- United States

- /

- Software

- /

- NasdaqGS:ROP

Can Investor Caution Around AI Shift the Software Narrative for Roper Technologies (ROP)?

Reviewed by Sasha Jovanovic

- In late October 2025, Roper Technologies announced strong third-quarter results, new share repurchase authorization of US$3 billion, and reaffirmed its M&A focus, even as analyst RBC Capital Markets downgraded the stock citing artificial intelligence uncertainty and several near-term headwinds.

- This mix of robust financial performance and increased capital returns was accompanied by investor caution, reflecting concerns over the evolving impact of AI on Roper's application software business and short-term challenges related to acquisitions and certain business segments.

- We'll now examine how heightened investor concern around AI’s impact on Roper’s software portfolio could affect the company's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Roper Technologies Investment Narrative Recap

To own shares of Roper Technologies, an investor needs confidence in its ability to capture recurring growth by integrating mission-critical software, maintaining high free cash flow, and leveraging disciplined M&A in specialized vertical markets. The latest news, strong Q3 results and a US$3 billion buyback, does little to change the main near-term catalyst, which is accelerating adoption of AI-enabled solutions across Roper’s portfolio. However, it reignites focus on a key risk: the complexity of integrating new acquisitions amid uncertain AI impacts, which remains material.

Among recent announcements, the new US$3 billion share repurchase authorization stands out, signaling ongoing commitment to returning capital to shareholders even as M&A activity continues at a steady pace. This move closely relates to the catalyst of broader adoption of Roper’s vertical-specific SaaS platforms, as it underscores confidence in both earnings quality and long-term cash generation.

Yet, against these positives, investors should also be aware of integration risks from rapid M&A and the potential for...

Read the full narrative on Roper Technologies (it's free!)

Roper Technologies' outlook anticipates $10.2 billion in revenue and $2.2 billion in earnings by 2028. This is based on an 11.0% annual revenue growth rate and an increase in earnings of $0.7 billion from current earnings of $1.5 billion.

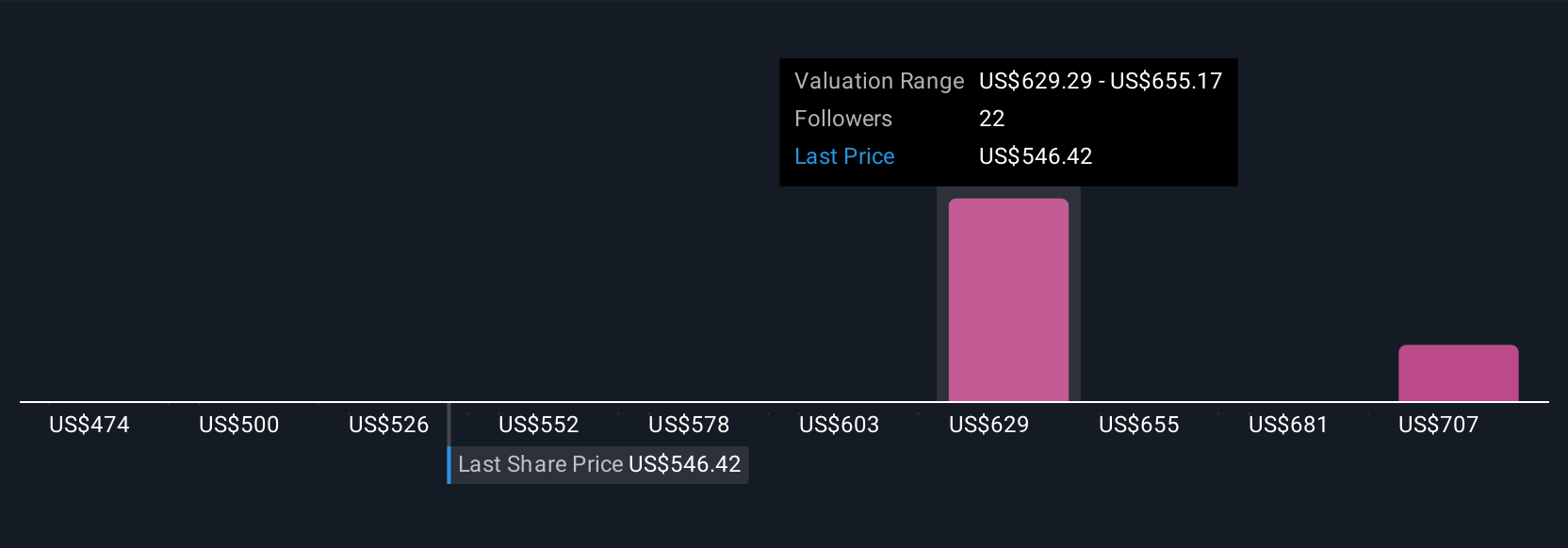

Uncover how Roper Technologies' forecasts yield a $626.80 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span from US$500 to US$682, reflecting a wide range of outlooks. With accelerating AI adoption shaping both opportunity and uncertainty, readers can explore several viewpoints on what may drive Roper’s future performance.

Explore 3 other fair value estimates on Roper Technologies - why the stock might be worth just $500.00!

Build Your Own Roper Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roper Technologies research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Roper Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roper Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROP

Roper Technologies

Designs and develops vertical software and technology enabled products in the United States, Canada, Europe, Asia, and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion