- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (NasdaqGS:PLTR) Joins S&P 100 After 12% Price Jump Last Quarter

Reviewed by Simply Wall St

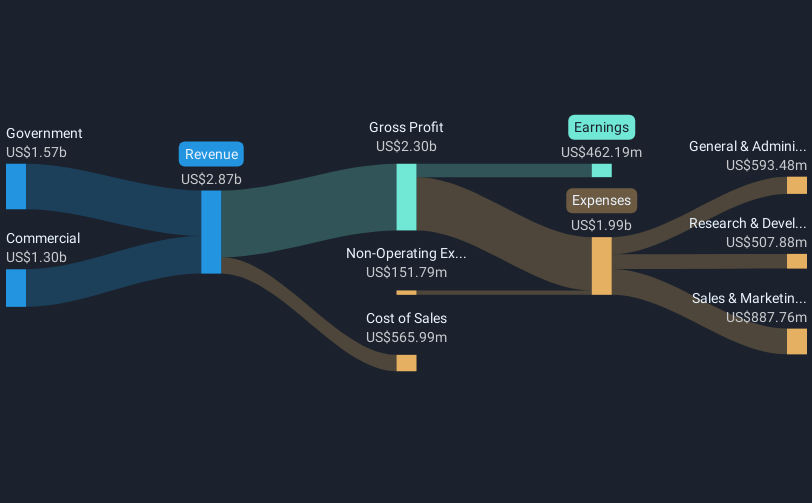

Palantir Technologies (NasdaqGS:PLTR) experienced an 11.97% increase in its stock price over the last quarter, amidst significant developments including its inclusion in the S&P 100. The company has been actively forming alliances, such as with Everfox and R1, which may have strengthened investor optimism. Additionally, Palantir's partnerships with companies like Databricks and Archer Aviation demonstrate its involvement in expanding sectors like AI and aerospace, potentially enhancing its market appeal. Despite broader market volatility following potential tariff announcements by President Trump, Palantir's strategic positioning and partnerships appear to have positively influenced its stock performance within the tech-heavy Nasdaq Composite's gains of 0.9%.

Over the past three years, Palantir Technologies Inc. has achieved a very large total return of 509.65%, combining share price appreciation and dividends, reflecting strong investor confidence in the company's growth trajectory. Such a robust performance can be attributed to several key developments. The recent index addition to the S&P 100, announced on March 8, 2025, underscores its market recognition and may have bolstered investor interest. A strategic expansion of Palantir’s collaboration with the U.S. Army's PEO EIS program, valued at over $400 million, further showcased its governmental engagement. Moreover, the company's earnings have surged, with significant growth over the past year. This earnings momentum has outpaced both the software industry and broader market performance.

Additionally, Palantir's active partnerships, such as those with Everfox and Databricks, have supported advancements in AI and data analytics capabilities, potentially enhancing revenue prospects. The company's strategic initiatives, including share buybacks totaling $64.2 million since August 2023, also potentially contributed to share value appreciation, reflecting confidence in Palantir's long-term vision. These elements collectively outline a period of dynamic growth and strategic positioning in the tech industry.

Evaluate Palantir Technologies' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion