- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (SHOP): Evaluating Valuation After Q2 Surge, Upbeat Guidance, and Major Client Wins

Reviewed by Simply Wall St

Most Popular Narrative: 10.9% Undervalued

According to the community narrative, Shopify is currently valued below its estimated fair price based on projected future earnings, margin assumptions, and a growth-focused strategy.

"Shopify is expanding rapidly in international markets, with 42% year-over-year GMV growth internationally (especially in Europe, but also in Asia Pacific). As digital commerce adoption increases globally, this drives a larger addressable market and is expected to support outperformance in revenue growth and GMV. The company is aggressively integrating AI-driven capabilities (such as Sidekick, the AI store builder, and conversational commerce integrations with large language models). These tools enable merchants to launch, manage, and scale stores with less friction and greater efficiency. This is likely to accelerate merchant acquisition, improve retention, and drive higher margins through automation and new high-value features."

Is Shopify’s next chapter about to break the mold? The narrative’s predicted fair value relies on ambitious sales expansion, dramatic international gains, and margin resilience. These are important ingredients behind this eye-catching price target. What does this combination mean for growth, and how bold are those financial forecasts? Discover the critical numbers fueling this undervalued call.

Result: Fair Value of $159.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition and increasing regulatory challenges could quickly dampen Shopify’s growth momentum and pose difficulties for even the most optimistic outlooks.

Find out about the key risks to this Shopify narrative.Another View: Are the Numbers Misleading?

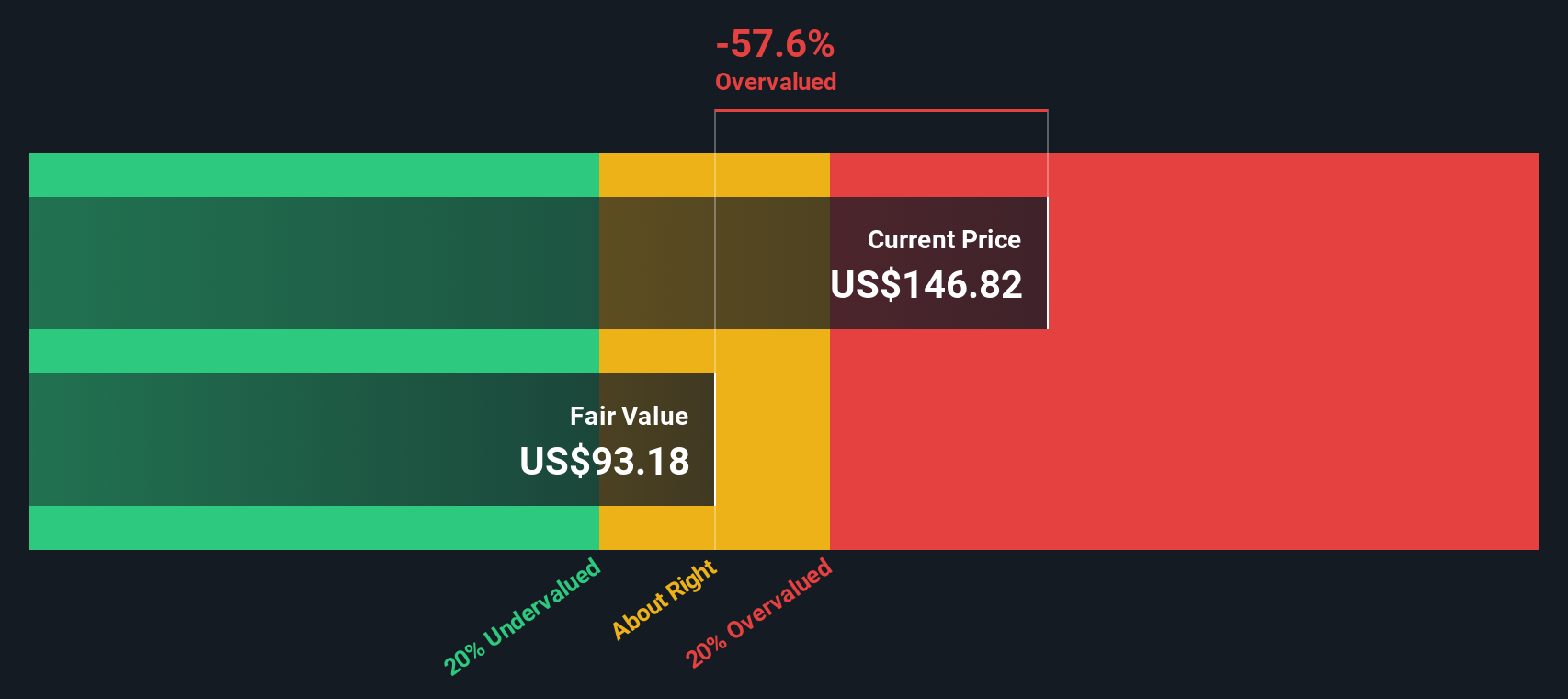

Looking from a different angle, our DCF model paints a less optimistic picture. This suggests Shopify may actually be trading above what its future cash flows would justify. Could the market be overlooking hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Shopify Narrative

If you're not convinced by the perspectives covered here or want to dig into the figures yourself, you can shape your own narrative in just a few minutes. Simply do it your way.

A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep their edge by always scouting for fresh opportunities. Strengthen your portfolio and stay ahead of the market by checking out these handpicked strategies on Simply Wall Street that thousands are using to find tomorrow’s standouts.

- Spot resilient earners by searching for steady dividend stocks with yields > 3% to lock in the power of reliable income streams amid market swings.

- Jump on trends early and pinpoint the next wave of innovation with our exclusive list of promising AI penny stocks before the crowd catches on.

- Accelerate your financial goals by lining up value plays using stocks that pass strict cash flow tests. Start with our undervalued stocks based on cash flows to identify real bargains in plain sight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives