- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

PayPal's (NASDAQ:PYPL) Diversification Should Boost Already Solid Returns

Although it never achieved the "verb" status like Google Search or Adobe Photoshop,PayPal Holdings (NASDAQ: PYPL) has been the leading brand of the digital payment industry.

As a continuous innovator, the company is now looking at new opportunities to boost its bottom line and leverage 400m accounts into an advantage.

In this article, we will explore these efforts and examine the company's efficiency in using capital.

View our latest analysis for PayPal Holdings

Latest Developments

PayPal just announced an expansion into cryptocurrency for its users located in the U.K. They will buy, hold and sell 4 cryptocurrencies so far: Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

This move is in line with the previously announced plans, intending to morph into a super app. This app would see PayPal become a one-stop-shop for personal budgeting, bill management, subscription management, crypto operations – but also, interestingly, a chat application.

CEO Dan Schulman noted it would enable users to pursue high-yield savings and early access to direct deposit funds. Finally, through artificial intelligence and machine learning, the app would customize itself to best suit user's needs.

As this was not ambitious enough, PayPal is now exploring the possibility of becoming a stock-trading platform. The company likely hired the co-founder of online brokerage TradeKing precisely for this purpose. It is important to note that one of the competitors, Square, already offers stock and cryptocurrency trading through its app.

An Overview of Return On Equity

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company concerning shareholder's equity.

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for PayPal Holdings is:

23% = US$4.9b ÷ US$21b (Based on the trailing twelve months to June 2021).

The 'return' is the amount earned after tax over the last twelve months. That means that for every $1 worth of shareholders' equity, the company generated $0.23 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain," we can evaluate its future ability to generate profits.

Generally speaking, other things being equal, firms with a high return on equity and profit retention have a higher growth rate than firms that don't share these attributes.

PayPal Holdings' Earnings Growth And 23% ROE

To begin with, PayPal Holdings has a pretty high ROE. Second, a comparison with the average ROE reported by the industry of 17% also doesn't go unnoticed.

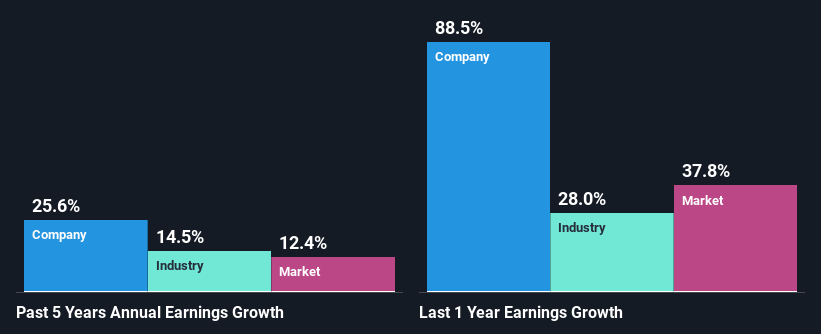

As a result, PayPal Holdings' exceptional 26% net income growth was seen over the past five years, which doesn't come as a surprise.

Next, comparing with the industry net income growth, we found that PayPal Holdings' growth is quite high compared to the industry average growth of 14% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await.

Is PayPal fairly valued compared to other companies? These 3 valuation measures might help you decide.

Diversifying Should Boost Returns

In total, we are pretty happy with PayPal Holdings' performance. Particularly, we like that the company is reinvesting heavily into its business and at a high rate of return. Unsurprisingly, this has led to impressive earnings growth.

With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. Thus, it doesn't surprise that the company is exploring so many possibilities to diversify. By looking through our data, we have concluded that the average ROE is even higher in those sectors, as high as 26.6%. In the case of a successful expansion, it wouldn't be surprising to see returns boosted to those levels.

For more information, check the forecast page on the link below.

Analyst's forecasts page for the company.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion