- United States

- /

- Software

- /

- NasdaqGS:PLTR

Is Palantir's AI Momentum Justifying Its Surging Share Price in 2025?

Reviewed by Bailey Pemberton

If you have been watching Palantir Technologies, chances are you are wondering whether now is the right time to buy, sell, or simply hold on for the ride. The stock has been nothing short of electrifying over the past year, climbing an incredible 322.9% in twelve months and boasting a year-to-date surge of 141.5%. Even when looking further back, the performance is eye-popping, up 1,558.4% over the last five years. However, the past month has been a reality check, with shares nearly flat at -0.4% and a modest 1.0% gain in the last week as investors digest Palantir’s evolving narrative.

So, what’s driving these dramatic moves? Recent news has reinforced Palantir’s growing role in supplying AI-driven analytics to governments and major corporations, fueling optimism about its long-term relevance. Yet, just as public enthusiasm peaks after every new government contract or product announcement, some investors have started to question whether expectations have gotten ahead of the fundamentals.

This brings us to the big question: Is Palantir undervalued, overvalued, or priced just right? Based on our latest valuation review, Palantir scores 0 out of 6 on our value checks, meaning it isn’t currently undervalued by any of our major benchmarks. But numbers can only tell part of the story. In the sections ahead, we’ll break down what’s behind these valuation methods and reveal a perspective on value that could give you an edge.

Palantir Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Palantir Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future free cash flows and discounting them back to today’s dollars. For Palantir Technologies, the analysis starts with its most recent Free Cash Flow, which stands at $1.7 billion. Over the next decade, projections anticipate this number will grow steadily, reaching about $14.8 billion by 2035. Analyst estimates only extend reliably for the next five years, and further forecasts use extrapolations.

This particular DCF uses a two-stage Free Cash Flow to Equity model, incorporating both analyst expectations and long-term estimates for sustainable growth. Notably, projected Free Cash Flow is expected to rise from $2.5 billion in 2026 to $7.3 billion in 2029, highlighting bullish expectations for Palantir’s expansion. All values are calculated in US dollars, per the company’s reporting currency.

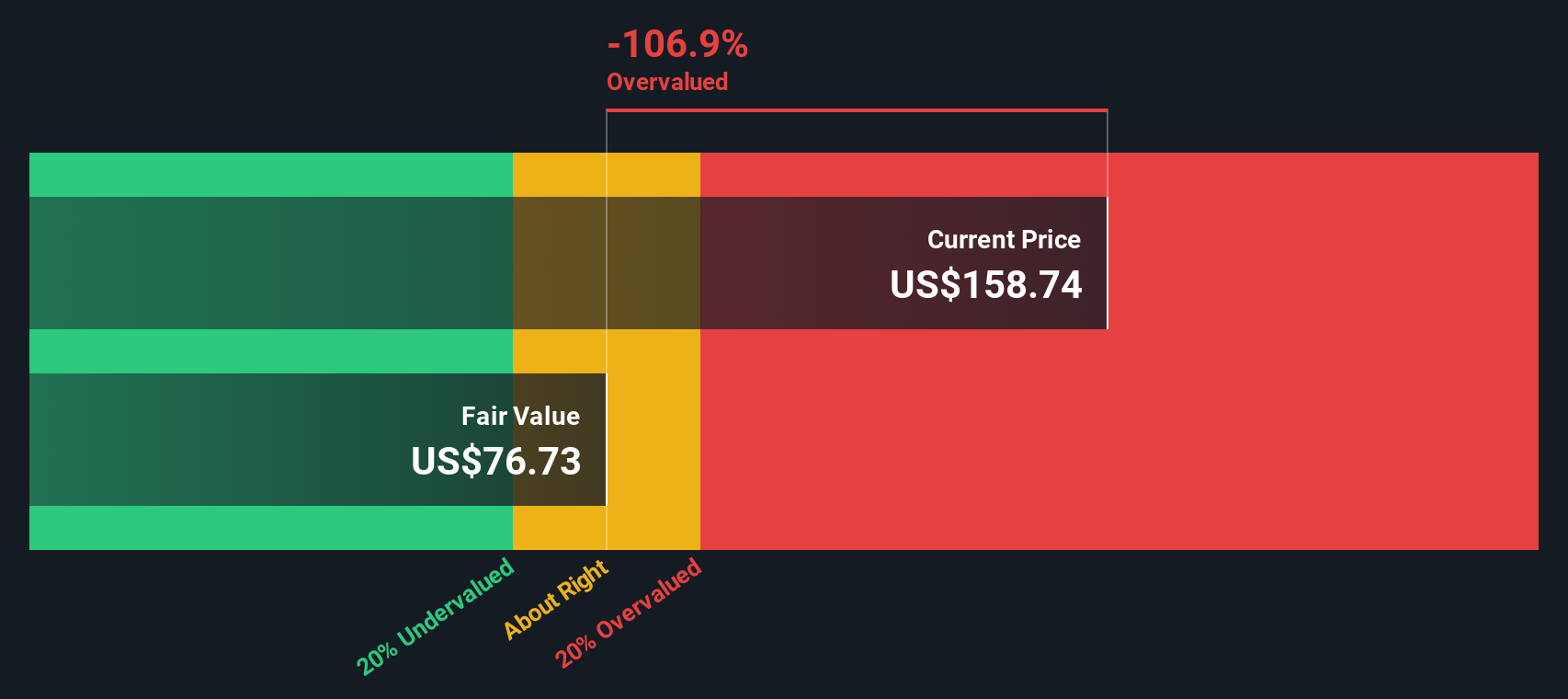

Based on these projections, the DCF model produces an intrinsic value of $76.36 per share. Compared to Palantir’s current share price, the model indicates the stock is trading at a 137.8% premium, meaning the market is valuing Palantir well above what this model deems justified.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Palantir Technologies may be overvalued by 137.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Palantir Technologies Price vs Book

The Price-to-Book (P/B) ratio is a commonly used valuation metric, especially effective for companies with established balance sheets and tangible assets. For profitable and asset-heavy businesses like Palantir Technologies, the P/B ratio helps investors gauge how much they are paying for each dollar of net asset value, making it a relevant lens for comparison.

Growth prospects and perceived risk play a major role in determining what constitutes a "normal" or "fair" P/B ratio. Companies expected to grow quickly or with less risk often trade at higher P/B multiples, while slower-growing or riskier firms typically warrant lower ratios. Therefore, looking at the P/B ratio alone only tells part of the story.

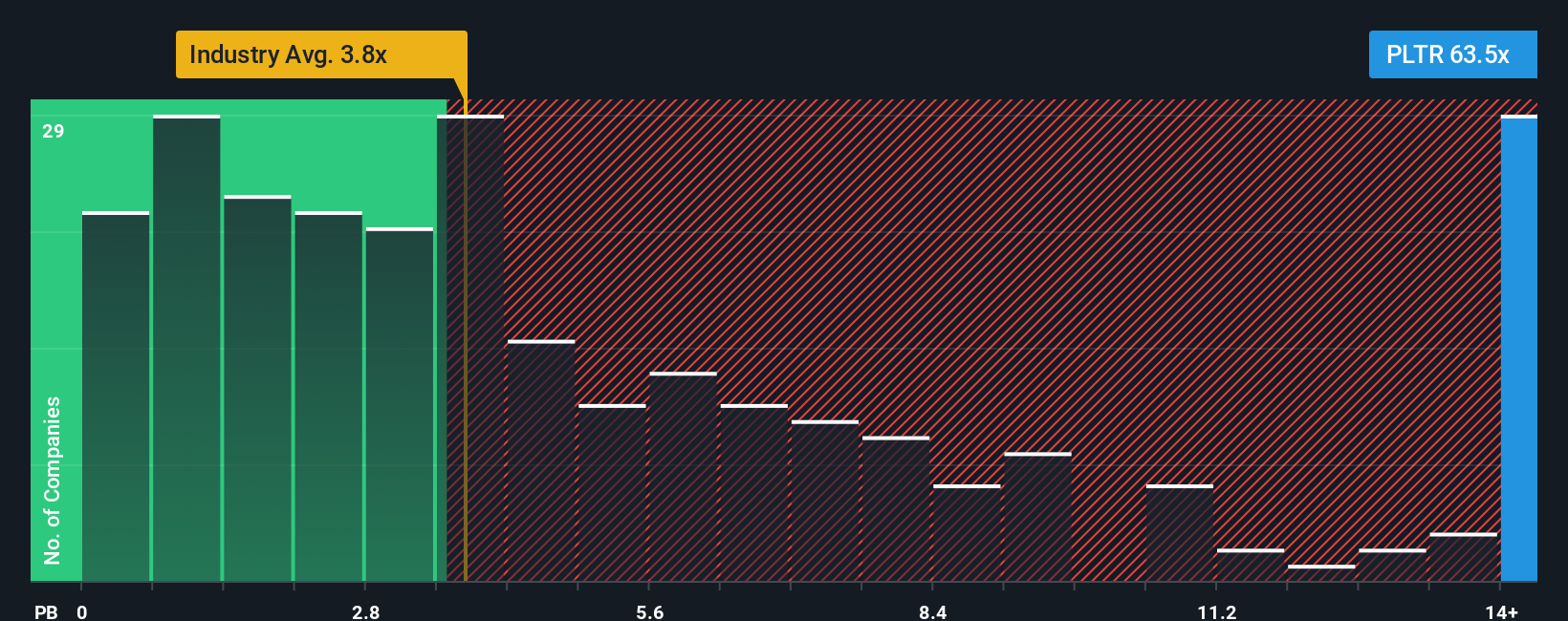

Currently, Palantir trades at a P/B ratio of 72.66x, a stark contrast not only to the Software industry average of 4.00x, but also well above the peer average of 47.40x. This suggests investors are willing to pay a substantial premium compared to similar companies in the sector.

This is where Simply Wall St’s proprietary Fair Ratio becomes relevant. The Fair Ratio integrates factors like Palantir’s growth outlook, profit margins, market cap, and risk profile. This delivers a more comprehensive and tailored benchmark than generic industry or peer comparisons. By considering the company’s specific circumstances, the Fair Ratio can offer a more accurate gauge of value.

When matching Palantir’s current P/B multiple with its Fair Ratio, the gap is significant, implying Palantir’s shares are trading at a notable premium to what its fundamentals justify at this moment.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Palantir Technologies Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. In investing, a Narrative is the story or perspective you create about a company, combining what you believe about its future growth, profitability, and the risks it faces. Rather than just focusing on financial ratios or models, Narratives put these numbers in context and help you connect the dots between what’s happening inside the company and what its stock should be worth.

Narratives link a company’s story to your financial forecast and translate that into a Fair Value, giving you a clear and reasoned price target based on your unique viewpoint. On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to bring their assumptions to life and track how their story stacks up against both market consensus and peers.

Narratives also empower you to decide when to buy, sell, or hold by comparing your calculated Fair Value to the real-time market price. What’s more, they automatically update as the facts change. For example, when Palantir secures a new contract or posts its latest earnings, your Narrative’s Fair Value will be refreshed with the latest data.

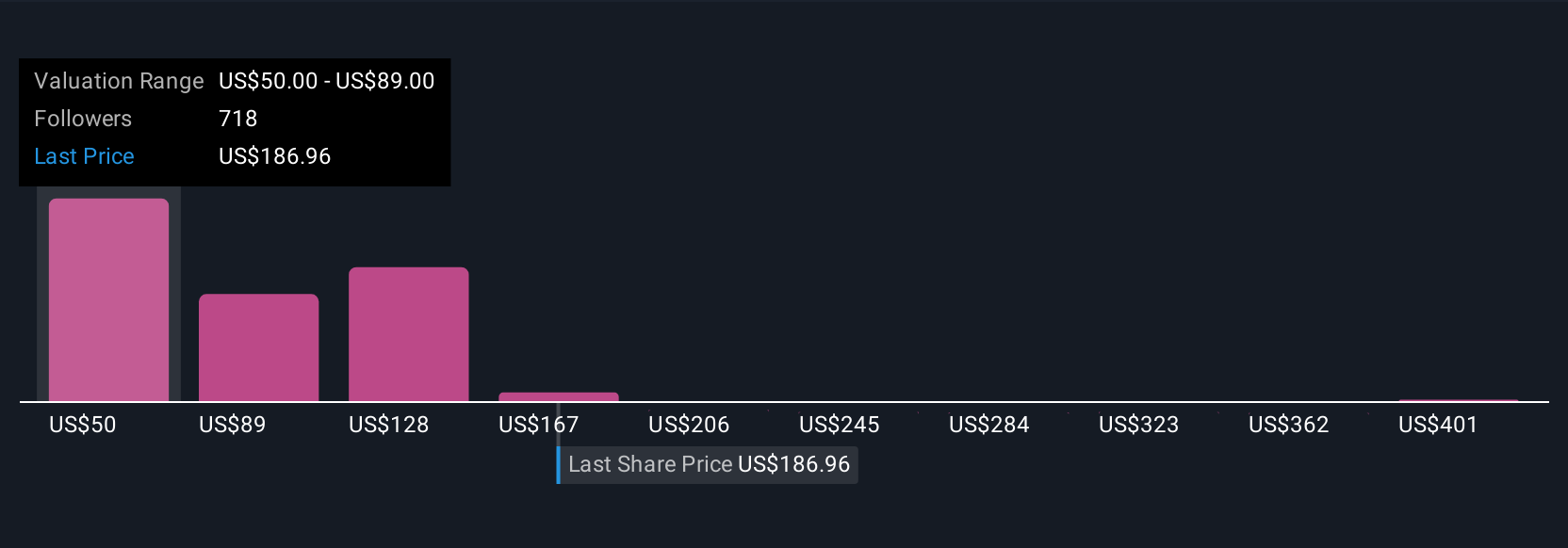

Take Palantir Technologies as an example: some investors’ Narratives see Fair Value near $112 per share, fueled by rapid growth and margin expansion, while others take a more conservative view, with Fair Value estimates closer to $66 per share.

Do you think there's more to the story for Palantir Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives