- United States

- /

- IT

- /

- NasdaqGS:SHOP

Can Shopify's (SHOP) AI Commerce Push with LTIMindtree Reshape Its Enterprise Growth Story?

Reviewed by Simply Wall St

- Earlier this month, LTIMindtree announced a partnership with Shopify to establish an AI-enabled Center of Excellence for digital commerce, focused on accelerating enterprise transformation and innovation using Shopify's platform.

- This collaboration highlights growing demand for AI-driven commerce solutions among global enterprises, potentially expanding Shopify's reach beyond traditional small and medium-sized businesses.

- We'll examine how the launch of an AI-powered Center of Excellence may influence Shopify's investment narrative and growth prospects.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Shopify Investment Narrative Recap

Shopify’s long-term story rests on its ability to expand beyond its core small business clients and grow internationally, fueled by rapid adoption of AI-driven commerce solutions. The LTIMindtree partnership to establish an AI-enabled Center of Excellence aligns with these ambitions but is unlikely to materially impact near-term catalysts, which remain centered on international merchant acquisition, or the main risk of rising competition from large e-commerce players and platform commoditization.

Of Shopify’s recent announcements, the expanded DHL integration stands out as a near-term catalyst, given its direct relevance to cross-border commerce and international revenue growth. This strengthens Shopify’s appeal for global merchants eager for streamlined operations and could amplify the benefits of AI-powered merchant solutions now being piloted with LTIMindtree. Yet, when weighed against potential margin pressures from increased competition and costly regional expansion, investors should keep in mind...

Read the full narrative on Shopify (it's free!)

Shopify's outlook forecasts $18.5 billion in revenue and $2.7 billion in earnings by 2028. This scenario assumes 22.6% annual revenue growth and a $0.4 billion increase in earnings from the current $2.3 billion.

Uncover how Shopify's forecasts yield a $161.11 fair value, a 5% upside to its current price.

Exploring Other Perspectives

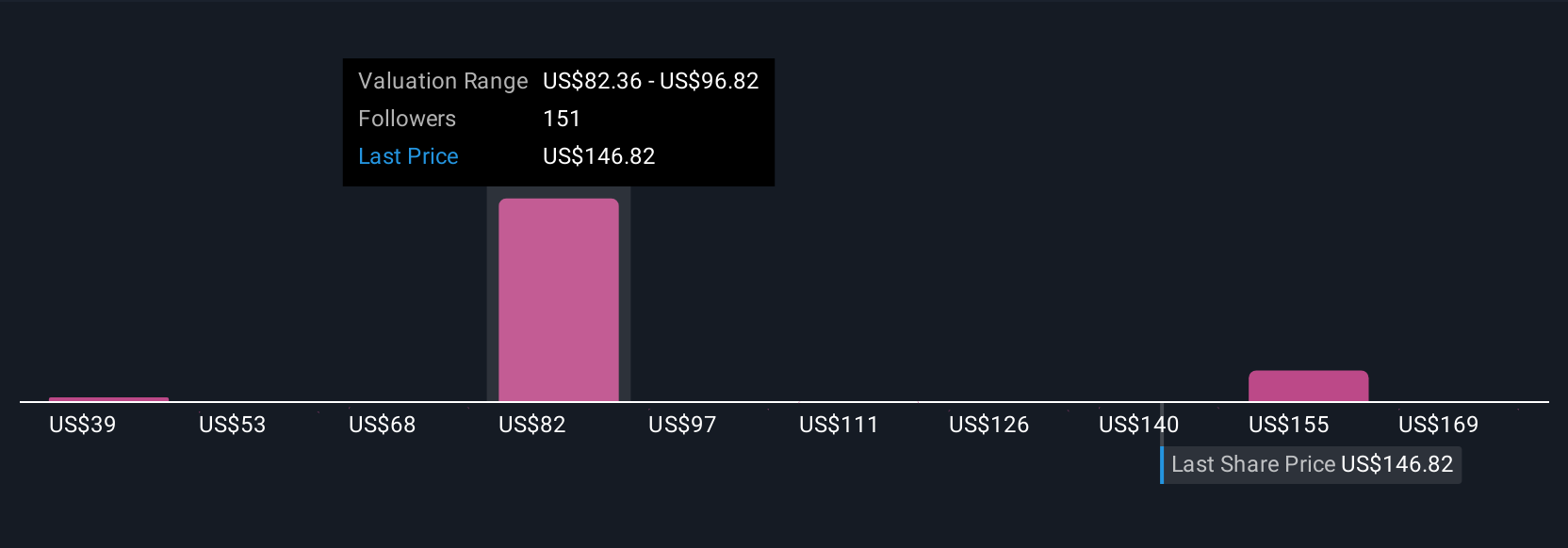

You’ll find 31 fair value opinions from the Simply Wall St Community, ranging from US$39 to US$200 per share. While these diverging estimates underscore varied conviction, many are watching the impact of Shopify’s rapid global expansion on market share and operating margins.

Explore 31 other fair value estimates on Shopify - why the stock might be worth less than half the current price!

Build Your Own Shopify Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Shopify research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shopify's overall financial health at a glance.

No Opportunity In Shopify?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion