- United States

- /

- Software

- /

- NasdaqGS:SAIL

SailPoint (SAIL): Assessing Valuation as Share Price Rebounds Over Past Three Months

Reviewed by Simply Wall St

See our latest analysis for SailPoint.

SailPoint’s share price has seen some swings lately, with the 7-day and 30-day share price returns each slipping over 7%. However, the 3-month share price return remains positive. The recent pattern suggests that investor enthusiasm is taking a breather, although interest could build again if business momentum picks up.

If SailPoint’s recent moves have you watching the market, consider taking the next step and discover fast growing stocks with high insider ownership.

With shares trading more than 30% below analyst price targets and growth numbers showing promise, is SailPoint an overlooked bargain, or is all of that upside already reflected in its share price?

Price-to-Sales of 11.4x: Is it justified?

SailPoint’s shares currently trade at a price-to-sales (P/S) ratio of 11.4x, noticeably higher than the US software industry average of 5.1x. Despite recent share price dips, this signals the market is placing a premium on SailPoint's potential for revenue growth, even as profitability remains elusive.

The price-to-sales ratio measures how much investors are willing to pay for each dollar of revenue generated by the company. For software firms, which often prioritize revenue expansion over immediate profits, this multiple can be a key indicator of market optimism about future growth prospects.

However, at 11.4x, SailPoint’s P/S ratio is not only above the industry average, but also elevated compared to peers (which average 7.4x). In addition, it exceeds the estimated fair ratio of 8x, suggesting the stock may be priced for especially robust expansion or execution. These premium levels imply high expectations embedded in the share price, and the potential for correction should growth falter.

Explore the SWS fair ratio for SailPoint

Result: Price-to-Sales of 11.4x (OVERVALUED)

However, slowing revenue growth or persistent net losses remain key risks. These factors could challenge investor confidence and SailPoint’s valuation premium.

Find out about the key risks to this SailPoint narrative.

Another View: What Does Our DCF Model Say?

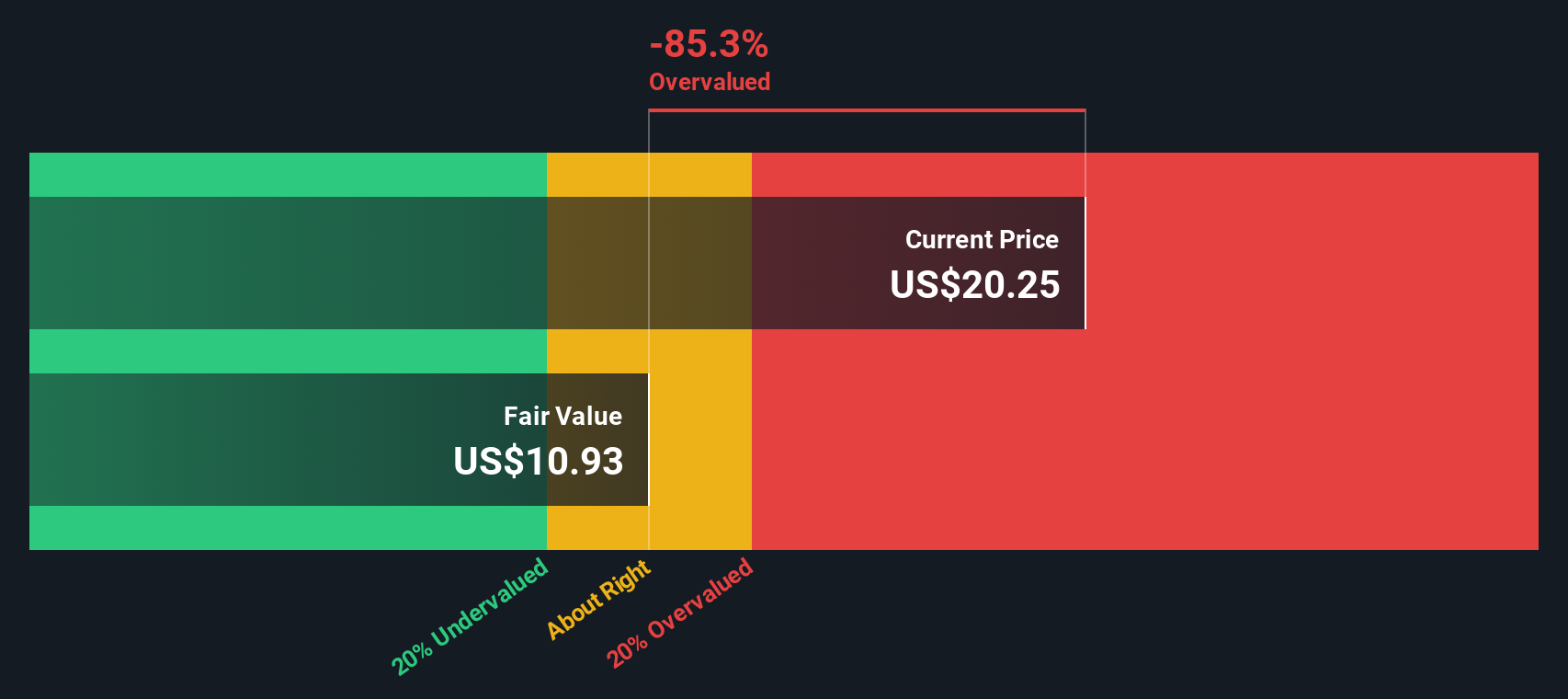

While SailPoint’s price-to-sales ratio suggests the stock is expensive, the SWS DCF model offers a different perspective. According to our DCF analysis, SailPoint shares are trading significantly above the estimated fair value of $10.88, indicating the stock is currently overvalued using this method. Are market expectations too high, or is there still additional upside to be considered?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SailPoint for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SailPoint Narrative

Keep in mind, if you see the story differently or want to draw your own conclusions, you can easily build your own perspective in just a few minutes using our data. Do it your way.

A great starting point for your SailPoint research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing strategy with hand-picked stock ideas. Don’t let great opportunities pass you by. Let your research lead to smarter decisions and stronger returns.

- Accelerate your portfolio’s growth and tap into unique potential with these 3597 penny stocks with strong financials featuring companies showing strong fundamentals in overlooked corners of the market.

- Boost your search for long-term wealth by viewing these 17 dividend stocks with yields > 3%, tailored for investors seeking reliable income and attractive yields above 3%.

- Spot new trends early and back future visionaries with these 25 AI penny stocks that are powering advancements in artificial intelligence and reshaping industries worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAIL

SailPoint

SailPoint, Inc. delivers solutions to enable identity security for the enterprise in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives