- United States

- /

- Software

- /

- NasdaqGS:PEGA

Pegasystems (PEGA): Assessing Valuation After Major Agentic AI Upgrade to Client Lifecycle Management Platform

Reviewed by Simply Wall St

Pegasystems (PEGA) just rolled out a major upgrade to its Client Lifecycle Management platform, adding agentic AI that automates onboarding, document handling, screening, and risk checks for banks while tightening compliance and cutting manual workload.

See our latest analysis for Pegasystems.

The launch lands as Pegasystems’ share price trades around $58.89, with a solid year to date share price return of 26.67 percent and a striking three year total shareholder return of 247.5 percent. This suggests momentum has broadly been rebuilding, supported by steady product innovation and a maintained dividend.

If this kind of AI driven workflow story appeals to you, it might be worth exploring other software names via our focused screener for high growth tech and AI stocks.

With shares still trading at roughly a 26 percent discount to analyst targets despite steady mid single digit growth and a robust CLM AI launch, is Pegasystems a misunderstood compounder, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 20.3% Undervalued

With Pegasystems last closing at $58.89 against a narrative fair value near $73.91, the gap hinges on how durable cloud and AI growth really is.

The adoption of agentic workflows and integration with AI models in Pega Blueprint, enabling predictable and streamlined processes, could enhance client satisfaction and retention, thereby improving net margins. Emphasis on Pega Cloud's growth, combined with high client retention and strategic cross-selling/up-selling, is poised to bolster revenue and profitability, supporting overall earnings expansion.

Want to see the math behind that upside case? The narrative leans on steadily rising revenues, fatter margins, and a rich future earnings multiple. Curious which assumptions really move the needle?

Result: Fair Value of $73.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering macro uncertainty, volatile term license revenue, and intensifying AI competition could easily derail the cloud driven upside embedded in this narrative.

Find out about the key risks to this Pegasystems narrative.

Another View on Valuation

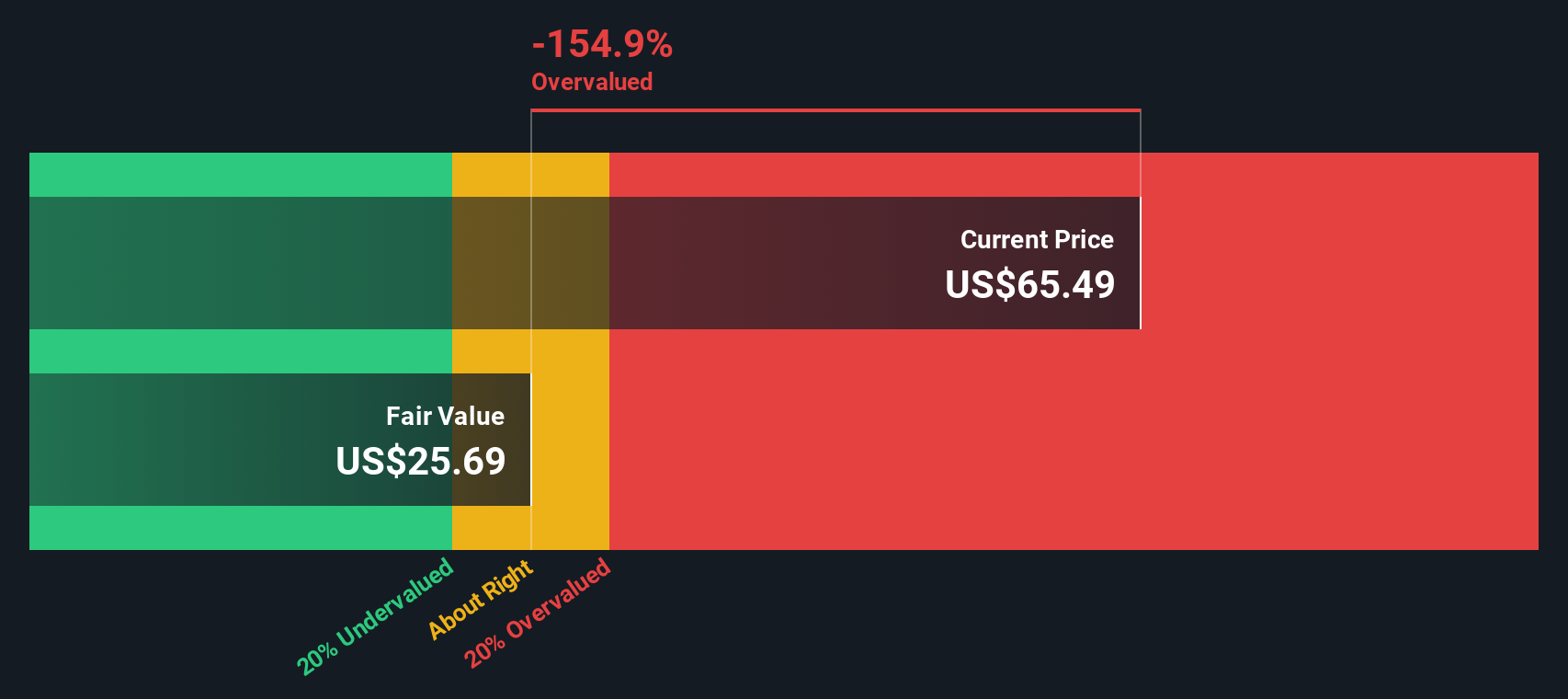

Our SWS DCF model is far less upbeat, putting fair value closer to $26.18 per share, which implies Pegasystems is trading well above what its long term cash flows might justify. Are analysts leaning too hard on narrative strength and momentum, or is the model missing the cloud and AI inflection?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pegasystems Narrative

If you would rather stress test the numbers yourself and challenge these views, you can build a personalized Pegasystems story in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pegasystems.

Looking for more investment ideas?

Before you move on, you may want to scan targeted opportunities our screener has already surfaced for active investors like you.

- Explore potential in overlooked names by reviewing these 3608 penny stocks with strong financials that already show strengthening financial foundations.

- Consider companies at the frontier of innovation by targeting these 24 AI penny stocks that may benefit from wider adoption across industries.

- Develop an income-focused strategy by reviewing these 13 dividend stocks with yields > 3% that offer regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEGA

Pegasystems

Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion