- United States

- /

- Software

- /

- NasdaqGS:PLTR

Has Palantir’s Huge 2025 AI Driven Rally Pushed Its Valuation Too Far?

Reviewed by Bailey Pemberton

- Wondering if Palantir is still worth buying after such a huge run, or if the easy money has already been made? You are not alone, and that is exactly what we are going to unpack.

- Palantir's share price has climbed 5.5% over the last week, 24.9% over the last month, and an eye catching 157.2% year to date, adding to a massive 139.7% gain over the past year and 654.5% over five years.

- Much of this momentum has been fueled by heightened investor excitement around AI driven analytics and Palantir's expanding role in government and commercial data platforms, including high profile contracts across defense and critical infrastructure. At the same time, debates about how defensible its technology is and how far its addressable market can really stretch have kept the stock front and center in discussions about long term growth versus risk.

- Despite all that enthusiasm, Palantir currently scores just 0/6 on our valuation checks. This might surprise investors who assume strong share price gains always reflect solid underlying value. Next we will break down the traditional valuation approaches, then finish with a more nuanced way to think about what the market might really be pricing in.

Palantir Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Palantir Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes Palantir's expected future cash flows and works backwards, discounting them to estimate what the business is worth in $ today.

Palantir generated about $1.79 billion in free cash flow over the last twelve months, and analysts expect this to rise sharply as the company scales. Simply Wall St aggregates analyst forecasts for the next few years, then extrapolates further out using a 2 Stage Free Cash Flow to Equity model, with projected free cash flow reaching roughly $15.01 billion by 2035.

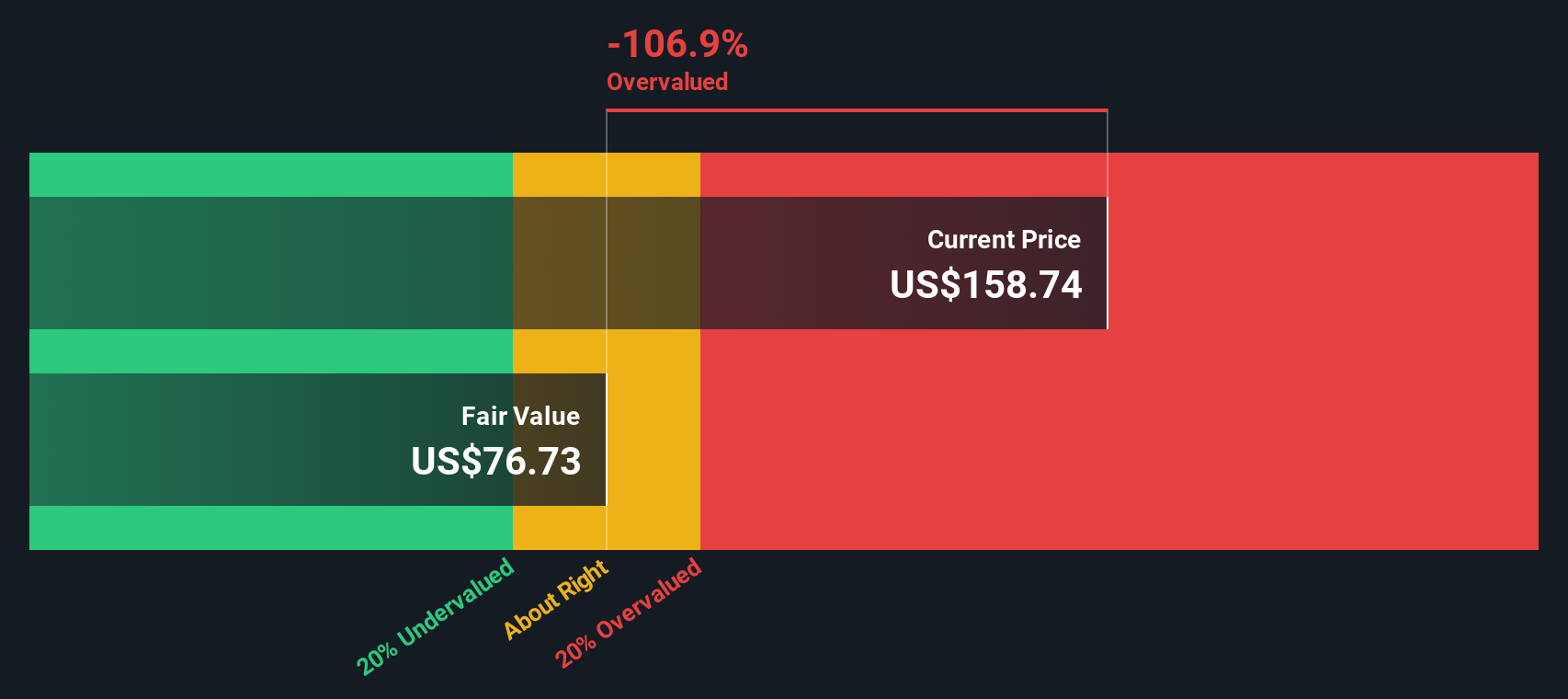

When all those future $ cash flows are discounted back, the DCF model arrives at an intrinsic value of about $79.19 per share. Compared with the current share price, this implies the stock is around 144.2% overvalued. This suggests that investor optimism is well ahead of what the cash flow outlook alone supports.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Palantir Technologies may be overvalued by 144.2%. Discover 909 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Palantir Technologies Price vs Book

For companies that are already profitable and have built up a substantial equity base, the price to book ratio can be a useful way to gauge how much investors are willing to pay for each dollar of net assets. In general, faster growth, higher profitability and stronger competitive advantages justify a higher multiple, while more cyclicality, execution risk or reliance on a narrow customer set usually argue for a lower, more conservative level.

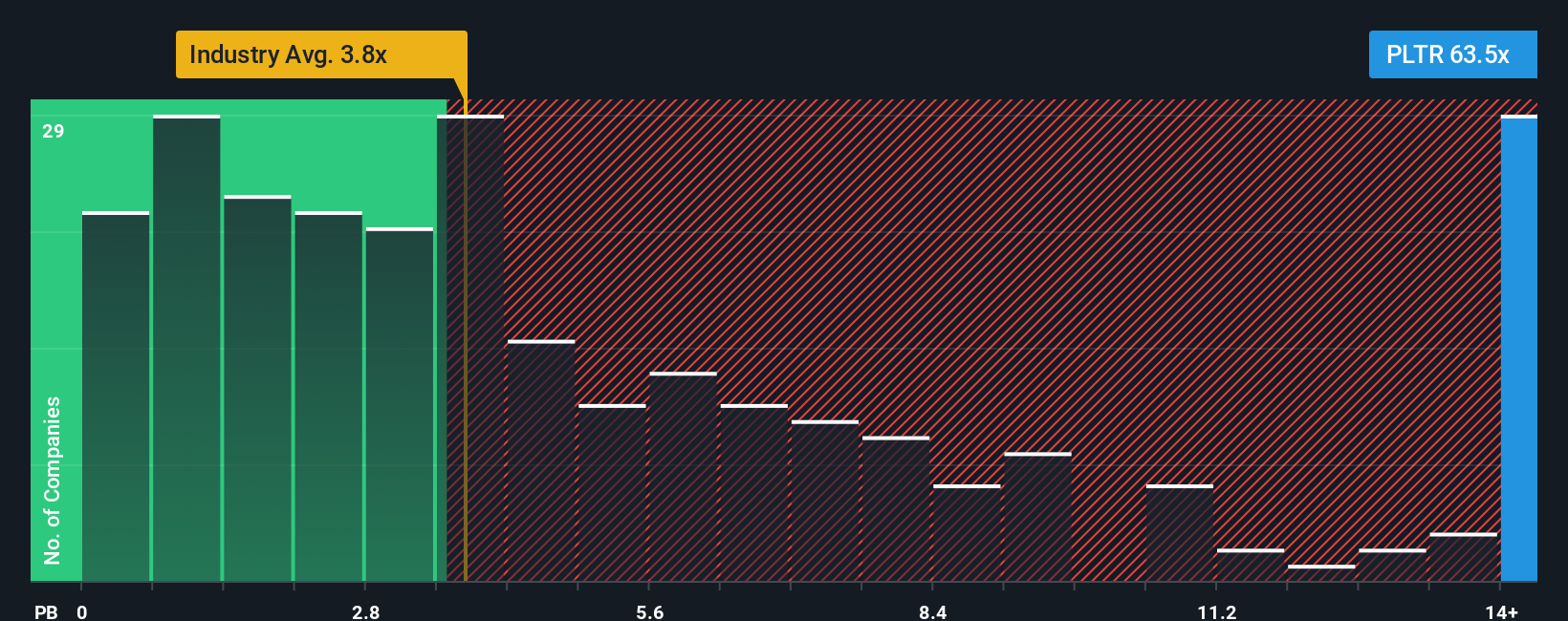

Palantir currently trades on a rich price to book ratio of about 69.94x. That is dramatically higher than the broader Software industry average of roughly 3.39x and also above the peer group average of around 47.99x, underscoring how much optimism is already embedded in the share price. Simply Wall St goes a step further by estimating a proprietary Fair Ratio, which is the price to book multiple you might reasonably expect once factors like Palantir's earnings growth potential, profit margins, scale, industry dynamics and specific risks are all taken into account. Because this Fair Ratio is tailored to the company rather than based on broad group comparisons, it provides a more precise yardstick for whether the current 69.94x multiple looks stretched or justified. In Palantir's case, the market price sits well above that Fair Ratio, indicating the shares are extended on this metric.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Palantir Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect the story you believe about a company with the numbers that sit behind its valuation. A Narrative is your own, clearly defined view of a business, where you spell out what you think will happen to its revenue, earnings and margins, and what that means for its fair value, instead of relying only on generic models. On Simply Wall St, Narratives live in the Community page and are used by millions of investors because they turn a company’s story into a financial forecast, and then into a fair value that can be compared directly with today’s share price to help inform a decision to buy, hold or sell. These Narratives update dynamically when fresh information like earnings or major news is released, so your view can evolve as the facts change. For example, one Palantir Narrative on the platform currently values the stock at around $66 while another sits closer to $154. This shows how different investors can look at the same business and reach very different, but clearly explained, conclusions.

Do you think there's more to the story for Palantir Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion