: 6.1% Undervalued

Shopify’s most widely-followed narrative points to an estimated fair value just above its recent closing price, suggesting analysts see further upside if bold business targets are realized.

Shopify is expanding rapidly in international markets, with 42% YoY GMV growth internationally (especially in Europe, but also in Asia Pacific). As digital commerce adoption increases globally, this drives a larger addressable market and is expected to support outperformance in revenue growth and GMV. The company is aggressively integrating AI-driven capabilities (such as Sidekick, AI store builder, conversational commerce integrations with large language models) to enable merchants to launch, manage, and scale stores with less friction and more efficiency. This is likely to accelerate merchant acquisition, improve retention, and drive higher margins through automation and new high-value features.

Want to know what’s powering this valuation? There is a secret growth recipe here: a blend of rising global expansion, innovation bets, and surprisingly optimistic financial projections. What are the key numbers that drive this target and set Shopify apart from peers? Find out what really underpins this ambitious price; some of the assumptions may surprise you.

Result: Fair Value of $161.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from rivals and rising regulatory costs could present challenges for Shopify as it works to maintain both growth momentum and strong margins going forward.

Find out about the key risks to this Shopify narrative.

Another View: Multiples Paint a Riskier Picture

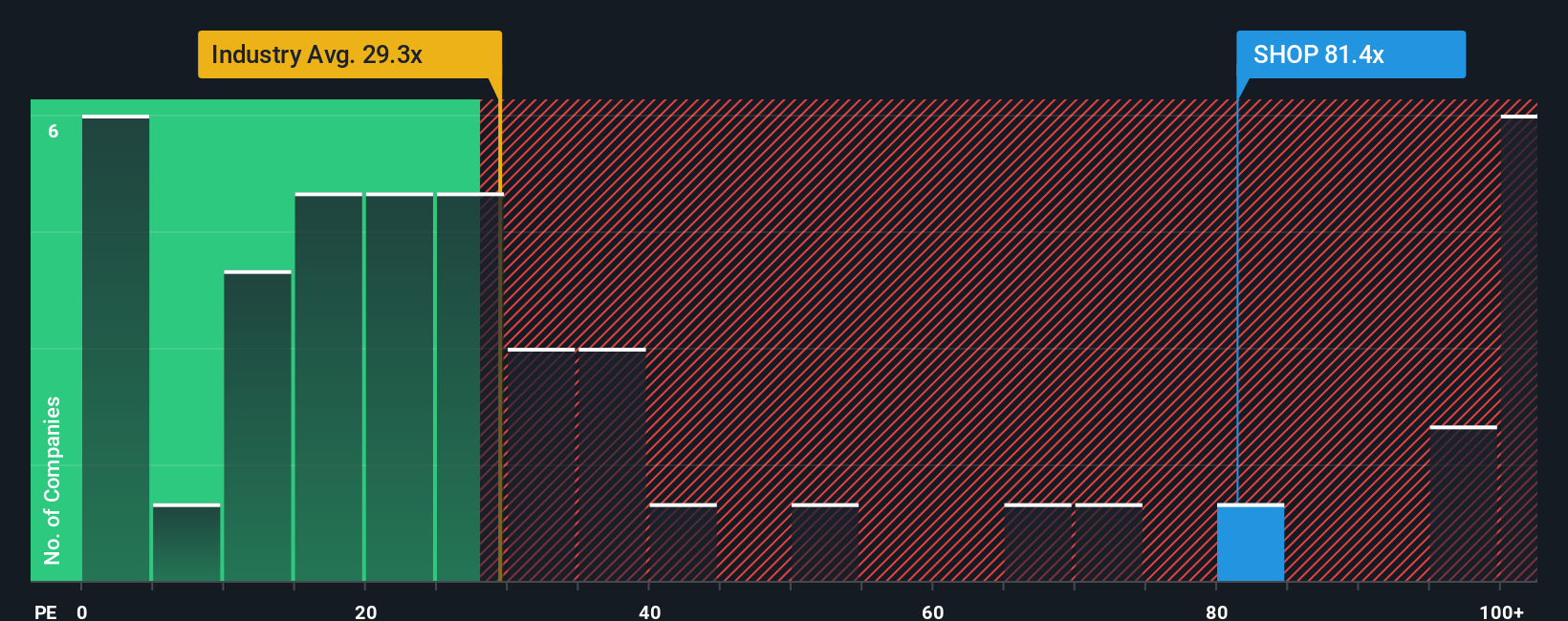

Looking at Shopify’s valuation through its price-to-earnings ratio tells a more cautious story. At 83.9x, the stock trades much higher than both its peers (51.5x) and the broader US IT industry (32.7x). It is also above the fair ratio of 42.9x. This signals investors are paying a steep premium compared to the market’s typical pricing, increasing the risk if high growth fails to materialize. Could this gap close soon, or does the premium have staying power?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shopify Narrative

If you have a unique perspective or believe there’s more to the story, you’re free to dig into the data and build a personalized view in just minutes. Do it your way

A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. The financial markets are full of smart moves waiting for you. Expand your options with hand-picked strategies tailored for real results.

- Unlock income growth potential through these 19 dividend stocks with yields > 3%, featuring companies with reliable yields above 3%.

- Tap into future tech trends by checking out these 24 AI penny stocks, already making waves in artificial intelligence.

- Catch undervalued gems others might miss with these 909 undervalued stocks based on cash flows, identified by strong cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives