Stock Analysis

- United States

- /

- Software

- /

- NasdaqCM:RIOT

The 3.1% return this week takes Riot Platforms' (NASDAQ:RIOT) shareholders five-year gains to 220%

Some Riot Platforms, Inc. (NASDAQ:RIOT) shareholders are probably rather concerned to see the share price fall 40% over the last three months. But that scarcely detracts from the really solid long term returns generated by the company over five years. We think most investors would be happy with the 220% return, over that period. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Only time will tell if there is still too much optimism currently reflected in the share price. While the returns over the last 5 years have been good, we do feel sorry for those shareholders who haven't held shares that long, because the share price is down 62% in the last three years.

Since the stock has added US$90m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Riot Platforms

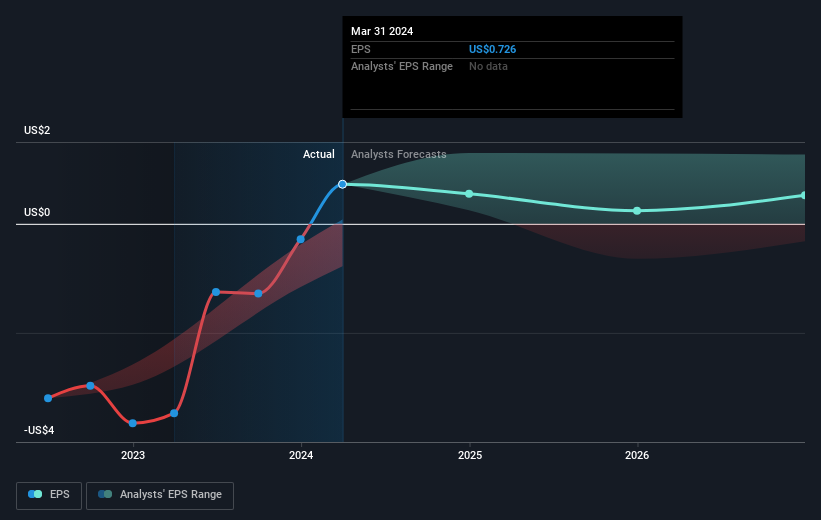

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Riot Platforms became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Riot Platforms has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Riot Platforms will grow revenue in the future.

A Different Perspective

Riot Platforms shareholders are down 5.0% for the year, but the market itself is up 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 26%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Riot Platforms better, we need to consider many other factors. For example, we've discovered 5 warning signs for Riot Platforms (3 are significant!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Riot Platforms is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RIOT

Excellent balance sheet and slightly overvalued.