- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms (RIOT): Valuation Insights After Surging Revenue and Data Center Expansion

Reviewed by Simply Wall St

Riot Platforms (RIOT) delivered a much stronger third quarter than many expected. Revenue and profitability jumped as Bitcoin mining activity soared and cryptocurrency prices climbed. The company is also pivoting toward high-performance data centers.

See our latest analysis for Riot Platforms.

Following its standout quarter, Riot Platforms’ shares have seen powerful momentum, with a 73% share price return over the last 90 days and a total shareholder return of 109% in the past year. This surge has been fueled by record revenue, a strategic expansion into data centers, and growing optimism about the company’s ability to capture value from both bitcoin mining and high-performance computing. This demonstrates that sentiment is building fast around Riot’s transformation story.

If Riot’s rapid turnaround grabbed your attention, now is a great time to expand your search and discover fast growing stocks with high insider ownership.

But after such a dramatic rally, the key question is whether Riot Platforms’ recent gains have already factored in its transformation and future growth. Alternatively, there may still be a compelling buying opportunity for investors.

Most Popular Narrative: 12% Undervalued

Riot Platforms’ widely followed narrative valuation points to a fair value comfortably above its last close of $19.78, suggesting meaningful upside in the eyes of those tracking analyst consensus. This latest target reflects Riot’s transformation story and bullish expectations tied to AI and digital infrastructure.

Riot's aggressive build-out of a scalable data center business leverages its extensive, readily available power capacity in high-demand regions. This positions the company to benefit from surging demand for AI and cloud computing infrastructure and is likely to drive higher revenue growth and improved valuation multiples over time.

The growth forecast behind this valuation is bold. It hints at a major shift: fast-evolving business lines, accelerating cash flow, and a profit outlook that many wouldn’t expect from a traditional bitcoin miner. Want to know which high-stakes assumptions are driving that target price? Dive in and see what analysts see in Riot’s future.

Result: Fair Value of $22.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing volatility in Bitcoin prices and uncertainty around Riot’s ability to secure large data center tenants could quickly challenge the bull case.

Find out about the key risks to this Riot Platforms narrative.

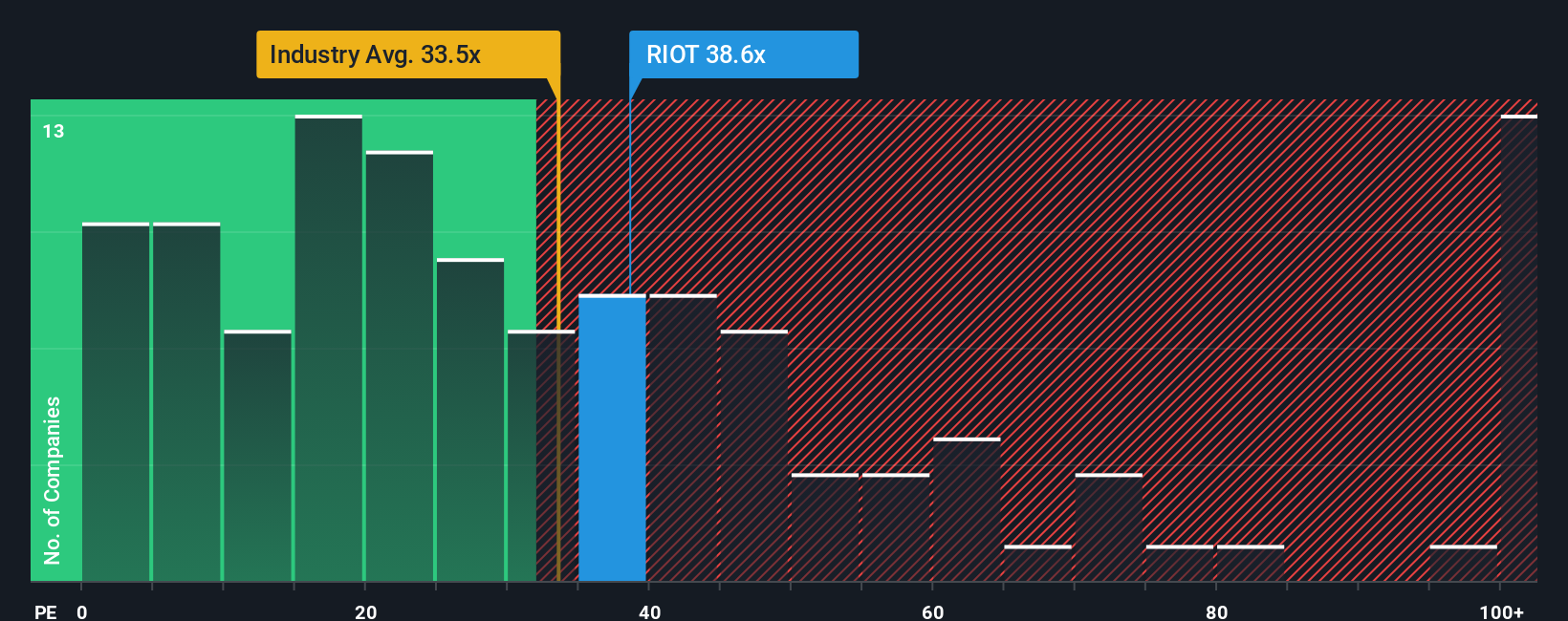

Another View: Looking at Earnings Multiples

While the narrative valuation paints Riot Platforms as undervalued, the current price-to-earnings ratio is 44.8x, which is considerably higher than both the US Software industry average of 34.9x and the peer group’s 21.3x. It also stands far above the fair ratio of just 3.6x, suggesting the market may be pricing in a lot of optimism and investors face notable valuation risk if expectations are not met. Does this premium signal lasting confidence, or is it a warning sign for those buying at current levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Riot Platforms Narrative

If you think there’s more to the story or want to build your own take from the latest numbers, you can craft your own analysis quickly. Do it your way.

A great starting point for your Riot Platforms research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t stop at Riot Platforms when you could be finding tomorrow’s winners today. Let Simply Wall Street’s powerful tools give you a real edge.

- Spot game-changing technology early and power your portfolio by checking out these 27 AI penny stocks, which are at the forefront of artificial intelligence innovation.

- Seize the chance for long-term growth and potential bargains by searching through these 840 undervalued stocks based on cash flows, selected for their compelling valuations.

- Unlock passive income and financial stability with these 22 dividend stocks with yields > 3%, which offer attractive yields above 3% and strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives