- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

PayPal (NASDAQ:PYPL) Can Easily Afford to Explore Crypto Projects

After declining almost 40% from the all-time high in 2021, PayPal Holdings, Inc. ( NASDAQ: PYPL ) stock is still looking for a sure footing.

Despite increasing institutional optimism, it remains below US$200, and a popular technical measure – a 50-day moving average.

Check out our latest analysis for PayPal Holdings

Optimism After a Sell-Off

Paypal's performance in 2021 was the worst one in a long time. While we can blame the US$45b acquisition of Pinterest fizzling out in October, the disappointing guidance following the Q3 earnings, and finally, the broad market sell-off in November didn't help the case.

While the chart is still failing to show the recovery, the number of institutions willing to take an optimistic stance is increasing. Evercore ISI has named Paypal the top pick in the payment space for 2022, while BMO Capital upgraded the stock to Outperform. BMO analyst James Fotheringham noted tax-loss selling is done and now sees strong organic revenue growth potential. However, his new price target has been reduced from US$278 to US$224.

Meanwhile, PayPal's senior VP of crypto and digital currencies, Jose Fernandez da Ponte stated that the company is exploring the creation of a stablecoin. The announcement came after a developer discovered evidence within the app, referring to "PayPal Coin," which would be backed by the U.S. dollar.

Examining PayPal's Balance Sheet

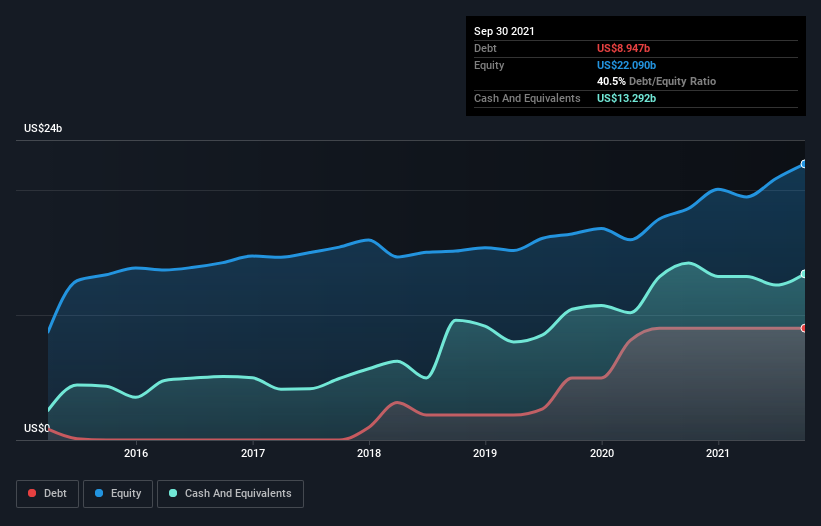

As you can see below, PayPal Holdings had US$8.95b of debt, which is about the same as the year before. You can click the chart for greater detail.

However, its balance sheet shows it holds US$13.3b in cash, so it has US$4.35b net cash.

How Strong Is PayPal Holdings' Balance Sheet?

According to the last reported balance sheet, PayPal Holdings had liabilities of US$41.7b due within 12 months and liabilities of US$10.7b due beyond 12 months.Offsetting these obligations, it had cash of US$13.3b as well as receivables valued at US$4.48b due within 12 months.So it has liabilities totaling US$34.7b more than its cash and near-term receivables combined.

Of course, PayPal Holdings has a market capitalization of US$220.4b, so these liabilities are manageable.But there are sufficient liabilities that we would undoubtedly recommend shareholders continue to monitor the balance sheet in the future.Despite its noteworthy liabilities, PayPal Holdings boasts net cash, so it's fair to say it does not have a heavy debt load.

In addition to that, we're happy to report that PayPal Holdings has boosted its EBIT by 33%, thus reducing the specter of future debt repayments.The balance sheet is the area to focus on when analyzing debt.But it is future earnings, more than anything, that will determine PayPal Holdings' ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

While PayPal Holdings may have net cash on the balance sheet, it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow because that will influence both its need for and its capacity to manage debt.Over the last three years, PayPal Holdings produced more free cash flow than EBIT.

Summing up

Although PayPal Holdings' carries some debt, it is clearly positive to see that it has net cash of US$4.35b.The cherry on top was that it converted 130% of that EBIT to free cash flow, bringing in US$5.0b.Overall, it seems PayPal passes our debt risk checks.

If the company decides to pursue the crypto strategy, it looks like it can certainly afford it. Interestingly, the company made the statement only after the 3rd party discovery, leading us to believe that PayPal Coin is still far from realization.

The balance sheet is the prominent place to start when analyzing debt levels.But ultimately, every company can contain risks outside of the balance sheet. We've identified 2 warning signs with PayPal Holdings , and understanding them should be part of your investment process.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)