- United States

- /

- Software

- /

- NasdaqGS:PLTR

Assessing Palantir After 130% Rally and Expansion Into AI and Government Contracts

Reviewed by Bailey Pemberton

- Wondering if Palantir stock is a hidden gem or if the story has already played out? Let's dig into whether the current price really stacks up to the company's fundamentals.

- After a remarkable 131.4% gain year-to-date and a 164.6% return over the past year, Palantir has certainly caught the market’s attention, even with a brief pullback of 3.1% in the last month.

- Much of this excitement follows Palantir’s recent expansion into several high-profile government contracts and its steady push into the artificial intelligence space. Both of these factors have driven investor enthusiasm. Headlines also point to strong partnerships with industry leaders, fueling optimism about the company's long-term growth prospects.

- Despite all the momentum, Palantir scores just 0/6 on our basic valuation checks, meaning it isn't considered undervalued in any of the six traditional categories. We’ll break down each approach to see what the numbers say, and at the end, reveal a more insightful way to assess whether the price makes sense now.

Palantir Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Palantir Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a stock by projecting its future cash flows and discounting them back to their present value. In Palantir Technologies' case, analysts and valuation models estimate how much cash the company will generate, giving a sense of what the company is fundamentally worth today.

Currently, Palantir reports free cash flow (FCF) of $1.79 billion. Analyst projections suggest this figure could climb substantially, with a forecast of $7.00 billion in 2029. While analysts provide direct estimates for the next five years, figures beyond 2029 are inferred based on growth trends and financial assumptions. Over a ten-year horizon, cash flows are expected to multiply over fourfold, which highlights robust anticipated growth in the company's operations.

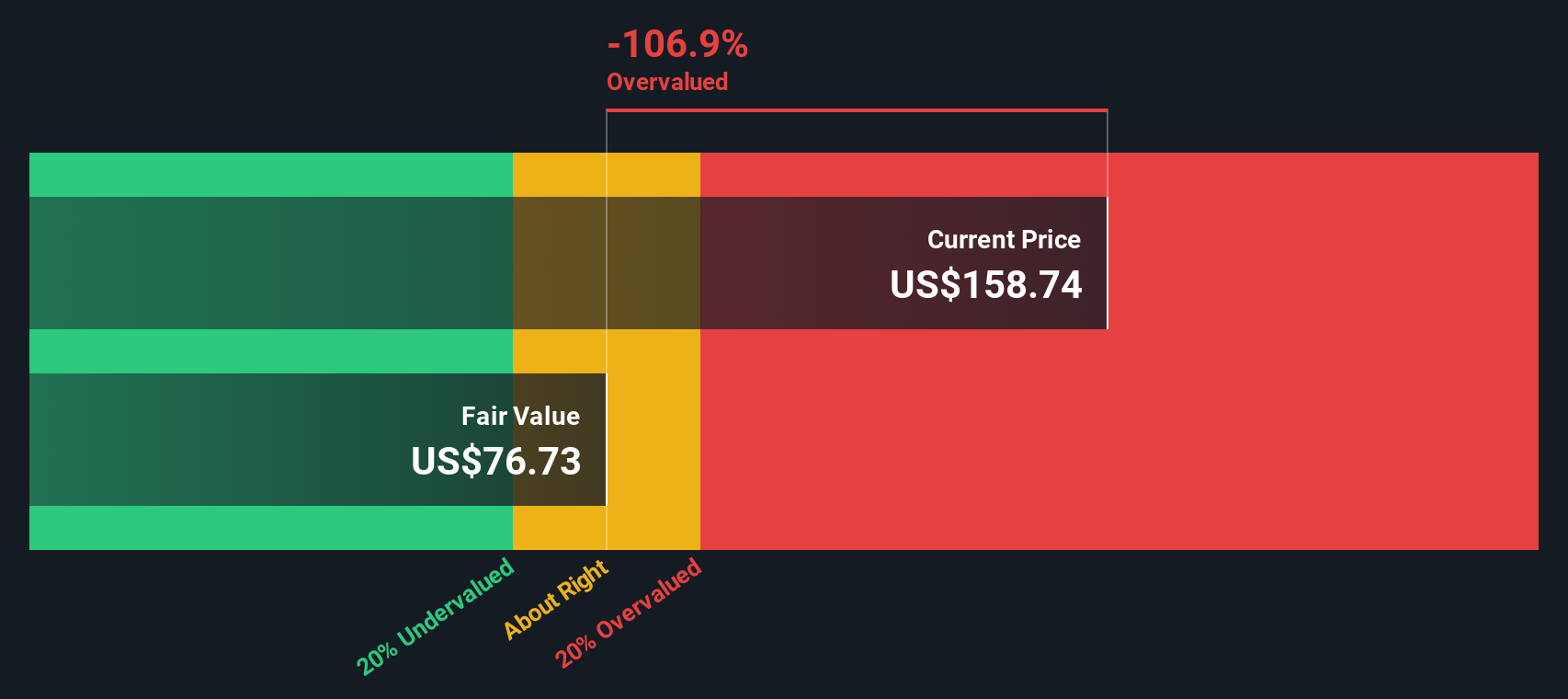

Running these projections through the DCF model produces an estimated fair value for Palantir stock of $73.44 per share. However, compared to the current stock price, this analysis reveals Palantir is trading at a 136.9% premium to its calculated intrinsic value. This means the stock is considered significantly overvalued using this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Palantir Technologies may be overvalued by 136.9%. Discover 878 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Palantir Technologies Price vs Book

For profitable technology companies, the Price-to-Book (P/B) ratio is often a valuable tool for assessing valuation because it compares the market’s perception of a business to its actual accounting value. Companies with higher growth prospects and lower risk generally command a premium P/B ratio, while those facing headwinds usually trade closer to their book value or even at a discount.

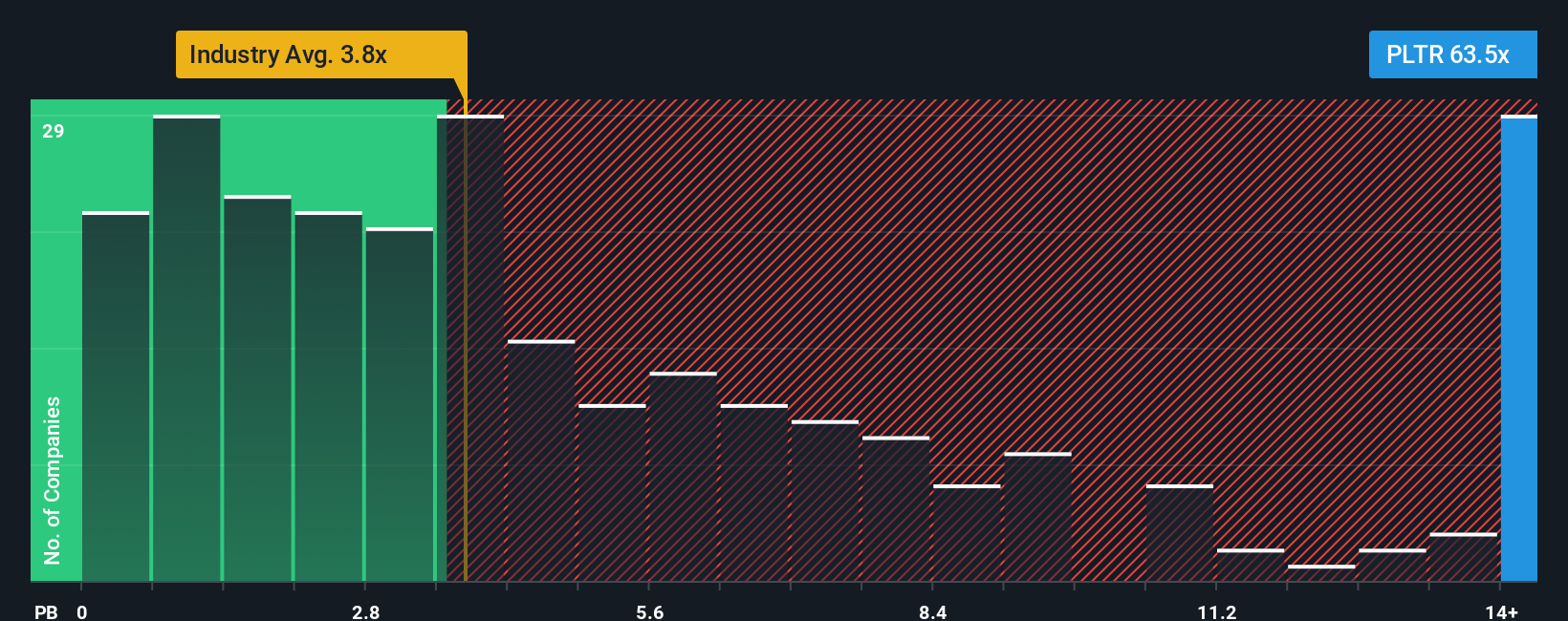

Currently, Palantir trades at a hefty 62.9x P/B ratio. This stands out significantly against the industry average of just 3.7x, and even among its software peers, which average around 38.2x. Such a high premium typically signals extremely optimistic growth and profitability assumptions built into the market price.

Simply Wall St’s proprietary "Fair Ratio" offers a more tailored benchmark by incorporating not just industry averages, but also Palantir’s specific earnings growth, market capitalization, risk profile, and profitability. This dynamic metric is more comprehensive than a basic peer or industry comparison because it reflects the actual level of financial outperformance required to justify the current market multiple.

Comparing Palantir’s present 62.9x to its Fair Ratio, the current valuation is well above what would be justified by its fundamentals and qualitative factors. This suggests the stock is most likely overvalued even when accounting for its solid performance and future growth projections.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Palantir Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, personalized story that connects your view of Palantir Technologies, including how you see its growth, risks, and competitive edge, with objective financial forecasts and a calculated fair value.

Unlike static models, a Narrative lets you attach real meaning to the numbers. You can explain the key drivers behind your forecasts for revenue, margins, or multiples, bringing the "why" to the "what." Narratives transform investing from just reading ratios to making thoughtful, transparent calls about when a stock is undervalued or too expensive, driven by your own assumptions, not just market consensus.

Simply Wall St’s Community page enables you to create, share, and update Narratives alongside millions of investors. You can easily compare your Narrative’s fair value with the current market price, supporting clearer buy or sell decisions. And because Narratives update as soon as new news or earnings are released, your investment story always stays relevant.

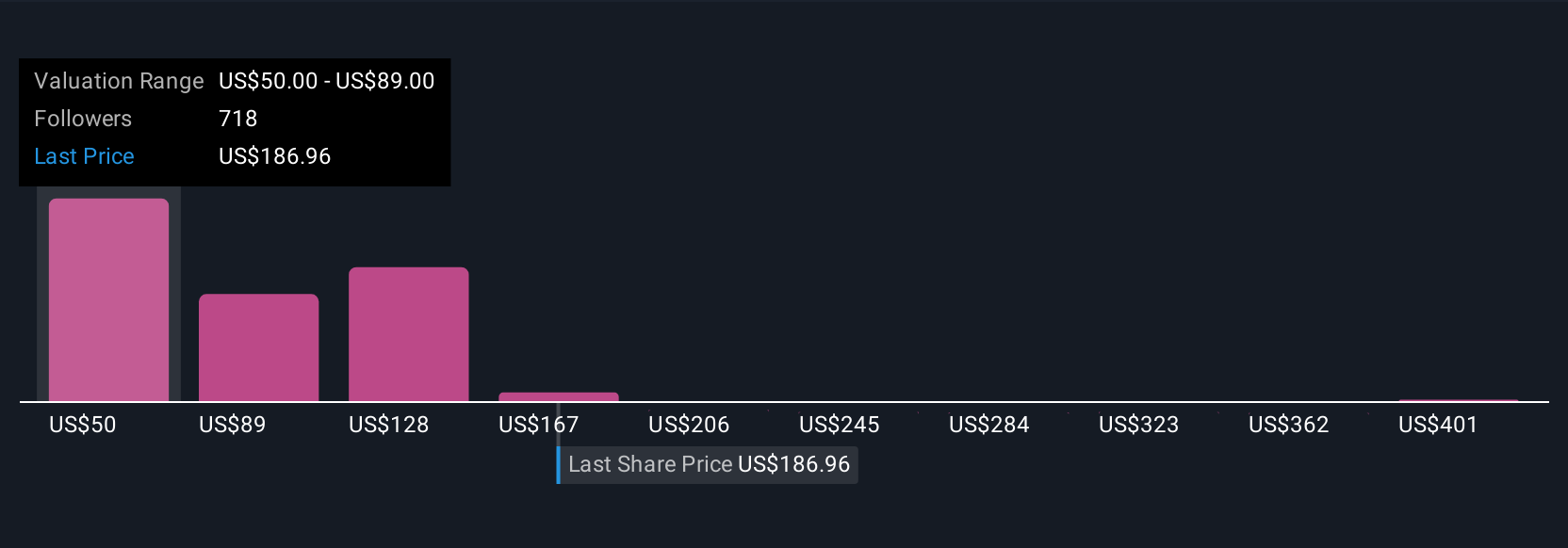

For example, looking at Palantir Technologies, one user’s Narrative forecasts explosive AI adoption and pegs fair value at $154 per share. Another, more conservative view based on slower growth puts it at $66, showing how Narratives flexibly capture different investor perspectives, all grounded in real data.

Do you think there's more to the story for Palantir Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives