- United States

- /

- IT

- /

- NasdaqGS:SHOP

Is Shopify’s Surge Justified After 51% Rally and New E-Commerce Partnerships?

Reviewed by Bailey Pemberton

Are you thinking about making a move on Shopify stock? You’re definitely not alone. There has been plenty of excitement around Shopify lately, with the share price surging 6.4% in just the last week, adding a 6.1% gain over the past month, and showing a significant 51.3% rise so far this year. In fact, anyone who held Shopify over the last twelve months would have nearly doubled their investment, with an impressive 99.3% return. Looking at a three-year view, Shopify is up more than 445.2%. All this price action raises the question: what is driving investor optimism, and is it justified?

Much of the recent momentum can be traced back to Shopify’s strategic partnerships in the e-commerce ecosystem, such as new integrations with logistics partners and the rollout of innovative merchant tools. Investors have also taken notice of Shopify’s ongoing international expansion, moves that signal the company is not content to sit still. While these headlines fuel hopes for long-term growth, some voices in the market are starting to question how much future upside is already reflected in the current price.

That brings us to the heart of the matter: valuation. Shopify faces high expectations, but is it actually undervalued right now? According to the numbers, Shopify’s valuation score currently sits at 0 out of 6, meaning it does not pass any of the standard checks for being undervalued. So, what goes into that score, and are the usual metrics telling the full story? Let’s take a closer look at the core valuation methods first, and then, at the end, consider a smarter framework for weighing if Shopify deserves a place in your portfolio.

Shopify scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Shopify Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those amounts back to their present value. In Shopify's case, the model uses analyst forecasts for Free Cash Flow (FCF) over the next five years, then extrapolates further data out to 2035 using internal assumptions.

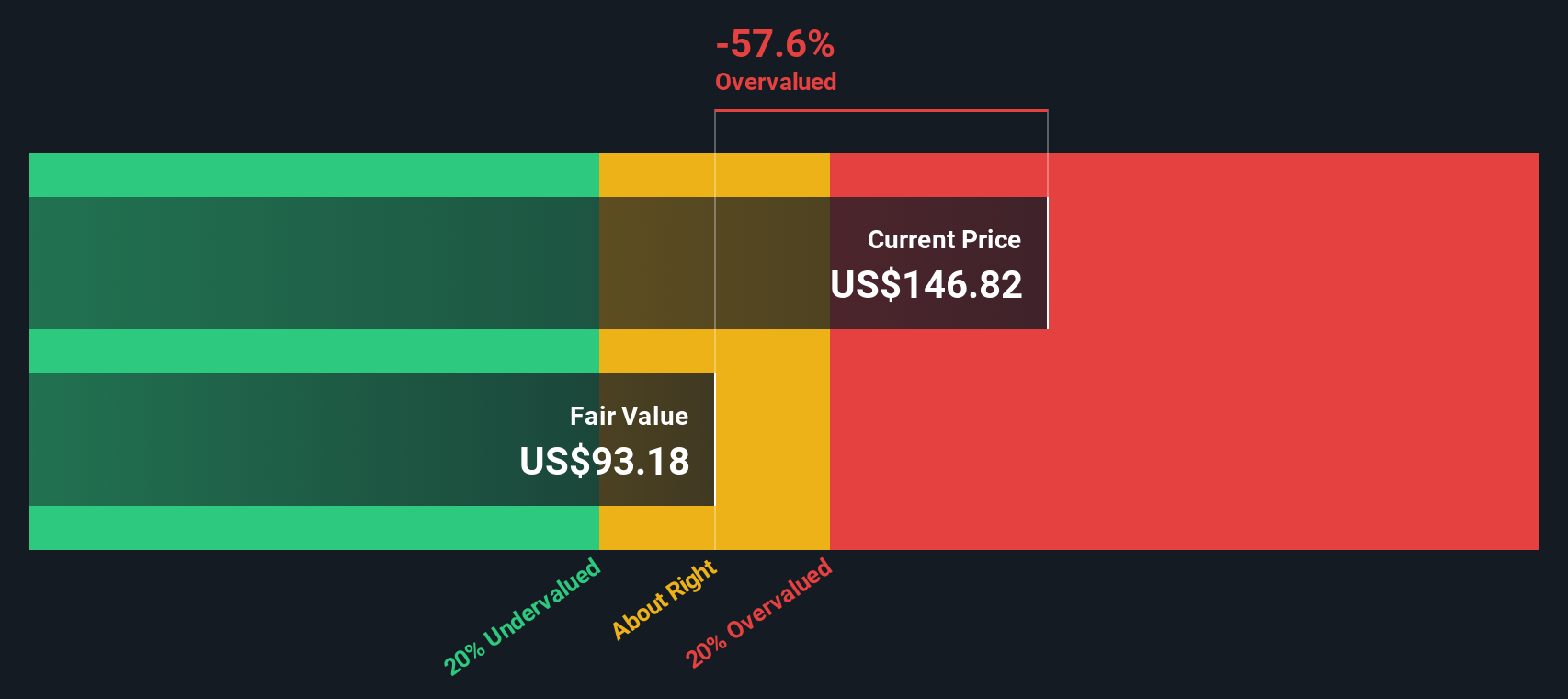

Shopify's current annual FCF stands at approximately $1.80 billion. According to projections, this figure is expected to more than triple over the next decade, with FCF reaching around $5.34 billion by 2029. It is important to note that analyst coverage ends around 2029, and any forecasts beyond that are modeled estimates rather than direct analyst predictions.

When these future cash flows are discounted, the resulting intrinsic value comes out to $93.24 per share. With Shopify's actual share price currently 74.4% above this fair value, the model signals that the stock is trading at a substantial premium and appears significantly overvalued based on long-term cash flow expectations.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Shopify may be overvalued by 74.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Shopify Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Shopify, as it relates the company’s current share price to its per-share earnings. For businesses with steady or growing profits, the PE ratio offers a snapshot of how much investors are willing to pay for each dollar of earnings and serves as a handy tool for comparing companies within the same industry.

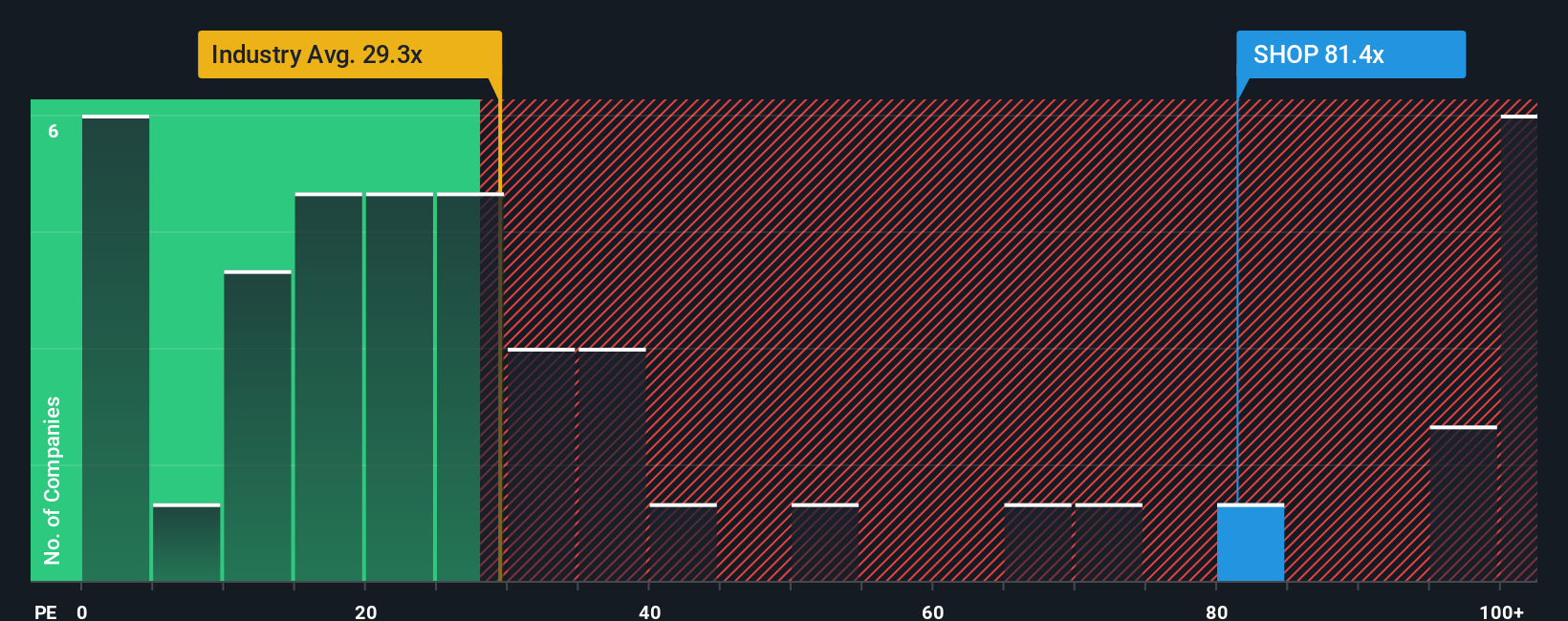

However, what counts as a "normal" or "fair" PE ratio can vary significantly depending on a company’s growth prospects and risk profile. Rapidly expanding businesses tend to command higher PE ratios from investors, while companies facing uncertainty or sluggish growth typically trade at lower multiples. This context is key for evaluating Shopify’s current PE ratio of 90.1x, which is more than double the IT industry average of 31.1x and well above the peer average of 43.4x.

This is where Simply Wall St's proprietary "Fair Ratio" comes into play. The Fair Ratio for Shopify stands at 43.5x, a calculation that factors in Shopify’s historical and projected earnings growth, profit margins, market capitalization, industry peers, and any relevant risks. Unlike a simple peer or industry comparison, the Fair Ratio provides a more holistic, customized benchmark, helping investors weigh if a stock’s current valuation is justified, given its unique fundamentals and circumstances.

Comparing Shopify’s actual PE of 90.1x to its Fair Ratio of 43.5x, the current market price implies considerably higher future expectations than what Simply Wall St’s model deems reasonable. This suggests Shopify is trading at a clear premium relative to its underlying fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Shopify Narrative

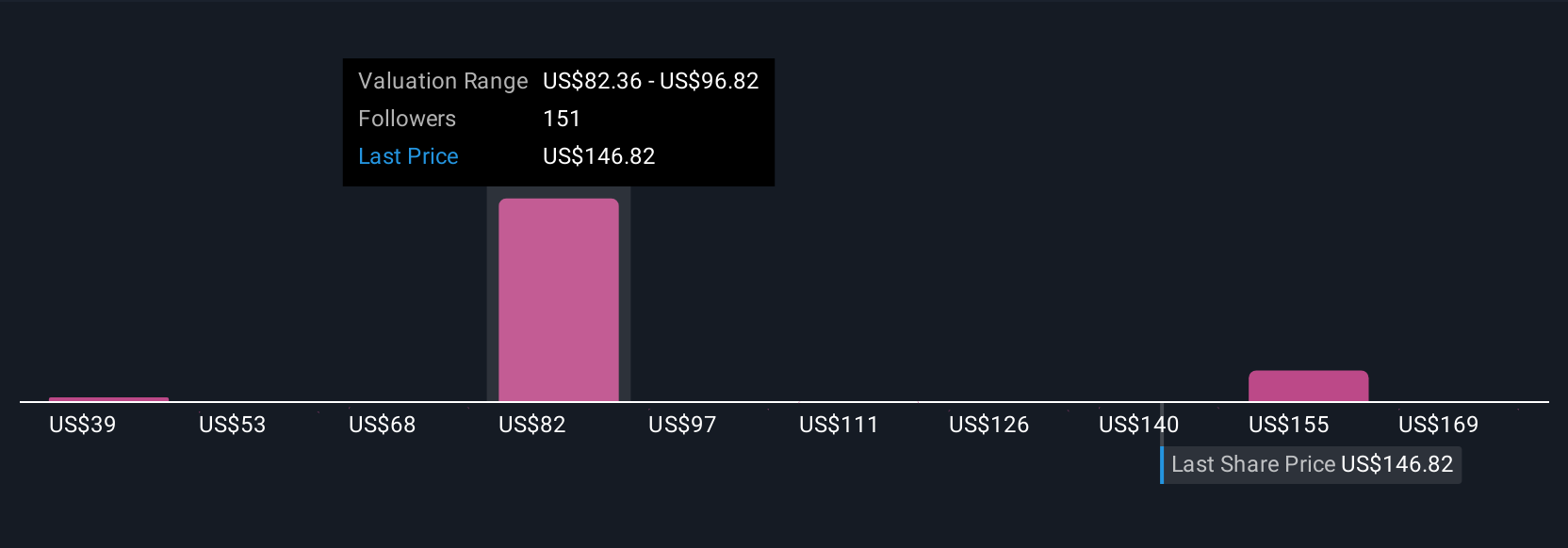

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique story or perspective about a company that goes beyond the numbers and connects what you believe about Shopify’s business, growth prospects, and industry trends directly to your assumptions about its future revenue, earnings, margins, and ultimately to your estimate of fair value.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy and accessible tool to lay out their “why” behind an investment, tying together a company’s business drivers, financial forecasts, and price targets. Narratives help you make more dynamic buy or sell decisions by clearly comparing your fair value estimate to the actual price, so you can see if the market is overvaluing or undervaluing Shopify right now based on your assumptions, not just analyst consensus.

What’s powerful about Narratives is that they update automatically with new company news, earnings, and announcements, keeping your thesis relevant and actionable as fresh information comes in. For example, one investor bullish on Shopify’s international expansion and AI integration might set a fair value of $200, while another who sees more risk from competition and slowing margins might argue for $114. This demonstrates exactly how different outlooks can shape investment strategy.

Do you think there's more to the story for Shopify? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives