- United States

- /

- Software

- /

- NasdaqGS:PEGA

Is Now the Right Time to Reassess Pegasystems After a 21.6% Weekly Surge?

Reviewed by Bailey Pemberton

If you’re staring at Pegasystems’ stock chart this week and wondering what’s behind those lively swings, you’re not alone. Investors everywhere have taken note as Pegasystems’ price jumped 21.6% over the last seven days and is up a staggering 66.3% in the past year. Now, with shares closing at $66.64 most recently, the question of whether it is time to buy, hold, or take profits has never been more relevant.

What is driving these moves? While no single event has turned the tide, positive sentiment has built up over months as Pegasystems continues to enhance its low-code automation offerings and attract new enterprise customers. Tech adoption trends have clearly provided fuel, and many see the company’s robust software solutions as well positioned for the acceleration happening across digital transformation sectors. However, after a 43.3% rally already this year and a massive 260.6% return over three years, some investors are understandably weighing whether the market’s optimism has already been priced in.

For anyone focused on valuation, here is where it gets especially interesting. Based on our six key checks for undervaluation, Pegasystems clocks in at just 1 out of 6, suggesting not much of a discount. Of course, valuation is about more than just ticking boxes. Walk through the main tools used to judge whether this stock is truly a bargain or if caution is warranted, and then take the analysis one step further to uncover an even clearer picture.

Pegasystems scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Pegasystems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future free cash flows and then discounting those back to today's dollars. This approach helps determine what the business is fundamentally worth, independent of the current market price.

Pegasystems' latest reported Free Cash Flow stands at $424.6 million. Analyst forecasts provide annual projections for the next few years, with 2026 FCF expected to rise to $548.4 million and 2029 projections at $308.2 million. While analyst estimates extend for five years, further out projections rely on extrapolations. All cash flow figures are based in US dollars, making comparisons straightforward.

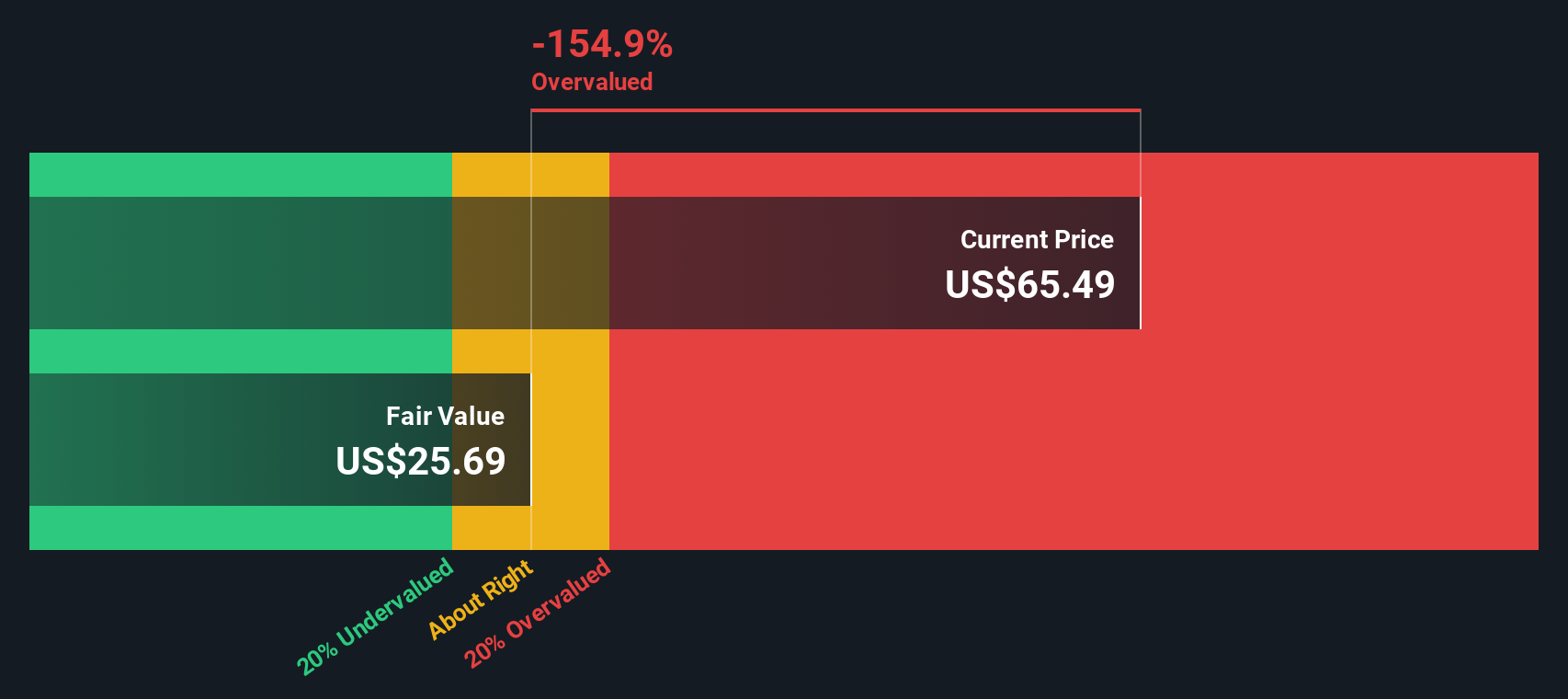

Given the sum of these discounted future cash flows, the DCF calculation yields an intrinsic value of $25.71 per share for Pegasystems. When compared to the most recent closing price of $66.64, this indicates the stock is about 159.2% more expensive than its fair value using this method, suggesting significant overvaluation according to DCF analysis alone.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pegasystems may be overvalued by 159.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Pegasystems Price vs Earnings

The price-to-earnings (PE) ratio is a popular valuation metric for profitable companies like Pegasystems because it directly relates a company’s stock price to its earnings per share. This makes it especially helpful for investors seeking a quick way to compare how expensive a stock is relative to the profits it generates, both against other companies in its sector and broader market benchmarks.

Deciding what counts as a “fair” PE ratio is about more than just the number itself. Faster-growing companies often justify higher multiples, while those with greater perceived risks might command lower ones. Industry context, profit margins, and potential for expansion all play a role in establishing what is normal for a software business like Pegasystems.

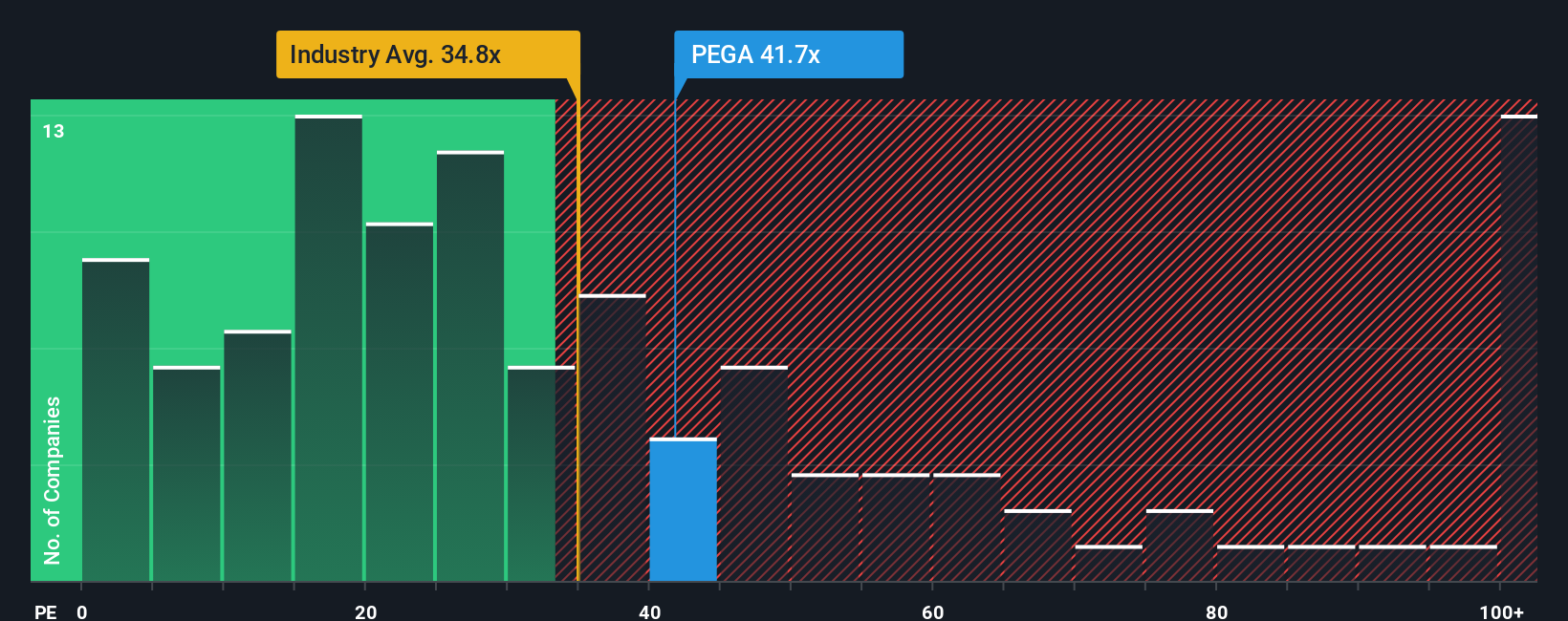

Pegasystems currently trades at a PE ratio of 40.69x. For context, the broader Software industry averages 33.31x, while similar peers command a slightly higher 47.71x. The proprietary Simply Wall St metric, the "Fair Ratio," goes a step further. Unlike a straight industry or peer comparison, the Fair Ratio incorporates Pegasystems’ earnings growth outlook, market cap, risks, and profit margins to tailor an expected multiple for this company. Pegasystems’ Fair Ratio is 28.94x, notably lower than its current valuation. This indicates the stock is pricing in more optimism than is justified by fundamentals and risk, suggesting the market may be a bit too bullish at these levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pegasystems Narrative

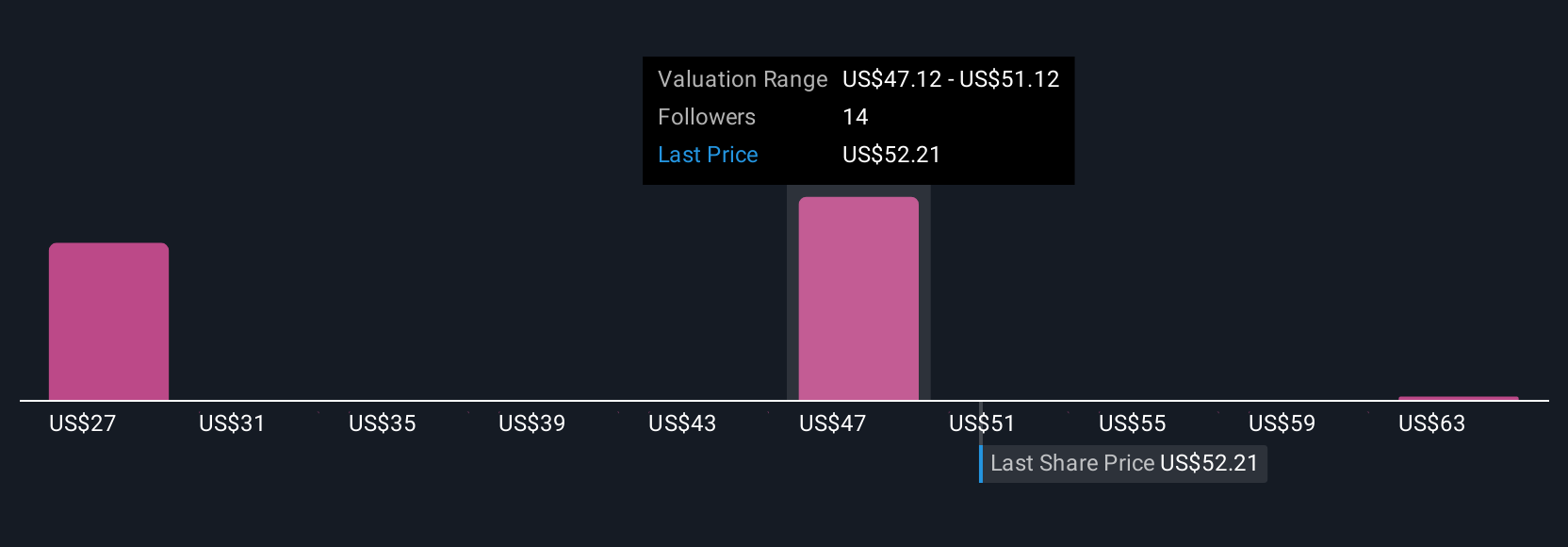

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, connecting your view of its future with financial forecasts, assumptions about growth and profit margins, and an estimated fair value. Narratives transform abstract numbers into a clear investment thesis, making it easier to link what you believe about a company’s prospects directly to concrete financial outcomes. Available right now on Simply Wall St’s Community page, used by millions of investors, Narratives are a user-friendly tool that lets you test your outlook versus the market, see how your Fair Value compares to today’s price, and easily update your view when news or earnings change. For example, with Pegasystems, some investors see AI-driven growth and recurring revenues as reasons to set fair values as high as $78.00. Others focus more on competitive risks and forecast just $40.19 as fair value. Narratives bring these differing perspectives into one place and keep them dynamic, so you always have a living, breathing framework to help decide when to buy, hold, or sell.

Do you think there's more to the story for Pegasystems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEGA

Pegasystems

Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives