- United States

- /

- Software

- /

- NasdaqGS:QLYS

A Valuation Check on Qualys (QLYS) Following Strong Q3 Earnings and Raised Full-Year Guidance

Reviewed by Simply Wall St

Qualys (QLYS) shares jumped sharply after the company delivered third-quarter results that beat expectations, highlighted revenue and profit gains, and raised its full-year financial guidance. Investors are watching these signals closely.

See our latest analysis for Qualys.

Qualys’ stronger-than-expected Q3 performance and upbeat outlook have fueled a rapid resurgence in investor confidence, resulting in a remarkable 21% share price gain over the past week alone. However, longer-term total shareholder return still trails at -2.8% for the past year, serving as a reminder that momentum is only now building after a more muted stretch.

If you’re curious which other tech innovators are catching market attention right now, it’s a great time to explore See the full list for free.

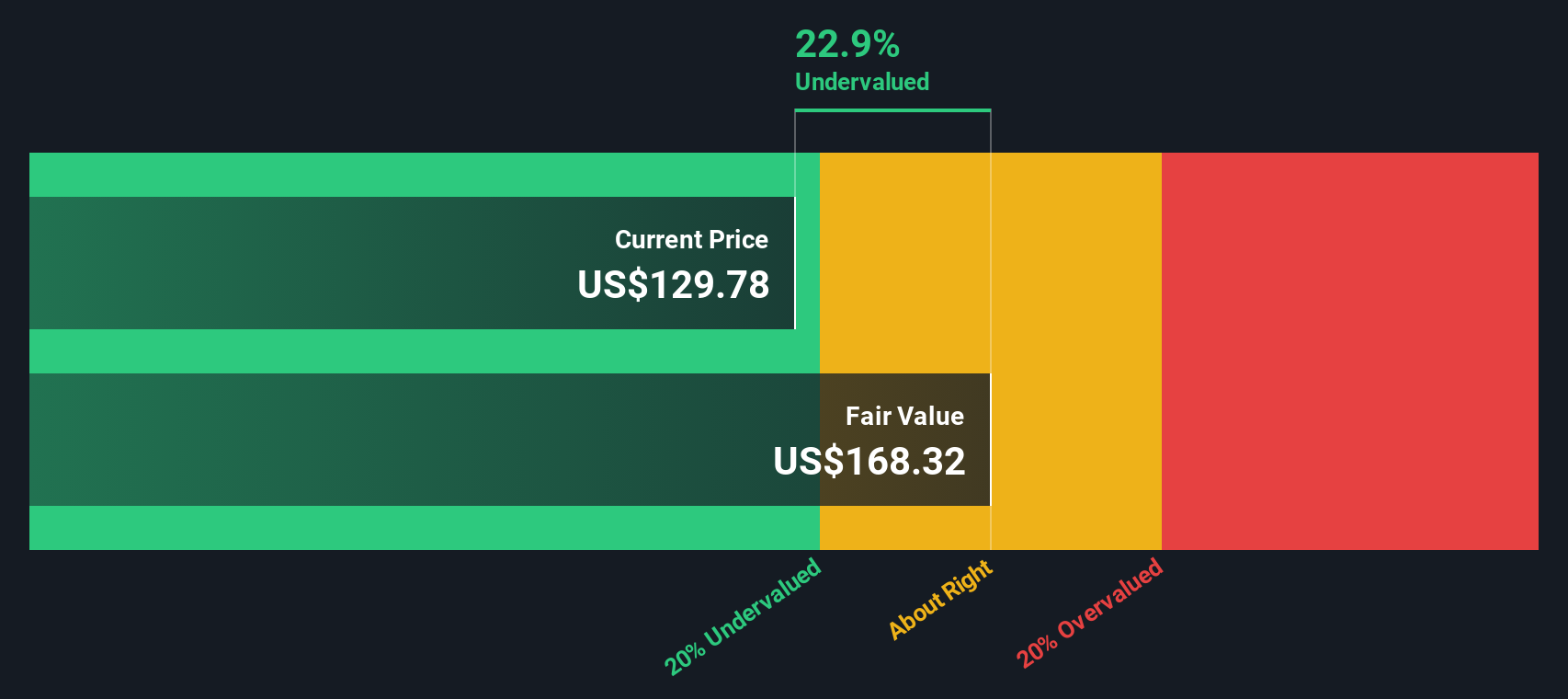

But after such a sharp run-up and management raising expectations, is Qualys still undervalued in the eyes of investors, or is the current price already reflecting all the future growth potential?

Most Popular Narrative: 6% Overvalued

Despite the current share price trading above the narrative's fair value estimate, support for Qualys remains anchored in its strong execution and industry leadership, particularly as regulatory and technological tailwinds gain pace.

Adoption of Qualys' new cloud-native risk operations center (ROC) and Agentic AI platform positions the company as a leading pre-breach risk management provider. It offers unified orchestration, automation, and remediation across both Qualys and non-Qualys data, which opens incremental greenfield opportunities and should support higher ARPU and expanded TAM, leading to durable revenue and earnings growth.

Want to know which future financial levers power this hotly debated valuation? Analysts are projecting big moves, from platform upgrades to strategic integrations, that could shift the entire cybersecurity landscape. Find out the underlying growth engines and margin plays driving their price target before everyone else catches up.

Result: Fair Value of $141.02 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid advances in AI security and uncertain customer adoption patterns could quickly undermine Qualys’ current growth outlook and disrupt its positive momentum.

Find out about the key risks to this Qualys narrative.

Another View: A Different Take Using Our DCF Model

While price targets using market multiples suggest Qualys trades above fair value, our SWS DCF model presents a more optimistic outlook. According to this analysis, shares are actually trading 3.5% below fair value, suggesting a possible undervalued opportunity. Is the market being too cautious, or does the DCF model identify something others may overlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Qualys Narrative

If you want to dig deeper or would like to run the numbers for yourself, it's quick and straightforward to craft your own perspective. Do it your way

A great starting point for your Qualys research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Fresh Stock Ideas?

Smart investors know that now is the moment to act, not wait. Use the tools at your fingertips to target hidden gems before everyone else catches on.

- Capture the power of market mispricing and target real value with these 870 undervalued stocks based on cash flows that pass strict cash flow checks.

- Supercharge your portfolio’s growth by tapping into these 24 AI penny stocks as these companies push the boundaries of artificial intelligence across industries.

- Secure reliable income streams by handpicking these 16 dividend stocks with yields > 3% with yields above 3% and solid financial foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qualys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QLYS

Qualys

Provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives