- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms (RIOT): Valuation Perspective After Target Cut and Crypto Sentiment Shift

Reviewed by Simply Wall St

Riot Platforms (RIOT) caught investor attention this week as shares edged higher, following a rebound in Bitcoin and Ethereum prices. The move came even after JPMorgan issued a price target cut. This development highlights sector-wide optimism.

See our latest analysis for Riot Platforms.

After a volatile few weeks, Riot Platforms is catching a fresh wave of momentum along with renewed optimism across the crypto mining space. Recent excitement comes on the back of a 7.6% share price gain this past week, though that follows some steep swings, such as a 21.7% drop over the last month. Still, with a year-to-date share price return of nearly 48% and a three-year total shareholder return of 253%, Riot continues to attract investors looking for both growth potential and sector exposure as sentiment toward Bitcoin and Ethereum improves.

If the action in Riot has you wondering what else is showing strong momentum, now is the perfect time to discover fast growing stocks with high insider ownership

After a week of renewed rally and analyst debate, the key question for investors is clear: Is Riot Platforms trading at a bargain with room to run, or has the market already accounted for all the upside?

Most Popular Narrative: 43.4% Undervalued

With Riot Platforms closing at $15.48, the most followed narrative calculates a fair value of $27.33. This represents a significant premium to the current price and is a driver of recent bullishness around the stock.

The company's expansion of vertically integrated mining operations, combined with ongoing deployment of new, more efficient hardware and a continued focus on operational efficiency, supports increased hash rate and lower unit costs. This enhances Bitcoin production and potential gross profit even as mining difficulty rises.

Want to know what powers this aggressive price target? The story hinges on surging revenues, a major swing in profitability, and a future multiple unlike most miners. Does this narrative rest on bold projections? Click to see which surprising metrics shape this valuation.

Result: Fair Value of $27.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in new data center projects or a prolonged drop in Bitcoin prices could quickly challenge bullish expectations for Riot’s growth.

Find out about the key risks to this Riot Platforms narrative.

Another View: Looking at the Numbers

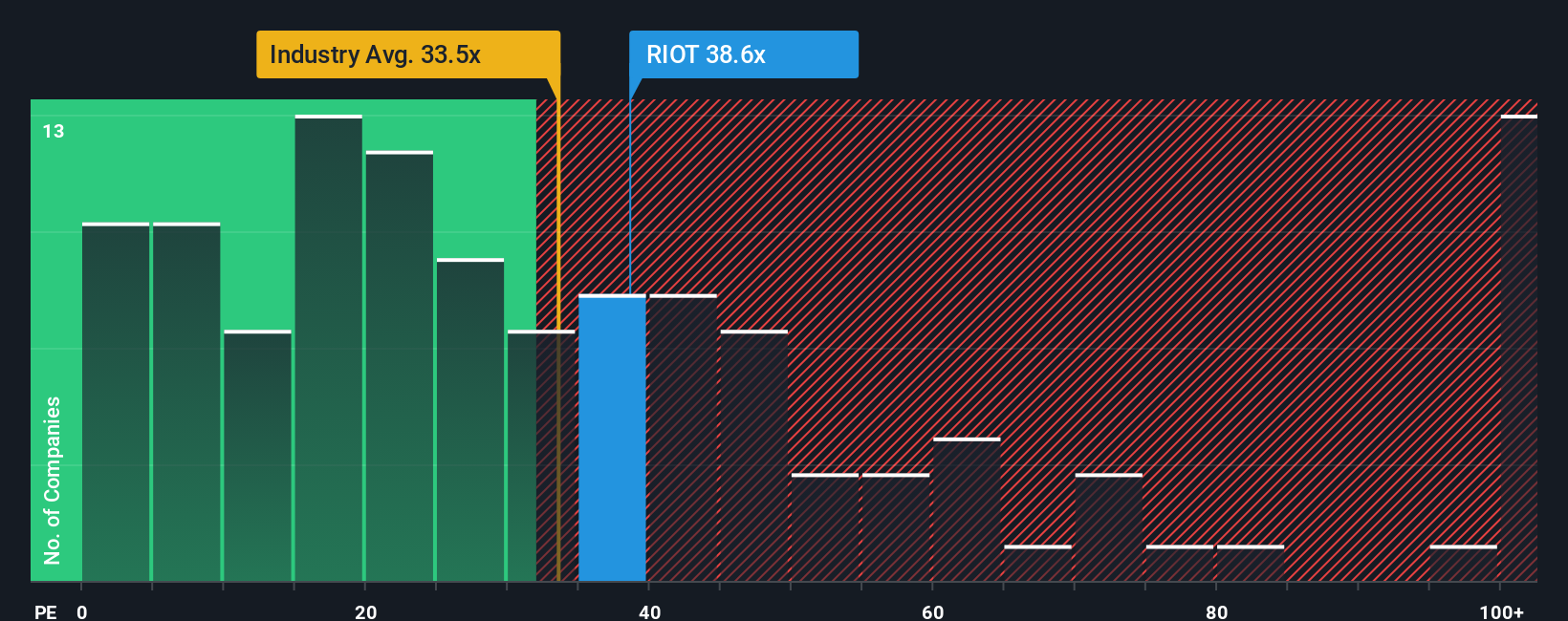

While many see Riot Platforms as significantly undervalued based on future growth, looking at the current price-to-earnings ratio tells a different story. The company trades at 35.1x earnings, which is higher than the US Software industry average of 32x and the peer average of 18.5x. Compared to the fair ratio of 7.6x, it suggests the market may be pricing in a lot of future optimism already. So is Riot offering real value, or is risk building in the gap between market and fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Riot Platforms Narrative

If you want to dig into the numbers and reach your own conclusion, you can shape your own Riot Platforms story in just a few minutes. Do it your way

A great starting point for your Riot Platforms research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizons and strengthen your investment strategy with curated stock lists on Simply Wall Street. Miss out now and you could overlook tomorrow’s market leaders.

- Power your portfolio with steady income by checking out these 14 dividend stocks with yields > 3% which offers attractive yields over 3% for those seeking reliable returns.

- Tap into the future of medicine and technology by exploring these 30 healthcare AI stocks for opportunities advancing patient care and innovation.

- Seize momentum in alternative currencies by reviewing these 81 cryptocurrency and blockchain stocks which leads the way in digital finance and blockchain-driven growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026