- United States

- /

- Software

- /

- NasdaqGS:ROP

How Roper Technologies’ (ROP) 33rd Consecutive Dividend Hike Has Shaped Its Investment Story

- Roper Technologies’ Board of Directors has declared a quarterly cash dividend of US$0.91 per share, a 10% increase over the previous quarter, payable on January 16, 2026, to stockholders of record on January 2, 2026.

- This marks the thirty-third consecutive year that the company has raised its dividend, highlighting an extensive track record of returning cash to shareholders.

- We'll explore how Roper’s latest double-digit dividend increase reflects management’s confidence and impacts the company’s broader investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Roper Technologies Investment Narrative Recap

To be a shareholder in Roper Technologies, you need to believe in the company’s ability to convert recurring SaaS revenue streams and disciplined acquisitions into stable, long-term earnings and cash flows. The most recent 10% dividend increase signals ongoing management confidence and strength in cash generation, but it does not fundamentally affect the near-term catalysts, which center on AI product innovation and further SaaS integration, nor does it alleviate the key risk of integrating new vertical market software acquisitions at scale, an area with operational and margin risks. Among recent announcements, the October earnings report aligns closely with the dividend news, showing rising top-line growth and increased net income year over year. Momentum in Roper’s core software segments, with growing adoption of AI-based solutions, supports management’s ability to fund ongoing dividend growth, maintain stable cash flow, and invest in new verticals, thus feeding the main short-term catalyst: expanding recurring SaaS revenues and margin resilience. Yet, despite the latest dividend hike and earnings strength, investors should also be aware that integration risks from ongoing acquisitions could impact future efficiency and profitability if not well managed...

Read the full narrative on Roper Technologies (it's free!)

Roper Technologies' outlook anticipates $10.2 billion in revenue and $2.2 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 11.0%, with earnings projected to rise by $0.7 billion from the current $1.5 billion.

Uncover how Roper Technologies' forecasts yield a $574.53 fair value, a 29% upside to its current price.

Exploring Other Perspectives

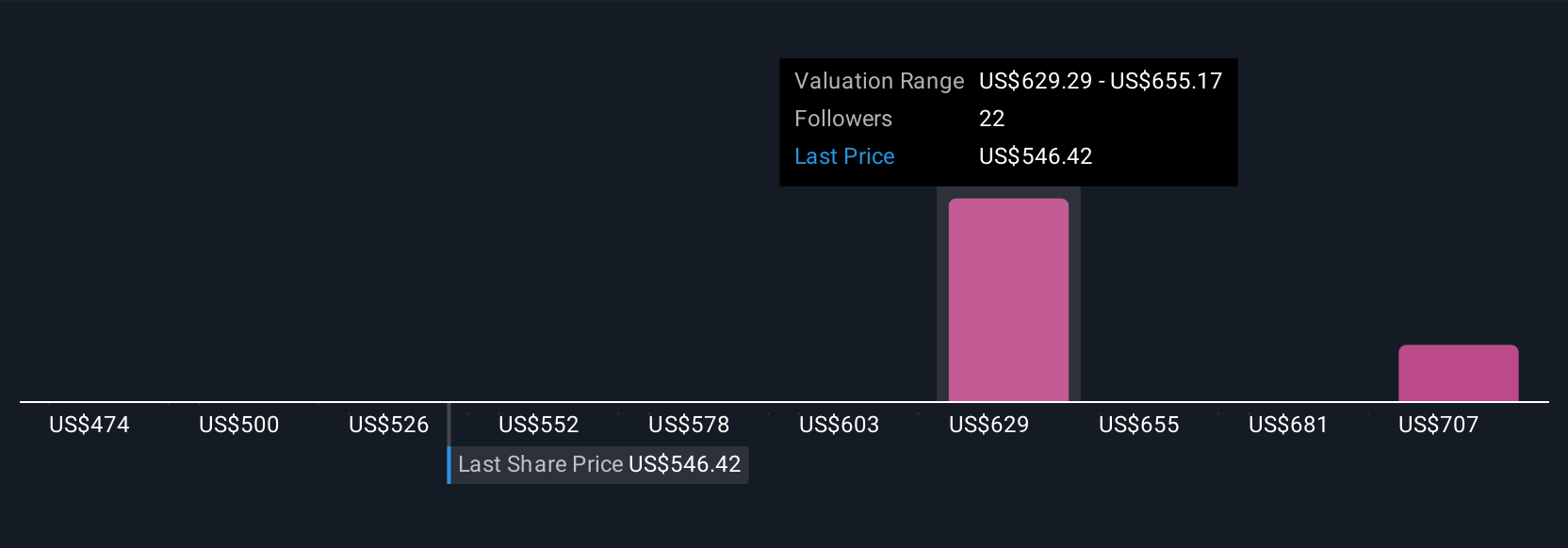

Three members of the Simply Wall St Community estimate Roper’s fair value between US$500 and US$701,078, each using distinct earnings and revenue outlooks. While momentum in recurring SaaS revenues is a catalyst, opinions still differ widely, so review alternative views before acting.

Explore 3 other fair value estimates on Roper Technologies - why the stock might be worth as much as 57% more than the current price!

Build Your Own Roper Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roper Technologies research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Roper Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roper Technologies' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROP

Roper Technologies

Designs and develops vertical software and technology enabled products in the United States, Canada, Europe, Asia, and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

DMCI Holdings will shine with a projected fair value of 68.43 in the next 5 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion