- United States

- /

- Software

- /

- NasdaqGS:PONY

Assessing Pony AI Stock After New Automaker Partnerships and Volatile Price Swings

Reviewed by Bailey Pemberton

If you’re holding Pony AI stock or thinking about jumping in, you’ve probably noticed the recent rollercoaster in its share price. After an impressive climb of 29.6% year to date, the last month saw a pullback of 7.0%, though the past week has nudged up by 0.3%. Is this a temporary dip, or the start of a bigger story? That’s the question everyone’s asking right now, and there are a few key signals you should know before making your next move.

There’s buzz in the industry about Pony AI’s latest partnerships with major automakers. These announcements haven’t just perked up investor interest; they have also put the spotlight on whether the company’s autonomous tech is on the verge of something big, or if increasing competition could raise risk in the months ahead. The market seems to be digesting these updates, as reflected in the stock’s volatility and shifting risk perception.

When it comes to valuation, Pony AI currently scores just 1 out of 6 possible checks for being undervalued. That means, at least by traditional metrics, the stock may be a bit pricey given its fundamentals. But numbers never tell the whole story. Next, let’s break down the different methods analysts use to assess whether a stock is undervalued or not. Then, I’ll introduce a perspective that might just change how you see Pony AI entirely.

Pony AI scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Pony AI Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company’s shares are really worth by forecasting its future cash flows and then discounting those projections back to their value today. This approach tries to capture the long-term earning potential of a business, looking well beyond this year’s financial statements.

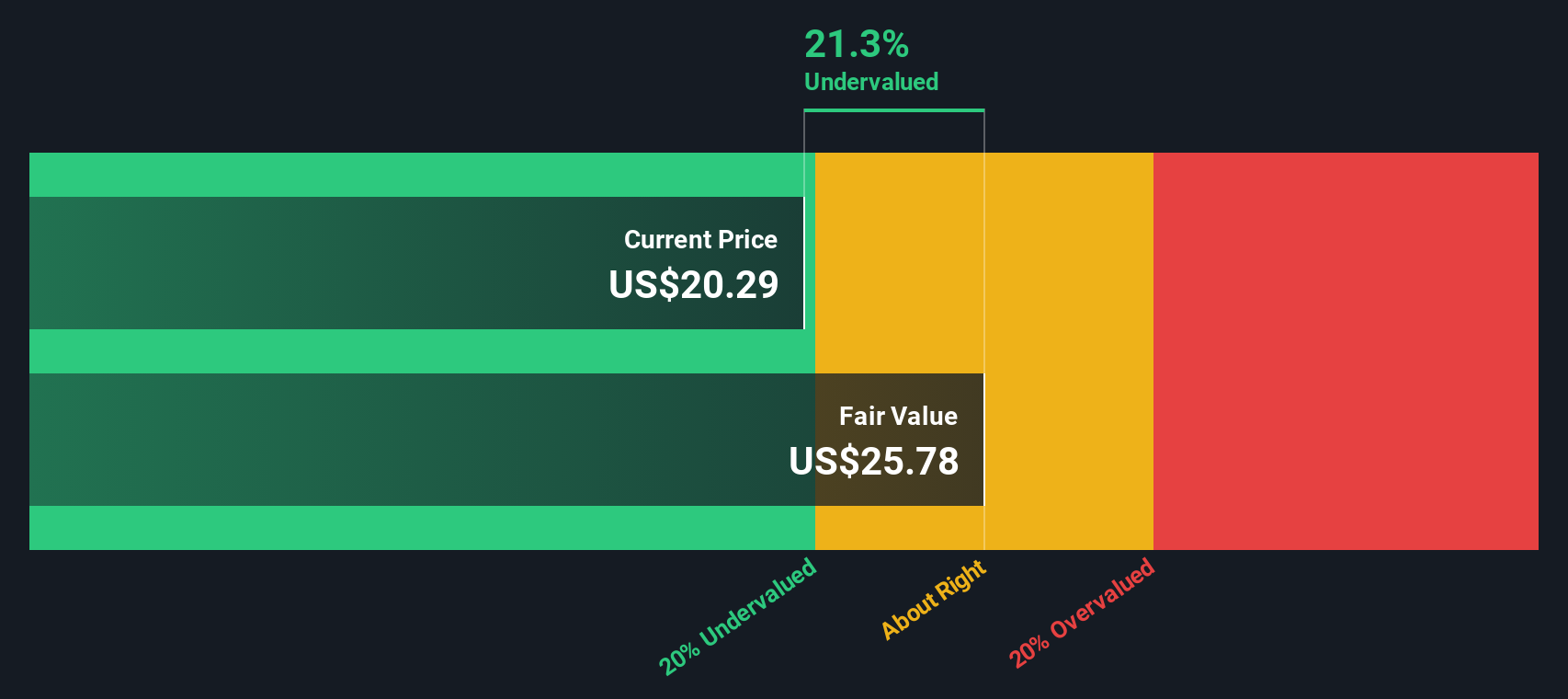

For Pony AI, the latest available Free Cash Flow (FCF) is a loss of $144.4 million. Analyst estimates suggest the business may turn a corner in the next several years, with projections reaching $214 million in FCF by the end of 2029. Looking even further out, extrapolating both analyst expectations and proprietary modeling, Pony AI could generate $1.04 billion in annual FCF by 2035, although that is an optimistic scenario. All reported cash flows are in dollars.

This model values Pony AI at an intrinsic share price of $23.74, which is 17.1% above its current trading price. That indicates the stock is undervalued by DCF standards. If these optimistic cash flow projections prove accurate, there may be meaningful upside from here.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pony AI is undervalued by 17.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Pony AI Price vs Book (P/B) Ratio Analysis

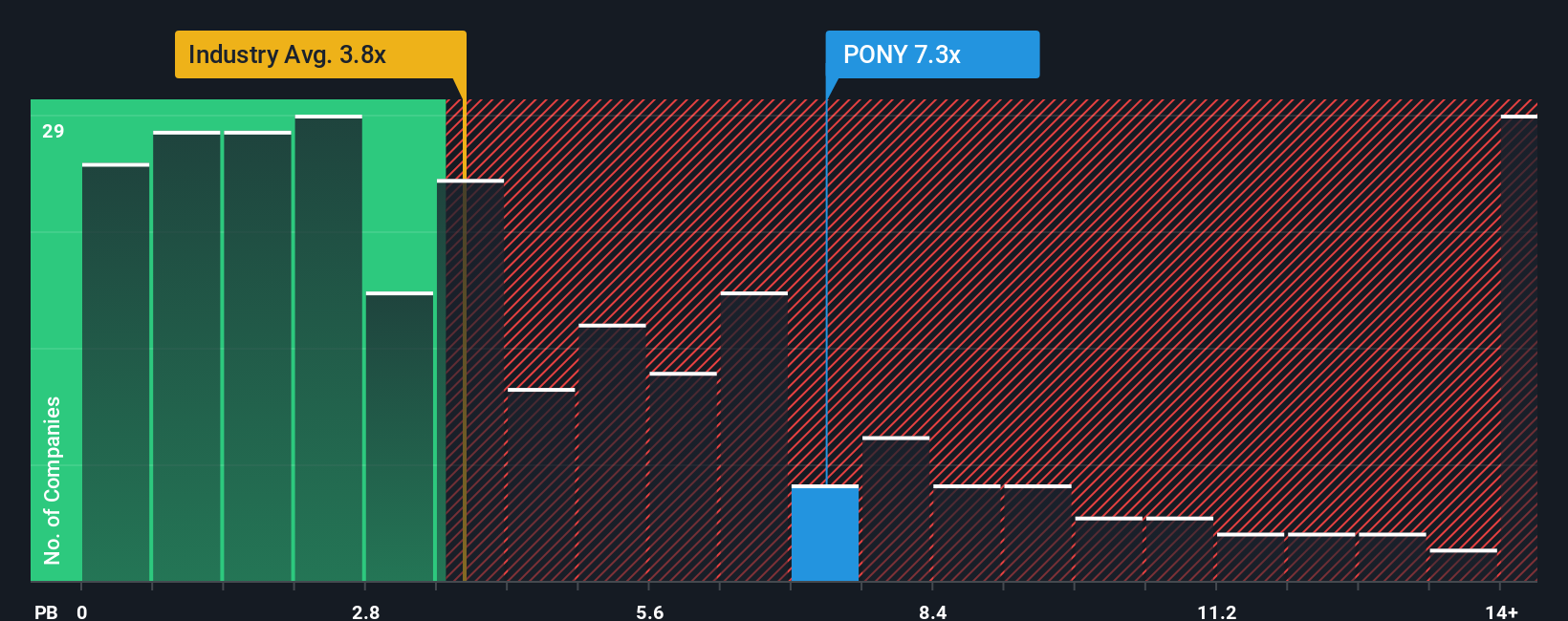

The price-to-book (P/B) ratio is often considered a strong valuation tool for tech companies that are not yet profitable, as it compares a company’s market value to its net asset value. While profits may be negative or volatile in the early stages, the book value provides a stable reference point for gauging how much you’re paying for the underlying business assets.

In fast-growing, innovative sectors like autonomous driving, investors are typically willing to pay a higher P/B ratio due to growth potential. However, this also means taking on greater risk. A "normal" or "fair" P/B multiple should reflect both the company’s future earning prospects and any uncertainties about achieving them.

Pony AI is currently trading at a P/B ratio of 8.9x, which is notably higher than the software industry average of 4.0x and just above the peer group average of 8.2x. At first glance, this seems lofty. However, Simply Wall St calculates a “Fair Ratio” that’s unique to Pony AI, taking into account its growth outlook, profitability trends, risk factors, and market cap. This proprietary Fair Ratio takes a more holistic approach than simply looking at what other companies are trading at, since it adjusts for the business’s specific circumstances and future trajectory.

Comparing Pony AI’s current P/B of 8.9x to its Fair Ratio, the difference is small and within an acceptable range, suggesting the stock is valued about right at these levels when adjusting for all relevant factors.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pony AI Narrative

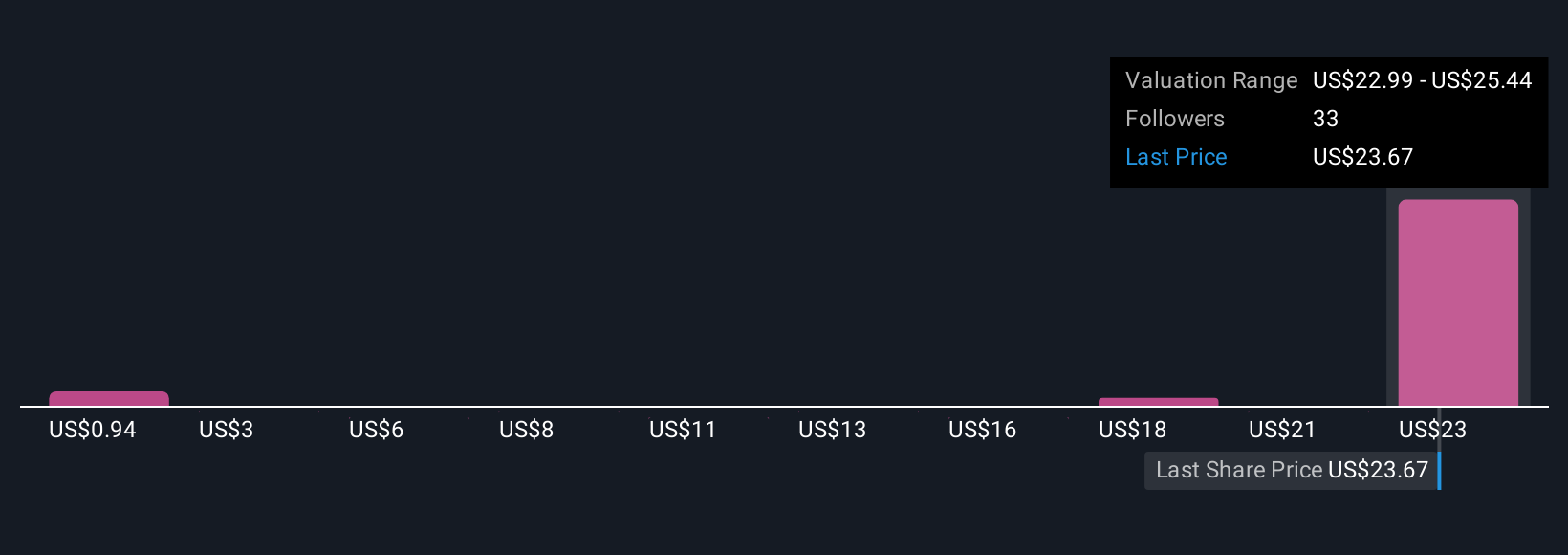

Earlier we mentioned there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company, connecting the dots from what you believe about its future to an actual financial forecast and fair value. Instead of relying only on numbers, Narratives bring together your assumptions for growth, profitability, and key events, making it easy to see why you value Pony AI the way you do.

On Simply Wall St’s platform, Narratives are available on the Community page and used by millions of investors to help make smarter decisions. Narratives empower you to compare your idea of fair value to the current share price, showing when opportunities might arise to buy or sell. What makes Narratives especially powerful is they update dynamically, reacting in real time as fresh news or earnings results change the outlook.

For example, some investors' Narratives see Pony AI revolutionizing urban mobility and assign a much higher fair value, while others, more cautious, anticipate ongoing losses and estimate a lower fair value. Narratives let every investor make choices based on their own informed story.

Do you think there's more to the story for Pony AI? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PONY

Pony AI

Through its subsidiaries, engages in the autonomous mobility business in the People’s Republic of China, the United States, and internationally.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives