Stock Analysis

- United States

- /

- Software

- /

- NasdaqGS:PTC

High Growth Tech Stocks To Watch For Future Potential

Reviewed by Simply Wall St

Over the last 7 days, the market has remained flat, yet it is up 32% over the past year with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks with strong potential can be crucial for investors looking to capitalize on future opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.46% | 66.34% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 255 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

BioMarin Pharmaceutical (NasdaqGS:BMRN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BioMarin Pharmaceutical Inc. focuses on developing and commercializing therapies for serious and life-threatening rare diseases and medical conditions, with a market cap of approximately $13.44 billion.

Operations: BioMarin Pharmaceutical Inc. generates approximately $2.59 billion in revenue from the development and commercialization of innovative therapies for rare diseases and medical conditions. The company's primary focus is on delivering treatments for serious health issues that have limited therapeutic options available.

BioMarin Pharmaceutical, amidst a flurry of recent activities, has shown promising advancements in its genetic skeletal condition treatments. The company's VOXZOGO® therapy demonstrated significant health improvements in children with achondroplasia during the CANOPY clinical program, spotlighting not only growth in bone length but also enhancements in quality of life metrics—a pivotal factor for patient-centric therapies. Financially, BioMarin is on an upward trajectory with expected revenue growth of 9.7% per annum until 2027 and a robust earnings forecast increasing by 30% annually. These figures underscore the firm’s strategic R&D investments which have consistently elevated its portfolio's potential and market position within biotechnology focused on rare diseases.

- Click here and access our complete health analysis report to understand the dynamics of BioMarin Pharmaceutical.

Assess BioMarin Pharmaceutical's past performance with our detailed historical performance reports.

Incyte (NasdaqGS:INCY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Incyte Corporation is a biopharmaceutical company focused on discovering, developing, and commercializing therapeutics for hematology/oncology, inflammation, and autoimmunity with a market cap of $12.68 billion.

Operations: Incyte generates revenue primarily from its biotechnology segment, which amounted to $3.86 billion. The company focuses on therapeutics for hematology/oncology, inflammation, and autoimmunity in both the U.S. and international markets.

Incyte, amid a flurry of clinical advancements and strategic R&D investments, is carving a niche in the oncology sector. Recent trials, notably INCB123667 for advanced solid tumors, have shown promising results with significant reductions in tumor DNA and favorable response rates in ovarian and endometrial cancers. Despite a challenging financial period with a net loss reported in Q2 2024, Incyte's commitment to innovation is evident with an 8.9% revenue growth forecast surpassing the US market average. The firm's R&D expenses are robustly aligned with its strategic goals, underpinning future prospects in high-stakes cancer treatments where it demonstrates potential leadership through targeted therapies.

- Unlock comprehensive insights into our analysis of Incyte stock in this health report.

Evaluate Incyte's historical performance by accessing our past performance report.

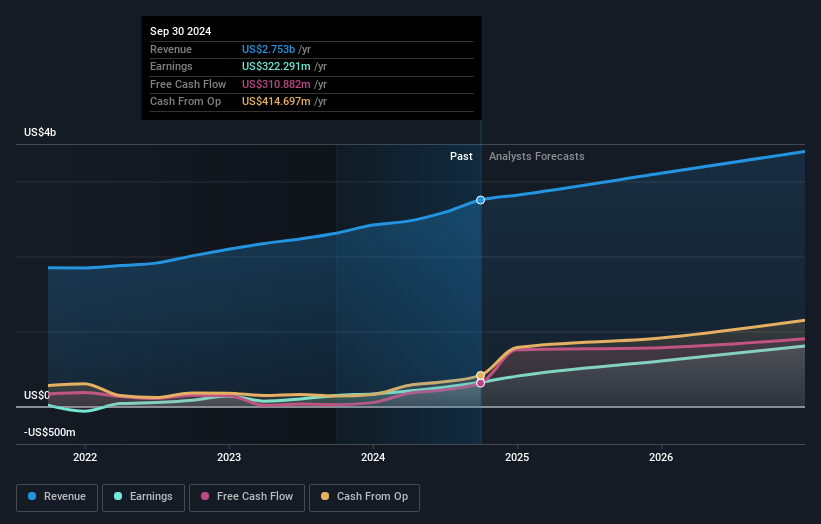

PTC (NasdaqGS:PTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PTC Inc. is a software company that operates across the Americas, Europe, and the Asia Pacific with a market cap of $21.89 billion.

Operations: The company generates revenue primarily from its CAD/CAM software segment, which brought in $2.22 billion. The software is sold across various regions including the Americas, Europe, and the Asia Pacific.

PTC, amid recent executive reshuffles and robust earnings projections, reflects a dynamic stance in the tech sector. With a revenue forecast growth of 10.1% per year, slightly outpacing the US market average of 8.7%, PTC is positioning itself as a resilient competitor despite some industry challenges such as its recent drop from the Russell 2500 indices. The company's strategic focus on R&D is evident with an expected significant annual profit growth rate of 21%, highlighting its commitment to innovation and sector leadership. This approach, coupled with high-profile board appointments like Rob Bernshteyn, underscores PTC's drive to blend experienced leadership with aggressive growth and development strategies in software technology.

- Get an in-depth perspective on PTC's performance by reading our health report here.

Examine PTC's past performance report to understand how it has performed in the past.

Key Takeaways

- Navigate through the entire inventory of 255 US High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTC

PTC

Operates as software company in the Americas, Europe, and the Asia Pacific.