The Proofpoint (NASDAQ:PFPT) Share Price Is Up 122% And Shareholders Are Boasting About It

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. For example, the Proofpoint, Inc. (NASDAQ:PFPT) share price has soared 122% in the last half decade. Most would be very happy with that. And in the last month, the share price has gained 2.0%. But this could be related to good market conditions -- stocks in its market are up 11% in the last month.

Check out our latest analysis for Proofpoint

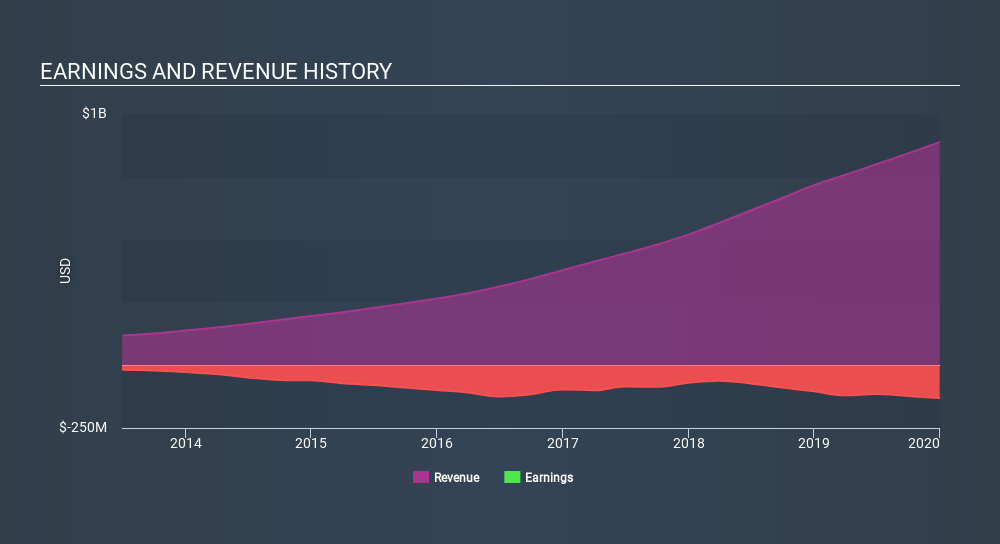

Because Proofpoint made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Proofpoint can boast revenue growth at a rate of 30% per year. That's well above most pre-profit companies. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 17% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. Proofpoint seems like a high growth stock - so growth investors might want to add it to their watchlist.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Proofpoint is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Proofpoint in this interactive graph of future profit estimates.

A Different Perspective

We regret to report that Proofpoint shareholders are down 5.0% for the year. Unfortunately, that's worse than the broader market decline of 3.2%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 17%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Proofpoint better, we need to consider many other factors. Even so, be aware that Proofpoint is showing 2 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives