- United States

- /

- Software

- /

- NasdaqCM:REKR

Why Investors Shouldn't Be Surprised By Rekor Systems, Inc.'s (NASDAQ:REKR) 73% Share Price Surge

Rekor Systems, Inc. (NASDAQ:REKR) shareholders have had their patience rewarded with a 73% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 81%.

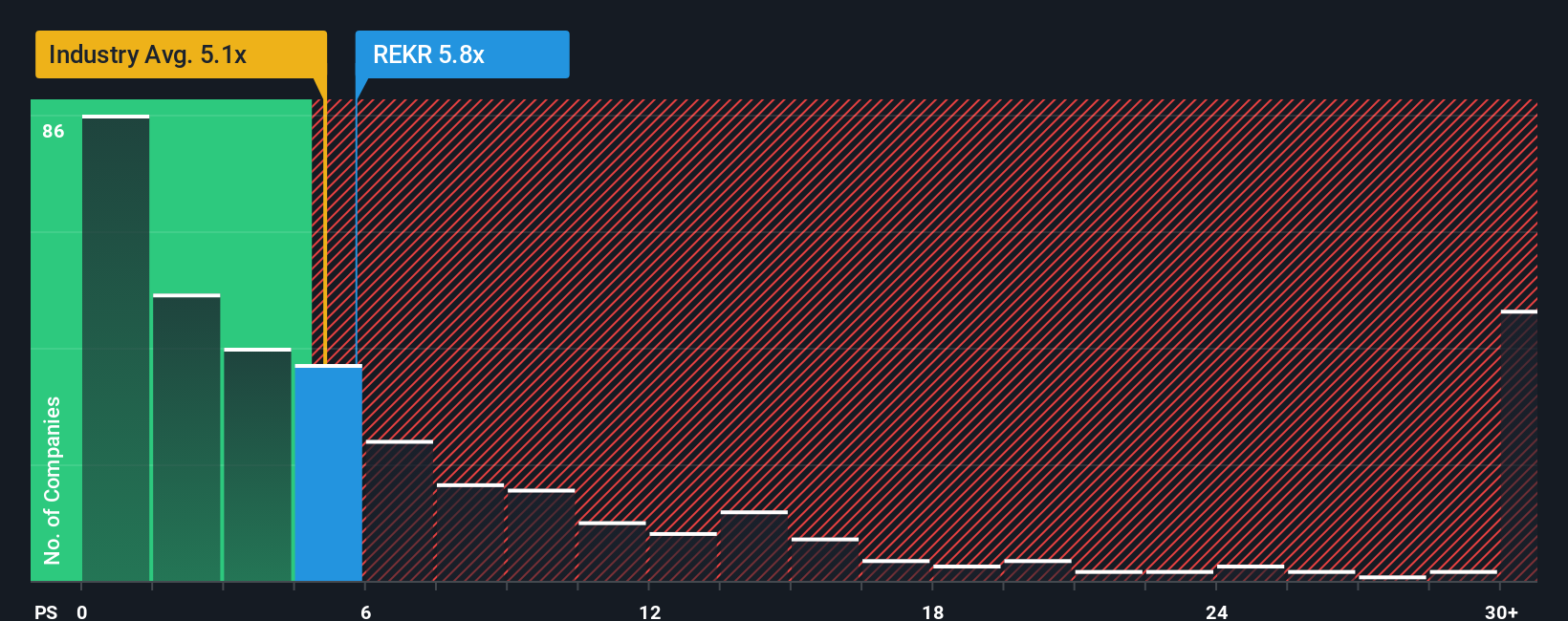

Even after such a large jump in price, it's still not a stretch to say that Rekor Systems' price-to-sales (or "P/S") ratio of 5.8x right now seems quite "middle-of-the-road" compared to the Software industry in the United States, where the median P/S ratio is around 5.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Rekor Systems

What Does Rekor Systems' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Rekor Systems has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rekor Systems.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Rekor Systems would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.1%. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 19% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 21%, which is not materially different.

With this in mind, it makes sense that Rekor Systems' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Rekor Systems' P/S?

Rekor Systems appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Rekor Systems' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It is also worth noting that we have found 3 warning signs for Rekor Systems (1 is a bit unpleasant!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:REKR

Rekor Systems

Provides infrastructure solutions for public safety, urban mobility, and transportation management markets in the United States and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026