- United States

- /

- Software

- /

- NasdaqGS:ROP

Will Roper Technologies’ (ROP) New AI Leadership Accelerate Its Long-Term Growth Narrative?

- Roper Technologies recently appointed Shane Luke as Senior Vice President of AI, a newly created position focused on advancing artificial intelligence across its vertical software businesses.

- This move brings in a leader with experience from Workday and Nike, highlighting the company’s intent to accelerate product innovation and long-term growth through AI capabilities.

- Now, we will explore how bringing an experienced AI executive on board could influence Roper Technologies’ long-term growth prospects and investment case.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Roper Technologies Investment Narrative Recap

To own shares in Roper Technologies, you have to believe the company will keep growing in niche software markets and successfully compound cash flow through expanding its portfolio and strengthening its vertical platforms, particularly with the adoption of AI. The appointment of Shane Luke as Senior Vice President of AI signals an intent to accelerate product innovation, but it does not materially change the current short-term catalyst: driving organic growth while integrating new businesses. The biggest near-term risk remains operational inefficiencies from ongoing acquisitions and potential dilution of margins, this news does little to reduce that integration challenge in the short run.

Of recent company announcements, Roper’s $3 billion share repurchase program stands out as the most relevant to this AI leadership news, as it reinforces an emphasis on long-term value creation for shareholders. While boosting AI capabilities could increase the effectiveness of the company’s organic and inorganic growth strategies over time, efficient capital deployment through share buybacks can drive shareholder value even as management navigates evolving business risks and integration efforts.

But on the flip side, investors should remain aware of operational risks that could arise if Roper’s integration of acquired software businesses fails to deliver on margin improvements and...

Read the full narrative on Roper Technologies (it's free!)

Roper Technologies is projected to achieve $10.2 billion in revenue and $2.2 billion in earnings by 2028. This outlook assumes an annual revenue growth rate of 11.0% and a $0.7 billion increase in earnings from the current $1.5 billion.

Uncover how Roper Technologies' forecasts yield a $573.87 fair value, a 29% upside to its current price.

Exploring Other Perspectives

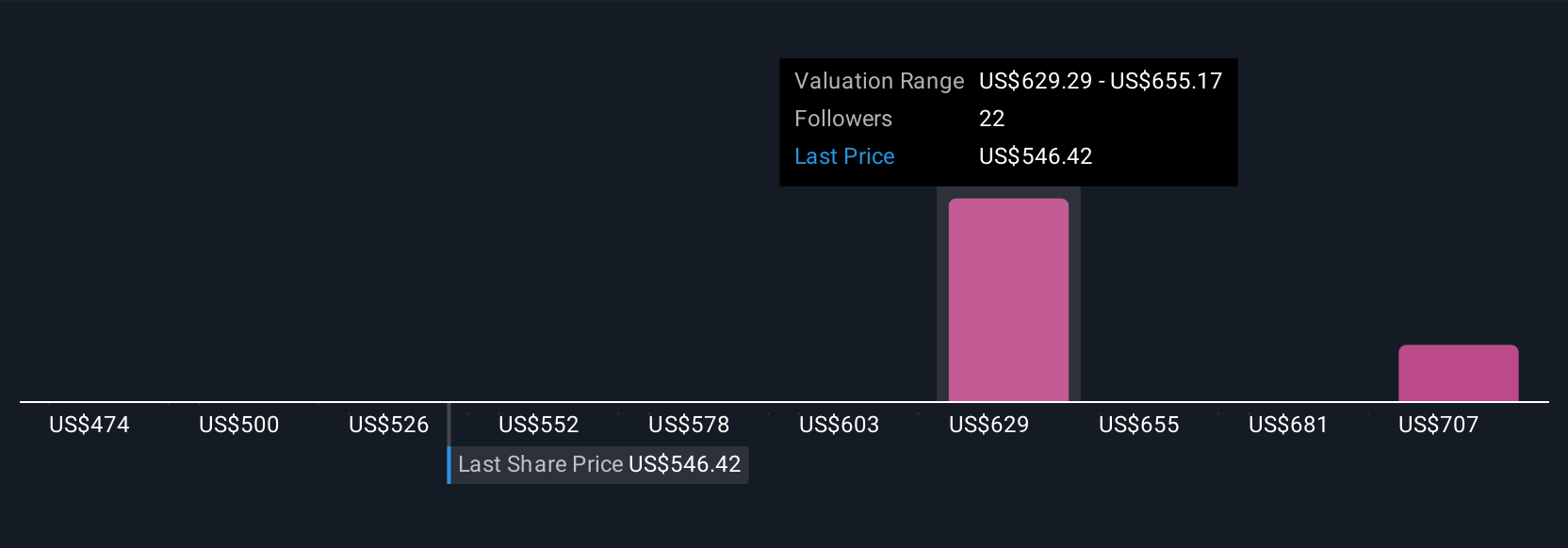

Two Simply Wall St Community fair value estimates range from US$573.87 to US$726.99 per share, showing a US$153.12 spread in expectations. Some community members see substantial room for upside, though concerns over acquisition integration and margin preservation remain key influences in the broader debate about future earnings and growth.

Explore 2 other fair value estimates on Roper Technologies - why the stock might be worth as much as 64% more than the current price!

Build Your Own Roper Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roper Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Roper Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roper Technologies' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROP

Roper Technologies

Designs and develops vertical software and technology enabled products in the United States, Canada, Europe, Asia, and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Xero: Growth Was Priced In — Execution Is Not

Rio Tinto (RIO): Cash Machine with a China Beta Problem — and a Copper Glow-Up

Inotiv NAMs Test Center

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion