- United States

- /

- Banks

- /

- NasdaqCM:NBBK

Discover 3 Undiscovered Gems In The US Market

Reviewed by Simply Wall St

In the midst of a challenging period for U.S. markets, with major indices like the Nasdaq experiencing significant declines due to tech sector pressures and economic uncertainties from a prolonged government shutdown, investors are increasingly looking beyond the usual suspects in search of opportunities. In this environment, identifying promising stocks often involves finding companies that demonstrate resilience and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 142.38% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Citizens & Northern (CZNC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Citizens & Northern Corporation is the bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate clients, with a market cap of $343.04 million.

Operations: Citizens & Northern generates revenue primarily through interest income from loans and investment securities, alongside non-interest income from service charges and fees. The company focuses on managing its cost of funds and operational expenses to optimize profitability. Recent financial data indicates a net profit margin of 25%, showcasing the company's ability to convert a quarter of its revenue into net income.

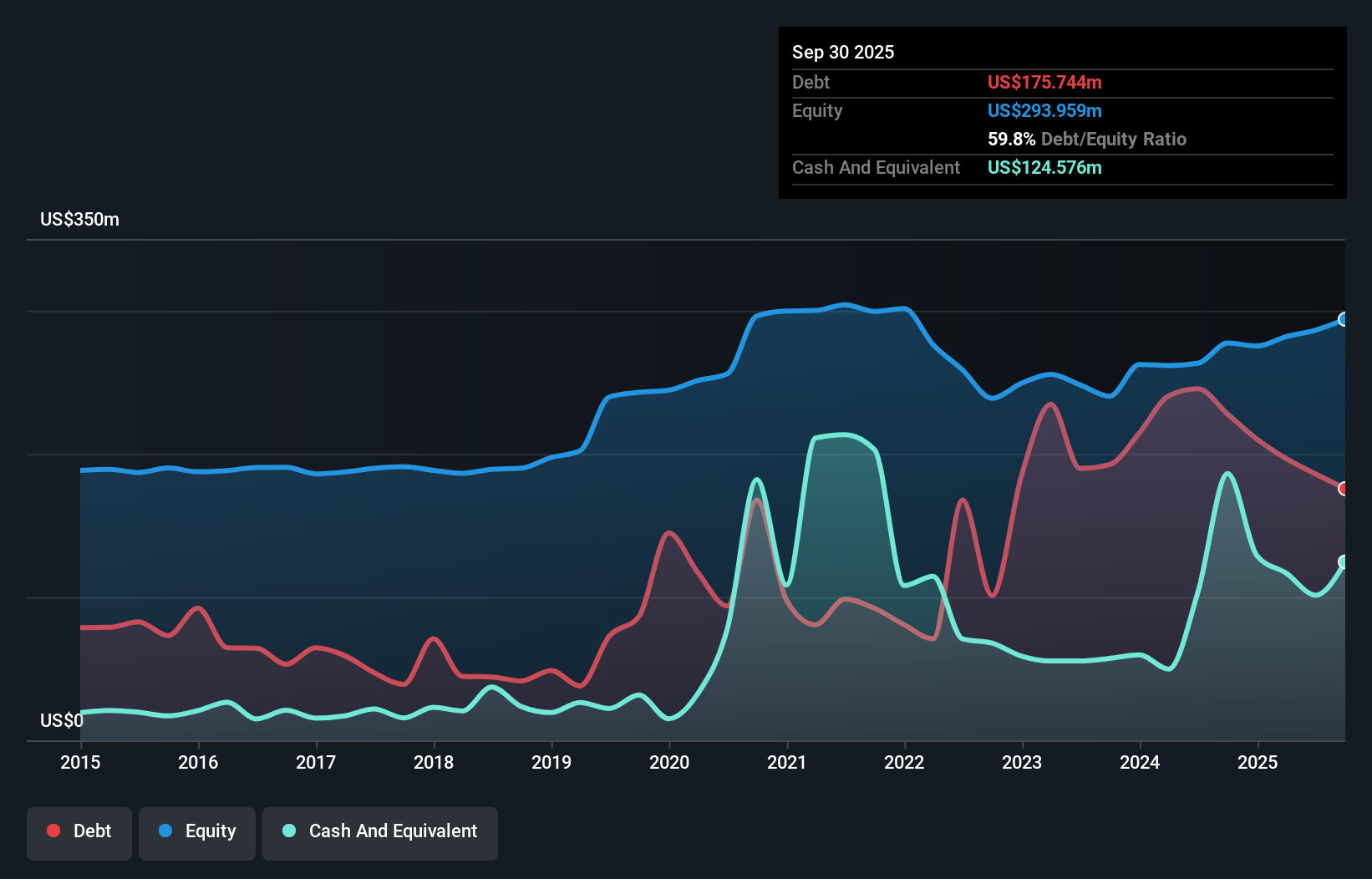

Citizens & Northern, with total assets of US$2.7 billion and equity of US$294 million, offers a compelling profile in the banking sector. The bank's total deposits stand at US$2.2 billion while loans reach US$1.9 billion, reflecting a net interest margin of 3.3%. Though earnings grew by 23% last year, its allowance for bad loans is low at 88%, with non-performing loans appropriately at 1.4%. Recent developments include a merger with Susquehanna Community Financial and an unchanged dividend payout of $0.28 per share, signaling stability amidst executive changes and strategic expansions.

- Click here and access our complete health analysis report to understand the dynamics of Citizens & Northern.

Evaluate Citizens & Northern's historical performance by accessing our past performance report.

NB Bancorp (NBBK)

Simply Wall St Value Rating: ★★★★★★

Overview: NB Bancorp, Inc. operates as a bank holding company for Needham Bank, offering a range of banking products and services in the Greater Boston area, with a market cap of $658.55 million.

Operations: The primary revenue stream for NB Bancorp comes from its thrift and savings and loan institutions, generating $189.48 million.

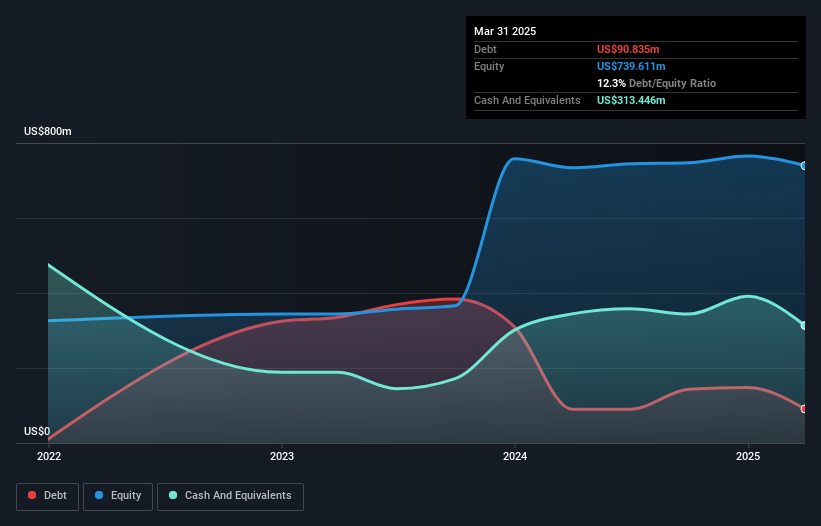

NB Bancorp, with total assets of US$5.4 billion and equity of US$737 million, stands out for its robust financial health. Its liabilities are 97% funded through low-risk customer deposits, minimizing external borrowing risks. The bank's allowance for bad loans is a substantial 379%, with non-performing loans at just 0.2%. Over the past year, earnings surged by 350.6%, surpassing industry growth significantly. The company also repurchased over two million shares this year for US$36.4 million, reflecting confidence in its valuation with a price-to-earnings ratio of 11x below the market average of 18x.

- Click here to discover the nuances of NB Bancorp with our detailed analytical health report.

Examine NB Bancorp's past performance report to understand how it has performed in the past.

Red Violet (RDVT)

Simply Wall St Value Rating: ★★★★★★

Overview: Red Violet, Inc. is an analytics and information solutions company that leverages proprietary technologies and analytical capabilities to provide identity intelligence services in the United States, with a market cap of $813.16 million.

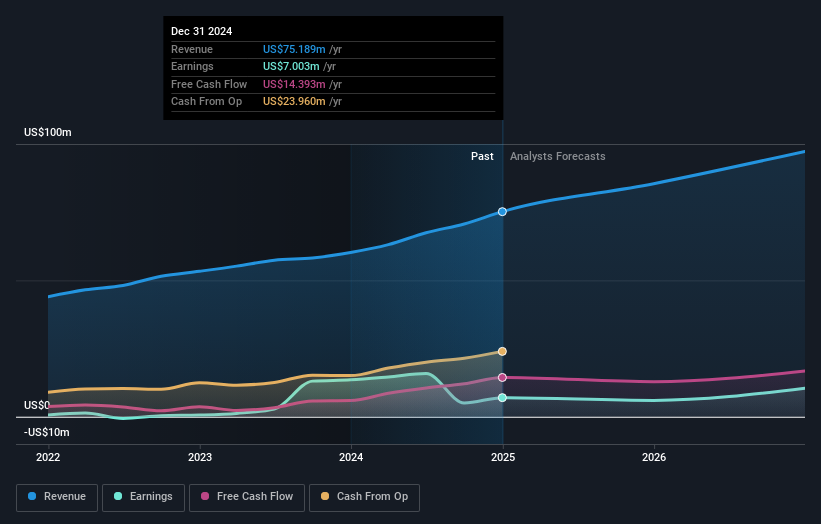

Operations: Red Violet generates revenue primarily from its Identity and Information Solutions segment, which reported $86.43 million. The company's financial performance is highlighted by a focus on this core revenue stream.

Red Violet, a nimble player in identity intelligence, is carving out a niche with its focus on enterprise and government sectors. Over the past year, earnings surged by 120.9%, surpassing the software industry's growth of 18.4%. With no debt on its books now compared to a debt-to-equity ratio of 5% five years ago, it has strengthened its financial footing. Recent sales for Q3 hit US$23.08 million against last year's US$19.06 million, while net income jumped to US$4.21 million from US$1.72 million previously reported—an indication of robust operational performance despite competitive pressures and regulatory challenges ahead.

Where To Now?

- Embark on your investment journey to our 296 US Undiscovered Gems With Strong Fundamentals selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NB Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NBBK

NB Bancorp

Focuses on operating as a bank holding company for Needham Bank that provides various banking products and services in Greater Boston metropolitan area and surrounding communities in the United States.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives