- United States

- /

- Software

- /

- NasdaqGM:RPD

Rapid7 (RPD): Evaluating Valuation Potential After Recent Share Price Rebound

See our latest analysis for Rapid7.

After a sharp single-day rebound, Rapid7's 1-week share price return is an impressive 14.2%. Still, the stock is coming off a tough stretch, with the year-to-date share price return deep in negative territory and the 1-year total return down over 63%. Momentum remains mixed, with recent gains offering a glimmer of hope. However, long-term returns indicate that many investors are still waiting for a sustained turnaround.

If you’re tracking tech stocks with more resilient momentum, now is a great moment to discover new leaders with our See the full list for free.

With shares rebounding and the company still trading at a notable discount to analyst targets, the real question is whether the market is underestimating Rapid7’s potential or if future growth is fully reflected in the price.

Most Popular Narrative: 23.8% Undervalued

Compared to Rapid7's last close of $15.51, the most widely followed narrative assigns a fair value of $20.37. This suggests meaningful potential upside if the narrative's assumptions hold. This valuation highlights a significant gap between the consensus view of future growth and how the market is currently pricing the stock.

"Rapid7's unified Command platform and MDR-led solutions are increasingly winning larger, strategic consolidation deals as enterprises seek to reduce fragmentation and simplify compliance in complex, highly regulated environments, pointing to an expanding addressable market, higher average revenue per customer, and sustained revenue growth opportunity."

Want to know which extraordinary growth levers could justify this valuation gap? Behind the scenes, analysts are focusing on operational efficiency, margin expansion, and a future earnings profile that some believe could rival the most optimistic forecasts. Interested in learning why there is a belief the market is underestimating this cybersecurity innovator? Start decoding the full narrative now.

Result: Fair Value of $20.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, future revenue growth could falter if extended deal cycles persist or if declines in legacy products are not offset by new customer gains.

Find out about the key risks to this Rapid7 narrative.

Another View: Are the Market’s Expectations Too High?

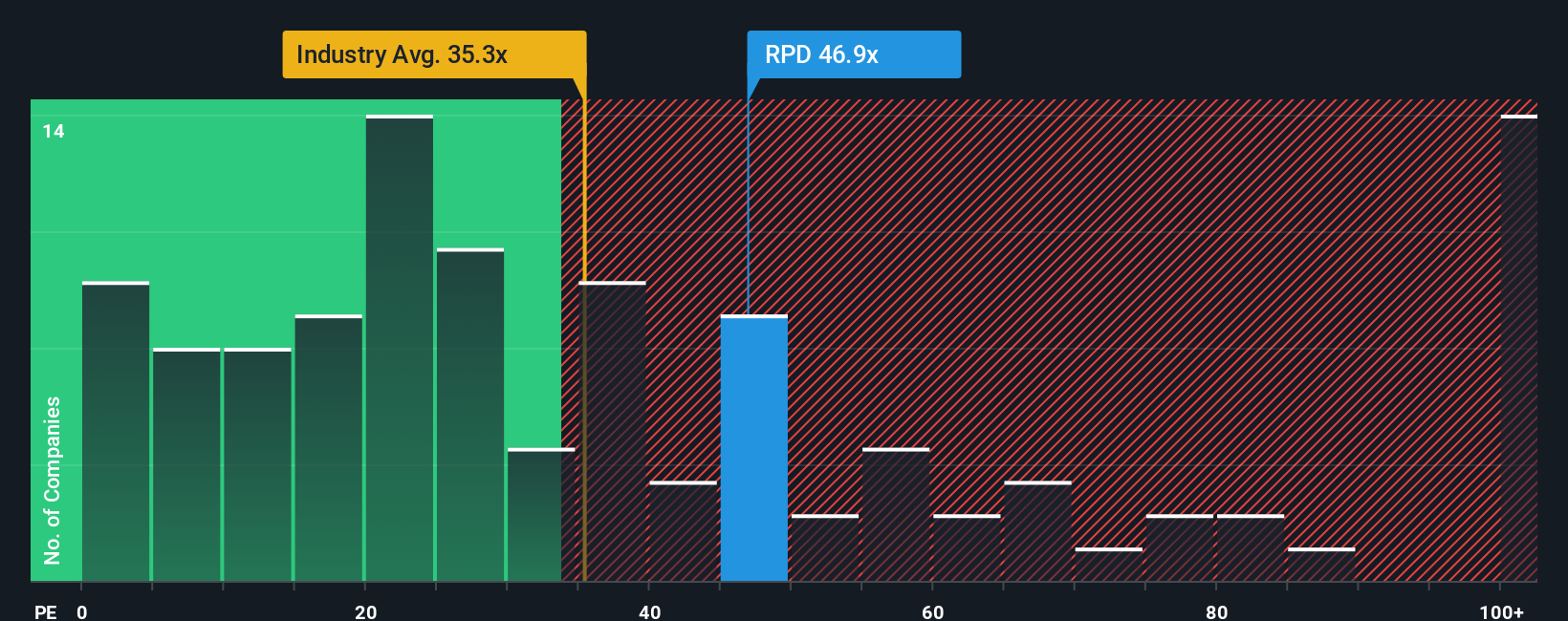

Shifting to a simple price-to-earnings comparison, Rapid7 trades at 45.3x earnings, which is well above the US Software industry average of 29.8x and the fair ratio of 36.1x. This premium suggests investors may already be pricing in a robust recovery. Are they overlooking risks or seeing value others don't?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rapid7 Narrative

If you see the story differently or want to dig into the details on your own, you can quickly build your own perspective in just a few minutes. Do it your way

A great starting point for your Rapid7 research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by tapping into stocks that others may be overlooking. Don’t let the next big opportunity slip past you in today’s fast-moving market.

- Target strong cash-generating businesses with future growth potential by filtering for these 927 undervalued stocks based on cash flows set to outperform.

- Access reliable income streams by seeking out these 15 dividend stocks with yields > 3% that meet your yield goals while maintaining financial health.

- Capture the future of technology by focusing on these 25 AI penny stocks positioned to lead the next wave of innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Undervalued with limited growth.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Why EnSilica is Worth Possibly 13x its Current Price

Inotiv NAMs Test Center

Credo Technology Group (CRDO): High-Speed Growth Meets Margin Compression in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks